Equitas Small Finance Bank or Equitas SFB doesn’t boast of a pristine loan book. With assets of ₹19,687 crore as on December 31, 2021, it has miles to go to secure a spot in the country’s banking landscape as a serious competitor.

Yet, for investors looking at affordable options within the financials space, Equitas SFB presents itself as a worthy option for its ability to think ahead of peers, without taking its eye off its primary customer base – the low to mid-income categories. When SFB licenses were handed out in 2015, Equitas was among the nine players with microfinance (MFI) background. But in seven years it has managed to reposition itself as a lender offering a bouquet of products rather than MFI loans. At 1.7x FY23 estimated price-to-book, valuations aren’t very demanding given the long-term potential.

However, having a near-term view (12 – 18 months) on the stock may not work due to the likely changes in corporate structure and the near-term asset quality pressures. It’s imperative to take a longer time-horizon (3 - 5 years) while considering Equitas SFB stock.

Progress so far

In 2016, the holding companies of Equitas and Ujjivan, its closest competitor, hit the bourses around the same time. Share of MFI loans back then was 50 per cent and 86 per cent respectively. Subsequently, to meet the licensing requirements of the RBI, both had to list their SFBs. Ujjivan SFB (which enjoyed a premium to Equitas) had a bumper listing in December 2019, while Equitas SFB listed about a year later when the Covid had already impacted the economy. But since their IPOs, Equitas SFB stock has appreciated by 67 per cent, while Ujjivan SFB’s stock price has fallen by 69 per cent. Here’s what helped Equitas SFB stay ahead of competition.

The most important point distinguishing factor for Equitas is its ability to take the risk of diversification.

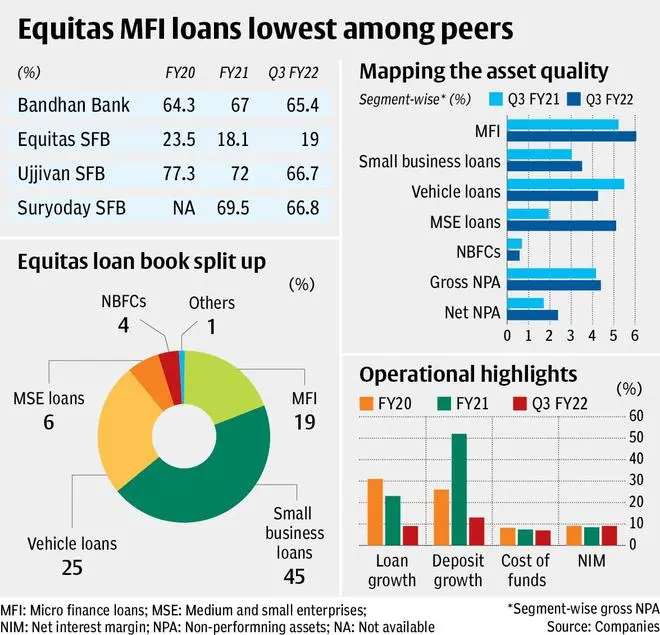

Share of MFI loans have reduced from 50 per cent in 2016 to 19 per cent in December quarter of FY22 (Q3 FY22). The aim is to further reduce it to by 400 basis point in the next few years. Ujjivan SFB and Suryoday SFB remain dependent on MFI loans. Interestingly, despite Bandhan Bank’s acquisition of Gruh Finance (housing finance NBFC) in 2019, its still reckoned as a MFI-led outfit (see chart). Among the MFI players turned banks, Equitas is the only one which has made decent headway in terms of diversification.

Most of the new products have been built around its existing customer profile or those similar. Even as the SFB has forayed into vehicle finance (used and new) and small business loans (including home loans), 40 per cent and 49 per cent of the respective books are comprised of loans with ticket sizes less than ₹5 lakh. In the vehicle financing space, the bank has just about 16 per cent exposure to loans with ticket size of ₹10 lakh or more, while its at 31 per cent for SME loans. For a bank with expertise in the low- to middle-income groups, these loans are a natural extension of its risk management framework. Equitas has also ventured into housing finance and agri-loans. All its product forays thus far have been organic efforts. Secured loans account for 81 per cent of the bank’s book, placing Equitas as a safer bet compared with others at less than 35 per cent of total book.

Also, with ticket sizes more granular compared to established banks (largely targeting the ₹10–15 lakh bracket for vehicle loans and ₹50 lakh – ₹1.5 crore for SME and home loans) recovery may be easier.

Equitas leads the segment with respect to CASA (Current account – savings account) as well. At over 50 per cent CASA ratio in Q3, competition is yet to touch even the 30 per cent mark despite over five years of operations.

Asset quality, management

At 4.4 per cent headline non-performing assets (NPA), loan book quality is a concern. Uneven collection efficiencies and delayed recovery in the vehicle financing book could remain pain points. With 9.8 per cent of total book restructured any noteworthy respite on asset quality can be expected only in FY24, when regularisation of restructured accounts happens. Therefore, achieving sub-3 per cent NPA seen before the pandemic may be difficult in the near-term.

However, SFBs as a class are expecting FY23 to be another year of elevated stress. For Equitas, the analyst consensus points at 4 per cent gross NPA for FY23, though a delayed improvement in loan book quality (trend by Q2 FY23) is a key risk for investors. What’s comforting is that despite breaching the 5-year average of 3.2 per cent, Equitas’ NPA is still better compared with Ujjivan or Suryoday where gross NPA is over 10 per cent each.

Unlike AU SFB or Ujjivan, which faced high top-management attrition last year, Equitas has been a steady ship especially with respect to leadership. Led by a team intact since its inception as a bank, this is a very comforting factor for investors.

Merger with holdco

Following the RBI’s dispensation of the mandatory holding company structure for SFBs, Equitas SFB has rolled out a scheme of amalgamation, whereby shareholders of Equitas Holdings will be allotted 2.31 equity share in Equitas SFB. While the market cap of Equitas Holding is at ₹3,770 crore, based on the swap ratio, its value works to ₹4,145 crore - at 10 per cent premium its market cap. However, considering its shareholding in Equitas SFB at 74.63 per cent, value of which is ₹4,905 crore, the swap ratio implies the holding company remains at a discount of 15 per cent to the SFB.

However, there is an arbitrage opportunity of around 10 per cent for investors based on the swap ratio and hence buying shares of Equitas Holdings in anticipation of the merger is also a favourable proposition. Going by the current market cap of Equitas SFB vis-a-vis the post-merger shareholding, the Equitas SFB share could be valued at 11 per cent over the current closing price, leaving upside for the existing shareholders as well.

What next

Upon completion of five years of operations as SFB, Equitas is eyeing at the next level – a universal bank license, which will allow the bank to offer wider range of loans and services and cater to a larger customer base. However, this may drain the bank’s profitability. At 64.7 per cent cost-to-income ratio (which rose due to the pandemic), the bank’s efficiencies lag its established peers such as City Union Bank and Federal Bank by 200 – 220 bps. In fact, when Equitas converted from NBFC-MFI to SFB, its cost-to-income ratio was over 70 per cent and fell to sub-55 per cent only by FY20. Aiming for a universal bank license may once be a costly affair.

Having a diverse loan book comes with its drawback. Although Equitas’ book is relatively short-tenured (12 months – 5 years; barring housing at 15 – 20 years), the disruption to asset quality is unavoidable at the early phases of experimenting its loan portfolio. Until the assets mature, and the bank has seen 2 – 3 full behavioural cycles of these loans, it may be a tight rope walk between growth, asset quality and capital consumption.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.