Market correction since the peak in October 2021 has seen several large-, mid- and small-cap stocks fall steeper than key indices. But some small-cap stocks such as Fiem Industries have been an exception, gaining 15 per cent since then. In fact, the stock has zoomed about 150 per cent from our ‘buy’ call at ₹598 in March 2021. With the market past its purple patch, mid- and small-cap stocks remain vulnerable to sharp corrections.

What should investors of Fiem Industries do? Despite the run-up, we think you can continue to hold the stock for three reasons. One, after few years of downturn, the auto sector is on a cyclical recovery right now. This is reflected in the Nifty Auto Index, which is up 4.6 per cent from the October 2021 Nifty peak, as against the Nifty’s 13 per cent fall. Two, prospects for Fiem remain bright, thanks to presence in promising segments such as electric vehicles (EVs) and LED lamps. Three, valuation continues to be reasonable. At the current market price of Rs 1479, the stock trades at about 20.5 times its trailing 12-month earnings. While this is higher than its 5-year historical average of 17 times, it is still cheaper than peer lighting player in the small cap space - Lumax Industries – which trades at 33 times its trailing earnings currently.

Cyclical upturn

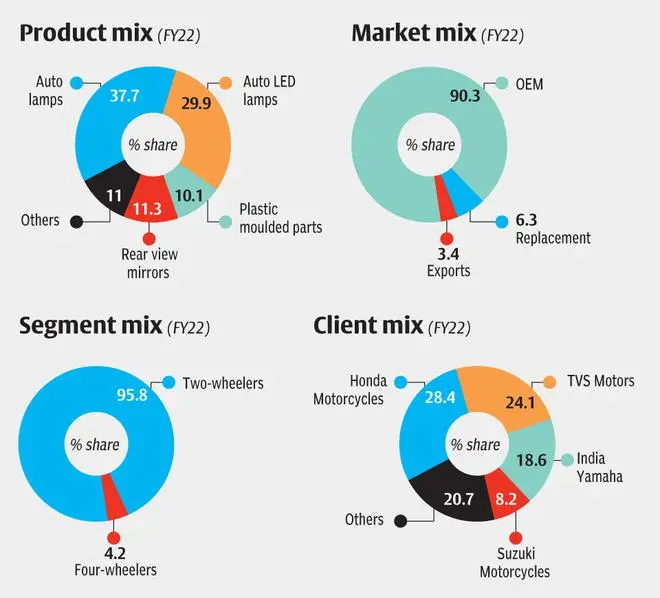

Fiem Industries derives 95 per cent of its revenues from the two-wheelers segment, with Honda, TVS, Yamaha and Suzuki being its key clients. Caught in a cyclical slowdown even as Covid hit, the overall auto industry sales volumes shrunk by 18 per cent year-on-year in FY20 and by another 13 per cent in FY21. Two-wheeler sales volumes too mirrored the industry fall in these two years. Into FY22, while commercial vehicle sales picked up riding on the economic recovery, passenger vehicle sale (especially utility vehicles) saw good demand as well, though hampered by chip shortages. However, two-wheelers continued to remain on a slippery slope, with sales volumes falling by about 11 per cent in the year ended March 2022. Being a more price sensitive segment of the auto industry, two-wheelers faced headwinds from price increases due to higher input costs and soaring petrol prices. Into this fiscal, demand is making a comeback. In the first three months, two-wheeler sales have soared 54 per cent. Though the volumes are still below pre-Covid levels, the low base from the downturn in the last three years as well good rural demand are tailwinds for bike sales.

Fiem is well placed to ride on this trend. The market share of Fiem’s key clients Honda and TVS has moved up from mid-single digit numbers 10 years ago to 26.7 per cent and 15.2 per cent respectively currently. Trends such as rising share of premium bike sales in the overall two-wheeler mix bodes well for the company as Fiem supplies to Royal Enfield, Harley-Davidson as well as other premium bikes from Suzuki and Yamaha. The company has a healthy pipeline of more than 80 projects over the next few years. It is supplying to three new models of Hero MotoCorp, expected to be launched in 2024.

LED, EV hold promise

What holds promise for Fiem is the higher adoption of LED lights by two-wheelers, given the focus on energy efficiency, be it through adoption of BS VI norms, the Café Regulations or EVs. Today, the mix of conventional lamps to LEDs in its lighting segment stands at 44 :56. The company expects the share of LEDs to move up 55-60 per cent over the next three years. While LED lamps may be priced 2-5 times higher than conventional ones, the company does not automatically get higher margins on this as, typically, most suppliers do not have good bargaining power with auto manufacturers. Even as LED share in the sales mix has gone up steadily over the last few years, the company’s operating margin has remained at about 10-12 per cent, given that they operate on a ‘cost plus 5 per cent margin’ terms with their buyers.

However, higher capacity utilisation following the comeback of demand could lead to greater absorption of fixed costs and bring about operating leverage to drive the margins. The current capacity utilisation stands at about 80 per cent. Secondly, higher content supplied per vehicle will also give them more pricing power. For example, Fiem is also supplying mirrors and plastic parts to some of its lighting customers. The company’s relatively newer products such as canisters (used for emission control), bank or lean angle sensors (to switch off engine when vehicle skids) will also help improve content per vehicle.

Fiem will be a beneficiary of the acceleration in EV adoption as well. The company currently earns less than 5 per cent of its revenues from supplies to electric bikes currently and has leading players such as Hero Electric, Okinawa and Ampere for clients. It also supplies to others such as Ola, Tork and Revolt. It expects the share of EV revenues to move up three times in the next 1-2 years. The government proposes 80 per cent EV sales penetration to be achieved for two-wheelers by 2030, according to a statement by the Transport Minister last year. As of 2021-22, only about 4.3 lakh electric two-wheelers (both registered and unregistered) were sold in the country which is about 3.2 per cent of the total two-wheeler (ICE) sales. Even assuming only a portion of the government’s target is met, this will still translate into substantial demand for LED lamps.

Financials

For the year ended March 2022, net sales grew by 29 per cent year-on-year to ₹1,578 crore and adjusted profits, by 93 per cent to ₹95 crore. Though domestic two-wheeler offtakes were lacklustre, EV supplies, replacement and export sales (especially for Yamaha) helped top line growth to an extent.

Operating margins came in at 12.3 per cent vs 10.7 per cent a year ago. The company has been on a debt reduction run in the last few years and interest costs have been progressively reducing. For 2021-22, it fell further by 26 per cent. Its debt-to-equity ratio stands at 0.03 times as of FY22. Capex plans for FY23 stand at ₹50 crore. Its de-leveraging efforts in the last few years will come in handy for further capacity expansions for LEDs, with growing demand.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.