From April 2021 to January 2022, only 6,684 kilometers of national highways were constructed against 9,132 kms a year-ago. The sluggish trend in road construction was due to disruption caused by Covid-19 and prolonged monsoons. A similar trend has also been observed in the contract awarding activities - only 6,000 kms of roads contacts have been awarded between April 2021 to January 2022 compared to 6,696 kms in the same period last year. But the sluggishness in the sector may soon be a thing of the past, with FY22 Budget increasing its focus on infrastructure spends. The allocation to MORTH (Ministry of Road Transport and Highways) has increased by 70 per cent year-on-year or by ₹80,000 crore to ₹1.9 lakh crore.

Allocation to NHAI has moved up two-fold at ₹1.34 lakh crore versus previous year’s budget. The government plans to expand the national highways network by 25,000 kms in FY23.

This creates a positive environment for road infrastructure companies like Ashoka Buildcon where 57.6 per cent of its order book is derived from road projects. Investors owning the stock can consider holding their position.

Ashoka Buildcon stock has fallen nearly 25.5 per cent from its recent high in October 2021 but has gained ground post the FY22 results and is trading at ₹ 85.65. 12-month trailing P/E of the stock at 3.08x positions it attractively compared to peers such as Dilip Buildcon, KNR Constructions and PNC Infratech trading at 11 – 23x valuations. Although the valuation looks very attractive as compared to its peers, investors must not jump the gun and wait for some time and check how the execution of the company fares and also how debt number pans out.

Order book

The order book of Ashoka Buildcon is worth ₹ 13,730 crore as of March 31, 2022. Adding up its order inflows till May 2022, the order book is ₹14,630 crore. This yields to 2.5 times FY22 revenue, thereby indicating good revenue visibility. The order book of the company is comprised of EPC contracts (39.7 per cent of order book), HAM projects (17.9 per cent), EPC contracts for Buildings (15.9 per cent), Railway projects (8.9 per cent), city gas distribution (0.5 per cent), power, and other orders (17.2 per cent). The share of road projects to the order book fell from 75.7 per cent in FY21 to 57.6 per cent in FY22. The overall strategy of the company will be 70:30 i.e., 70 per cent is expected to come from roads and bridges whereas remaining 30 from railways, buildings, power etc.

Business prospects

In FY23, Ashoka Buildcon has guided for 20-25 per cent revenue growth, while margins may be at 11-12 per cent. Order inflows are pegged at ₹10,000 crore. The bill to book ratio for FY22 is 2.31x which is ideal, whereas in FY21 it was only 1.63 times. This suggests good improvement in the execution capabilities of the company.

The company aims to be become an EPC major and has been concentrating on gaining EPC projects. EPC projects are generally preferred by the infrastructure companies as it does not require bringing in capital into the projects and the realization is also faster than HAM or BOT projects.

However, given that BOT and HAM tendering continue to happen, the company won’t entirely take its eyes off these projects. HAM projects may enjoy a favourable bias as these contracts witness 40 per cent stake participation from the government, while the remaining can be brought by the private parties. Also the government will provide semi-annual annuities for about 15 years, post which the project can be fully transferred to the government.

In case of BOT (Build operate transfer) projects, Ashoka Builldcon’s management is firm that such projects would be executed only through a joint venture model, where the burden of capital and risk can be shared. The company has sold five of its BOT projects for ₹1,337 crore to Galaxy Investments II Pte. Ltd, a KKR-owned entity. The proceeds will be utilised to repay debt to SBI Macquarie and with this SBI Macquarie will exit from Ashoka Concessions Ltd (ACL). This transaction is expected to conclude by September 2022. The closure of the deal will also help in reducing the overall consolidated debt by ₹3,090 crore. In FY23, Ashoka Buildcon plans to pare debt by ₹7,000 crore. This is without including the above-mentioned transaction.

The company will also sell 100 per cent in equity of Chennai ORR project to National Investment and Infrastructure Fund (NIIF) for ₹686 crore. Ashok Buildcon will receive ₹450 crore from the deal, which the company can use to further reduce its debt and prop up its working capital requirements.

Financials

The company registered 19.11 per cent growth in revenue year on year to ₹5,945.8 crore in FY22. The gross margin declined to 38 per cent in FY22 from 42 per cent in FY21, mainly due to 36 per cent year-on-year increase in construction expenses and cost of raw materials increasing by 17.26 per cent. EBITDA for FY22 stood at ₹1,937 crore, up 16.3 per cent year-on-year. against ₹1,665.7 crore in FY21. The EBITDA margin remained flat at 33 per cent per cent despite the fall in the gross margins. The company managed to control other expenses which came down 35 per cent which helped hold EBITDA margins at same levels. The profit for the FY22 was ₹771.4 crore, up 182 per cent year-on-year from ₹273.5 crore. The Net Debt/ EBITDA ratio, which is a measure showing the period of serviceability of debt for FY22 was 3.08 times and debt/equity ratio, which gauges a company’s indebtedness stood at 4.85 times.

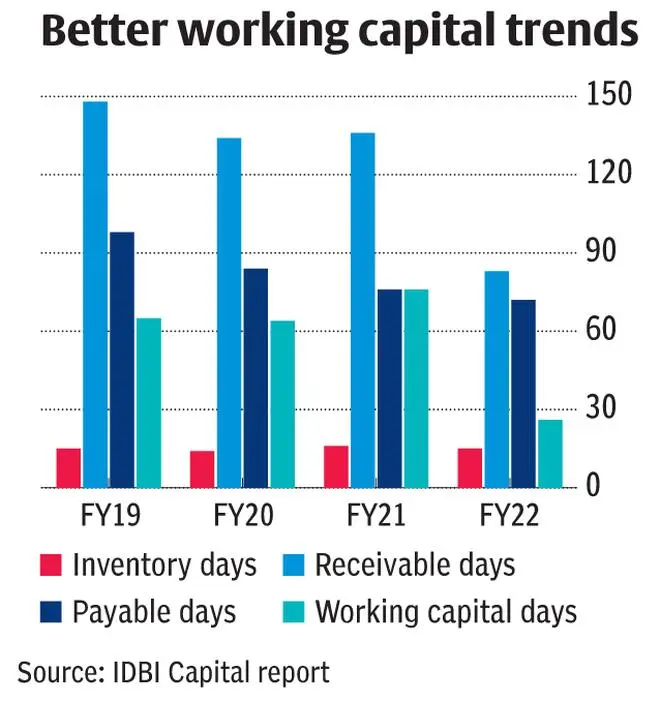

The working capital position has also improved with receivable days reducing by 53 days year-on-year to 83 days and working capital cycle fell to 26 days compared to 76 days in FY21.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.