Rising power demand, surging global coal prices due to geopolitical tensions and low coal inventory levels appear to have put Indian coal production major Coal India Ltd (CIL) in a favourable position.

The stock of CIL has shot up by around 50 per cent since the start of 2022 on the back of strong production levels and high e-auction premium. Also, the stock has risen more than 80 per cent since our previous recommendation given in the April 25, 2021, edition of BL Portfolio where we gave Accumulate rating to the stock.

The stock of CIL still trades at an attractive P/E level of around 6.27 times and has provided investors with a dividend yield of about 7.26 per cent at current market price (CMP) of ₹231. Further the stock is trading at one-year forward P/E of 5.1 (Bloomberg Consensus Estimates) which is at a discount of about 16 per cent and 36 per cent to last two-year and five-year average P/E respectively. This discount accounts for the cyclicality in the e-auction realisations. Currently, the company’s net cash is about 23 per cent of its market capitalisation and the positive net cash flow allows the firm to invest in capex for future projects. Investors can accumulate the stock of CIL on account of attractive valuation, healthy dividend yield, strong financials, high e-auction realisations, and future projects.

Business overview

Coal India Ltd, conferred with Maharatna status, is one of the largest coal producers in the world. The company is primarily involved in the production and sale of coal and thereby generates most of its revenue from its coal operations. Currently, CIL, along with its seven subsidiaries, produces about 80 per cent of India’s overall coal production. CIL’s supply powers 40 per cent of the country’s primary energy requirement.

As of now, the company has 318 working mines out of which 158 are open-cast, 141 are underground and 19 are mixed mines. The company produces majority of coal from the open-cast mines; This is because production from underground mines faces many issues, such as longer gestation periods with lack of skilled labour, unavailability of indigenous equipment, and high departmental production cost. However, one needs to consider that open-cast mines are more impacted by rain than underground mines. The company majorly produces non-coking coal to be supplied to thermal power generation companies besides supplying coking coal to steel companies. Further, CIL has 13 washeries to remove the ash content in the coal of which 11 are for coking coal while two are for non-coking coal.

Majority of CIL’s revenue is tied to the long-term Fuel Supply Agreements (FSA) wherein the company sells annual contracted quantity (ACQ) of coal at a notified price based on quality (coking or non-coking), which can be revised as and when required. If CIL is not able to meet demand under FSA, it can meet shortfall through importing coal and can supply it at a cost-plus basis. Further, the company also sells coal on spot basis to those whose coal requirement is seasonal and who are not willing to enter into long-term linkage. FSAs, being agreements for relatively longer-term frame, have fewer provisions for price changes. On the other hand, e-auctions are very much likely to reflect the increasing global prices, which are generally on the higher side compared to FSA notified price.

