Indian equities closed the week on a positive note with bellwether S&P BSE Sensex gaining over 4 per cent, even as rupee fell to a record level breaching 80 levels against US dollar. With the ongoing June quarter results season, the performance by Indian listed companies and the outlook for the upcoming quarters, will likely drive the market in the coming week too.

In this column we will look at three stocks that were favoured by investors and fared better than the broad market.

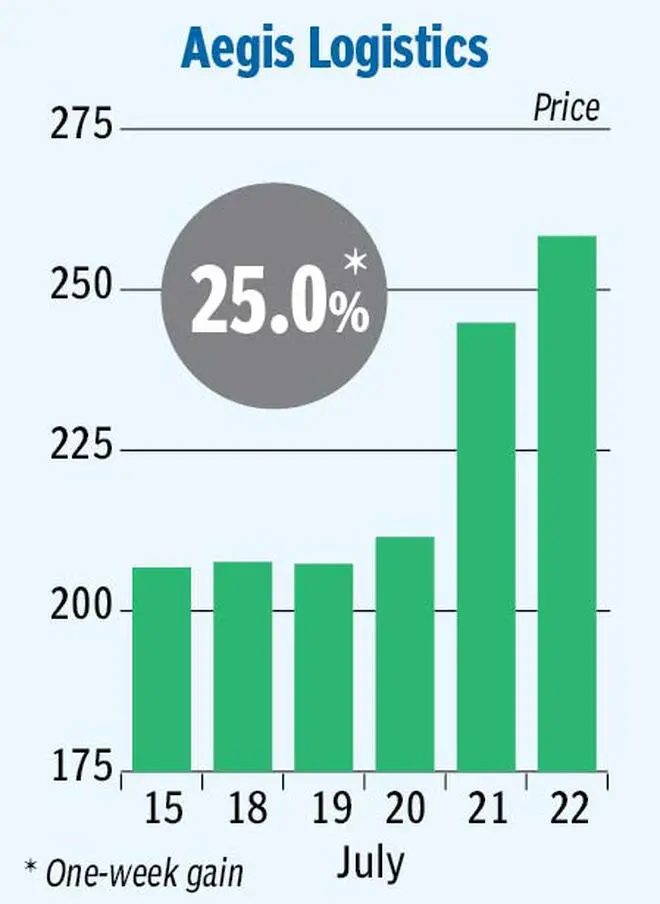

The stock of Aegis Logistics, a leading integrated Oil, Gas and Chemical Logistics company has gained over 25 per cent in the past week. The company operates through its state-of-the-art liquid, chemicals, and gas storage terminals across key ports in the country, with a capacity of 15.7 lakh tonnes for chemicals and 1.4 lakh tonnes of static storage capacity for LPG (Liquified Petroleum Gas).

Aegis is also into LPG distribution for home and industrial use. Other businesses include sourcing and distribution of LPG in India, wherein it manages the entire supply chain management for refiners BPCL and HPCL. Improving demand outlook for gas should have a positive rub off on the company’s business. The company reported revenue growth of 74 per cent to ₹1228 crore in FY22 vis-à-vis FY21. Its net profit nearly trebled to ₹452 crore in FY22, compared to the previous year. At the current price, the stock trades 10 times and 8.8 times its estimated FY23 and FY24 estimated earnings.

