Post Wipro’s results on Wednesday, the top 4 IT majors have all reported their Q2 results. How does it look? Overall not good! While management talk across companies has been cliched — stressing on how deal wins have been good and that they executed well in a tough environment, the underlying results belie the confidence. Further, the AI theme that every management has taken time to talk about in their post-results conferences is not a near-term game-changer. The beneficial impacts of these are likely to meaningfully impact results only in the medium to long term

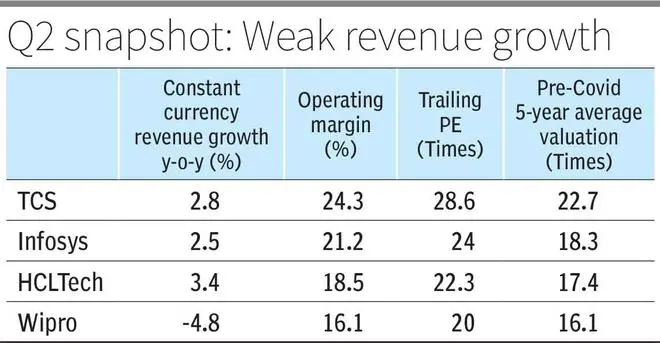

A year ago, companies were beating on revenue expectations and missing on margin expectations, now they are missing on revenue expectations/guidance and managing to meet on margin expectations. Both are not ideal and hence the weakness in IT services stocks/IT index is likely to sustain for some more time. The Nifty IT index peaked in January 2022 and is down more than 20 per cent from those levels.

The US economy has been consistently faring better than expected, but there are pockets/sectors of weakness and beyond that clients across sectors are factoring prospects of a US recession or at least a meaningful slowdown and hence cautious in their spending. This trend is unlikely to abate for now.

With the top 4 IT services companies deriving 50-60 per cent of revenue from North America and overall around 85 per cent of revenue from North America and Europe, a recovery in growth is likely only post improvement of macro economic fundamentals in these regions.

What should investors do?

In the Big Story in our bl.portfolio edition dated April 23, 2023, we had noted that amidst slowdown, a benchmark to assess attractiveness of top-tier IT services stocks was their pre-Covid five-year average valuation. The five-year FY rolling earnings CAGR (since FY12-17) of the top 4 IT services companies has ranged 7-12 per cent. There is not much reason to believe this trend will change much with the recent slowdown, undoing the post digitisation boom these companies witnessed. With interest rates higher today and likely to stay that way for longer, the valuation multiple expansion witnessed post Covid is likely to compress closer to pre-Covid valuation levels. Time to consider long-term investment in the stocks would be around then.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.