Recent performance

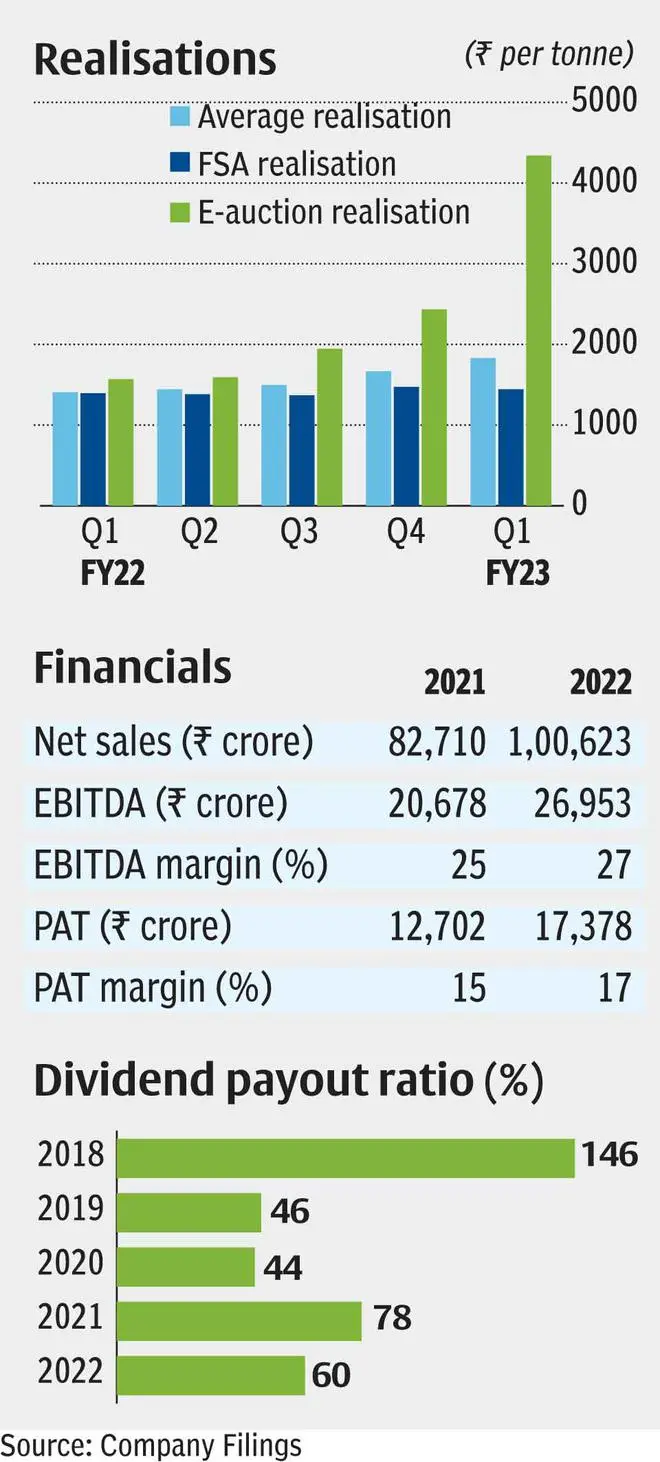

The company’s coal production and offtake have been strong during Q1 FY23 with an increase of 29 per cent and 11 per cent respectively on a y-o-y basis wherein 88 per cent of the offtake has been through FSA while rest is through e-auction. CIL’s average realisation for the quarter has been ₹1,789 per tonne, i.e., 25 per cent up from Q1FY22. The spike in average realisation is led by around 3-fold increase in e-auction realisation of ₹4,340 per tonne which has commanded a premium of 200 per cent over FSA realisation while the same was about 12 per cent last year. The continuous rise in e-auction premium has been on account of surging global coal prices and low coal inventories.

Considering the company’s financials, EBITDA for the quarter went up by 123 per cent along with increase in margins from 23 per cent to 39 per cent y-o-y. This has been on the back of increase in net sales (39 per cent), improved e-auction realisations and reduction in employee costs by 3 per cent. The increase in EBITDA margins has led to an increase in PAT margins, from 12 per cent to around 24 per cent y-o-y.

Despite being involved in a business of capital-intensive nature, CIL is a debt-free company and has provided investors healthy dividend yield of around 7.26 per cent at CMP with high dividend pay-out ratio averaging about 65 per-cent in the last 5 years. Further, the company has been able to maintain positive cash flows, which makes a case for further healthy dividend pay-outs and capex requirement.

Strategy and outlook

The company has targeted a capex of ₹16,500 crore for FY23 for its multi-prong strategy involving mechanisation of coal transport and diversification into different ventures. One, the company seeks to replace the existing road transport between pitheads and despatch points by mechanised coal transportation and loading system under ‘First Mile Connectivity’ projects through investments in railways lines and sidings. Two, it aims to control costs by closure of unviable underground mines as about 38 per cent of total workforce is employed while contributing only 4 per cent of the total production. Closure will take place in a phased manner wherein out of 141, 13 underground mines have already been suspended.

Three, the company aims to focus on renewable power generation as it is expected that coal-based power generation might get phased out in future. CIL has entered the renewable power generation space wherein CIL subsidiary has been awarded 100 MW solar power project via PPA (power purchase agreement) of 25 years with Gujarat state discom GUVNL. Here, we can expect more of such agreements. However, do note that this is a very long-term strategy as coal is not expected to be phased out any time soon. Further, the company is also looking to diversify its business by entering into the fertiliser space. Here, it has gone in for JVs to set up natural gas-based fertiliser plant and coal-based fertiliser plant, the operations of which are expected to commence by FY 2022-23 and FY 2024-25 respectively.

Considering earnings outlook, the company can continue to earn healthy margins led by high e-auction realisation as international coal prices are expected to remain elevated while slow FSA hikes and wage revision can be the key concerns for the firm. Ultimately investors can accumulate the stock of CIL due to attractive valuation, high dividend pay-out ratio, elevated e-auction premium, future renewable energy prospects and healthy financials.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.