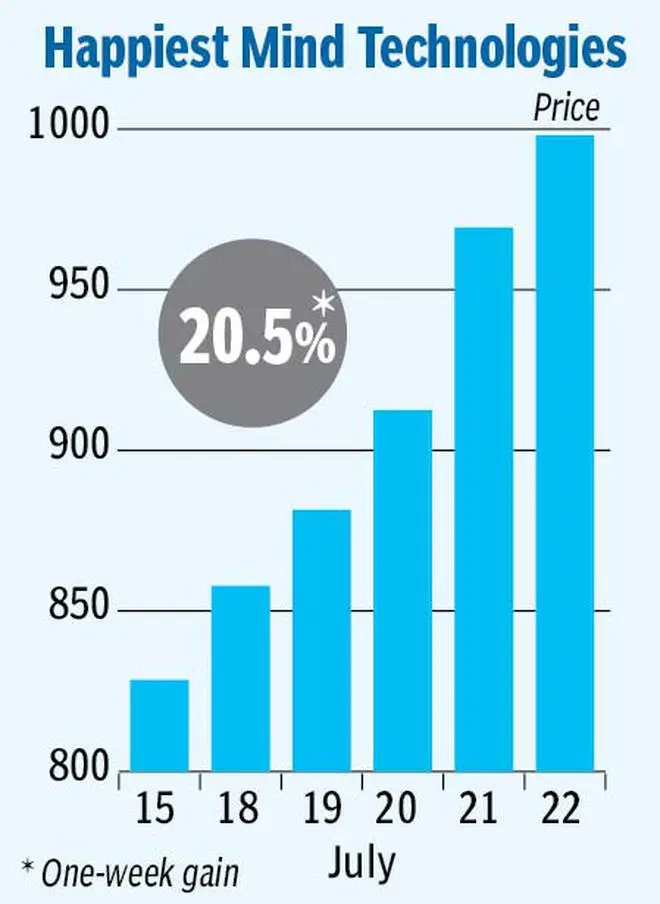

The other stock that fared better than the market last week was that of IT services company Happiest Mind Technologies. The stock which has more than doubled since its debut in September 2020, rallied by over 20 per cent. This was on the back of robust performance by the company in the June quarter. Revenue from operations grew 34 per cent in the June quarter to Rs 329 crore, compared with the same period last year. In USD terms the growth was 27 per cent.

Net profit for the quarter grew 58 per cent year-on-year to Rs 56 crore. Operating profit margin improved by 2.3 percentage points year-on-year. The company added 5 new clients during the quarter taking the total tally to 211. EdTech, Industrial and BFSI segments had seen good traction in terms of new multiyear deal wins. The stock currently trades at a whopping 58 and 48 times its estimated FY23 and FY24 earnings respectively.

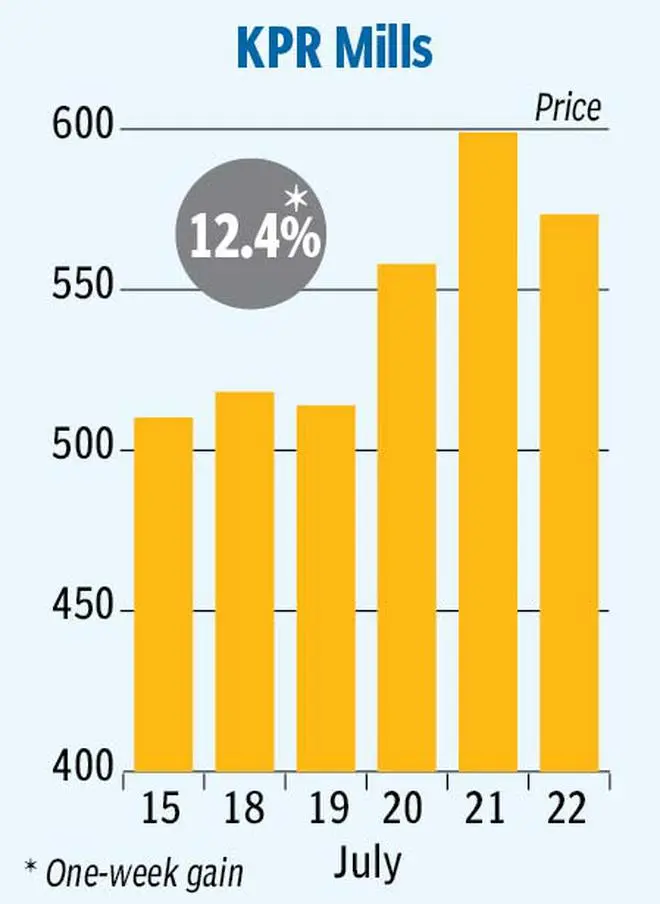

The stock of textile maker KPR Mills also zoomed over 12 per cent in the week ending July 22, after hitting a new low in the preceding week. After a brilliant rally in the second half of calendar year 2021 helped by strong operating performance, the stock witnessed pressure in the 4QFY22, on rising cotton prices.

The stock saw a strong rebound in the past week, though there was no significant news development. This rally was possibly driven by technical buy calls. The company reported stellar results in FY22, with revenue of ₹4073 crore, implying growth of 37 per cent compared to FY21, with adjusted net profit record of 69 per cent at ₹731 crore. At the current price, the stock trades about 27 times and 34 times its consensus FY23 and FY24 estimated earnings.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.