In our equities outlook for 2022 in our Portfolio edition dated January 2, we had noted that there are ample reasons to be cautious when comes to investing in stocks. Amongst few factors mentioned for this was the risk of high inflation in developed markets and the threat it poses to market valuations/multiples if global central banks embark on an aggressive tightening cycle. The risk on this count has only increased in recent weeks and global markets including India have been highly volatile since start of the year. Uncertainties and risks have further increased due to the Russia-Ukraine stand-off. In such uncertain scenarios we had recommended, in choosing investments cautiously, investors should focus on companies with strong balance sheets, generating positive free cash flows and can maintain margins in an inflationary environment.

One stock that appears to fit this criterion is Just Dial. Its strong balance sheet with net cash per share at around ₹410/share as against current share price of ₹847.20, gives good margin of safety in an uncertain environment. It also has a good historic track record of consistent free cash flow generation and conservative use of cash, which also lends confidence that existing cash is unlikely to get squandered in aggressive acquisitions. Trading at EV/Revenue of 4.5 times and EV/EBITDA of 22 times (both based on Bloomberg FY23 estimates), the risk reward appears favourable, for a company that is leveraged to digitization trends and can have a long runway of growth if it executes well.

Investors with a long a term perspective can consider accumulating the shares of Just Dial. While competition will be stiff, the presence of Reliance Industries as the largest shareholder in the company and scope for synergies with Reliance’s grandeur ecommerce plans lend confidence for company’s prospects. We would however like to stress that given the heightened global macro and geopolitical uncertainties which will keep market volatile, investors can look to gradually accumulate over next few months rather than buying in one go.

Business

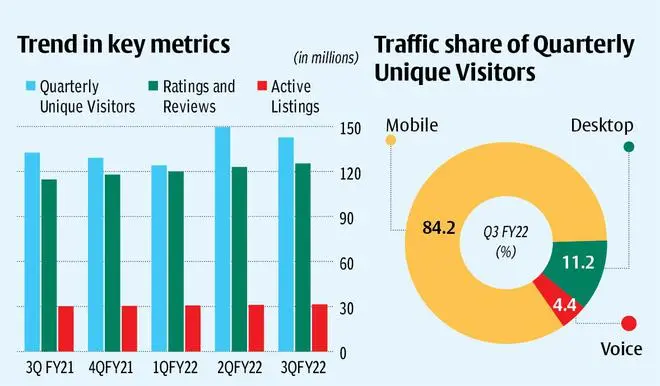

As India’s number 1 local search engine that provides information related to localised services to users in India through multiple platforms (mobile/desktop/telephone), the Just Dial is well established in the digital ecosystem in the country. With a vast database of over 30 million MSMEs (micro, small and medium enterprises), it provides a platform for millions of end consumers to get connected with these MSMEs on a daily basis for goods and services. The platform also has value added offerings in the form of transaction-enabled mobile friendly website for businesses, ratings tool to solicit online ratings from end users, payment gateway and escrow solutions. In addition to these, company launched JD Mart in FY21 – a dedicated platform for the B2B marketplace. JD Mart will connect bulk buyers with wholesale sellers across product categories.

Just Dial currently makes money primarily through two streams – paid advertising wherein advertisers pay a fixed fee to run search led advertising campaign on its platform; and from various premium and non-premium listing packages. Depending on the packages subscribed to, businesses would be able to get placement when customers search for products and services, based on their location.

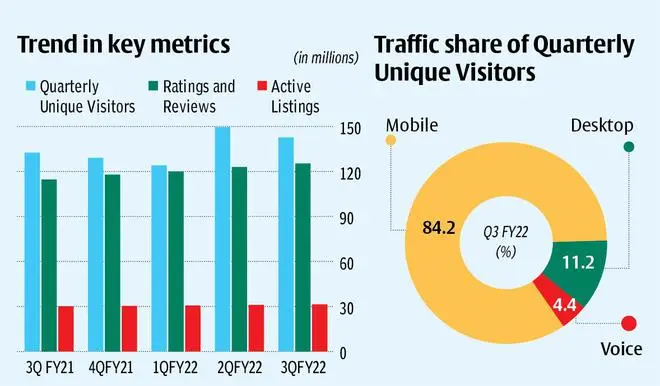

In 2H of CY21 Reliance Industries via its retail subsidiary acquired significant stake in Just Dial in a combination of subscription to preferential issue and secondary market purchases. Currently it owns 66.96 per cent stake in Just Dial. The acquisition was part of Reliance’s broader ecommerce strategy with plans to leverage and build upon Just Dial’s database of over 30 million listings and over 140 million unique quarterly visitors.

At an inflexion point

The sentiment around the stock has not been very positive in recent months as the company’s business is yet to show good recovery post pandemic impact. Unlike other digital companies, Just Dial business is levered to robustness in the MSME segment which is yet to bounce back from pandemic related impact. Further investors are also waiting for clarity on how its business will be synergised with ecommerce plans of Reliance.

Historically also the business performance of Just Dial has been lumpy since its listing in 2013. This is reflected in its share price performance also. After initial excitement following its listing (given it was one of the few digital new age company listed in the bourses at that time), the stock is trading more than 50 per cent below its all time high reached in 2014. Company’s financials have largely been stagnant with FY15-21 revenue and EBITDA CAGR at 2 and -1 per cent. Some of the big challenges that company has faced in growing its business are competition from Google, targeted and specialized aps (Uber, Zomato), and inconsistent monetisation of listings. Company also has not achieved much success with new initiatives like JD Omni in which company offers cloud/digital solutions to MSMEs.

It however needs to be noted that the Just Dial has maintained consistent profitability with EBITDA margins largely between 20-25 per cent during much of this period between FY15-21.

Against this backdrop, there are now few factors that are looking up for the company. The MSME sector is expected to recover going forward after hitting bottom in last two years and this should start reflecting in financials of Just Dial as well. Further Reliance Industries has mega countrywide plans to connect local kirana stores with consumers and provide logistics and supply chain support to small and medium businesses across the country. This can bring in synergies that can accelerate the business for Just Dial. The scope for synergies exists both on the B2C and B2B front with recently launched JD Mart. Further with the backing of Reliance and its strong balance sheet, competitive threats can be countered.

Financials and valuation

Just Dial is expected to close FY22 with revenue of ₹658 crore, EBITDA of 28.6 crore and net profit of ₹85.7 crore; decline of 2.5, 81 and 59 per cent respectively versus FY21. Performance/profitability was impacted during the year due to the pandemic and investments in new initiatives to grow business. Consensus expectation is for business to bounce back strongly in FY23 with year on year revenue, EBITDA and net profit growth of 29, 475 and 160 per cent respectively.

As compared to Just Dial’s FY23 valuation of 4.5 times EV/revenue and 22 times EV/EBITDA, B2B focussed peer IndiaMART InterMESH which has fared better in recent times trades at 14 and 34 times respectively.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.