Thanks to a favourable demand-supply mismatch and rising room rates, the Indian hospitality sector has been in the limelight for some time now. It has remained resilient even during recent corrections as business flourished due to the G-20 New Delhi summit and the Cricket World Cup.

Shares of the luxury hotel chain operator EIH Ltd., flagship of the Oberoi Group, have outperformed the markets (Sensex), gaining 32 per cent in the last 12 months and showing a 38 per cent CAGR in the last three-year period. However, with the stock trading at a decent 30 times FY24 estimated earnings, there might be some more gas left in the tank.

The company’s revenue and profit growth outlook seem positive. The stock appears fairly valued to peers, such as market leader Indian Hotels and high-growth Lemon Tree. However, in the absence of near-term triggers, growth may not accelerate. Considering both factors, the risk-reward ratio appears balanced and long-term investors can continue to hold the stock.

Business

EIH primarily operates in the two uppermost hotel segments, luxury, and upper upscale. This sets it apart from existing listed hotels, which usually encompass a mix of various segments. This positioning allows EIH to command twice the room rates (approximately ₹16,500 for domestic) compared to the industry average (₹7,000-7,200). This also ensures a good operating profit margin (27 per cent).

However, due to the higher development cost per upper upscale and luxury hotel room (3-5 times that of others), the number of such hotels across India is much lower, leading to higher occupancy (over 70 per cent vs. the industry average of 60-62 per cent).

EIH boasts over 4,200+ rooms (mainly Oberoi and Trident brands) across over 30 hotels in India and abroad. It aims to add a minimum of 50 more hotels with about 4,500 additional rooms by 2030 in a combination of owned and managed structures. However, doubling room count over 6 years may not prove to be that easy.

Prospects

Over the past year, the hotel/hospitality sector has experienced a rebound as a new cycle of strong growth is said to be under way, thanks to a pick-up in travel and significant events. This follows periods from FY15 to FY20 when the demand-supply imbalance corrected in favour of the industry, only to be disrupted by the Covid-19 outbreak and subsequent lockdowns from FY20 to FY22.

According to industry estimates, room supply growth will be subdued in the next 3-4 years, with only one-third of additional supply falling under luxury and upscale categories — categories served by EIH. With steady room rates and occupancy trends, EIH appears to be in a decent position, backed by growing affluence and rise in super-rich in India.

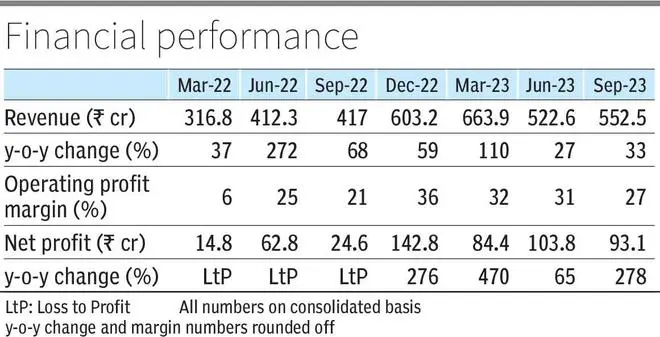

Bloomberg analyst estimates for EIH (consolidated) project 24 per cent and 15 per cent year-on-year revenue growth in FY24 and FY25, respectively. The adjusted EPS growth estimate for the same periods is 51 per cent and 17 per cent, respectively. These projections come on the back of over 100 per cent revenue growth in FY23 and a massive swing in profitability based on the high operating level nature of the hotel business. If these projections hold true, growth seems to be normalising.

One area where top hotel chains have not seen pre-Covid momentum return is with foreign tourists. Foreign room nights as a percentage of total room nights have yet to cross pre-pandemic levels. In the case of Trident, it was at 32 per cent in Q2FY24 compared to 45 per cent (pre-pandemic), while Oberoi was at 40 per cent compared to 53 per cent This recovery is still incomplete. Although Oberoi Flight Services and airport lounge businesses have performed well, they are not expected to compensate for the decline in foreign room bookings.

Other factors

While not directly linked to EIH’s current fundamentals, here are some key monitorables.

One, investors should track how the strategies and legacies at EIH evolve with the recent passing of hotel pioneer Prithviraj Singh Oberoi (EIH chairman emeritus). His son, Vikramjit Singh Oberoi, has been MD & CEO since 2015, while nephew Arjun Singh Oberoi is executive chairman since 2022.

Two, the low promoter holding of EIH (32.85 per cent) needs to be watched closely, as Reliance Industries (18.8 per cent) and ITC (over 16 per cent) are both public shareholders. If there is a takeover battle at a future date, EIH stock price could witness momentum. In August 2023, RIL and Oberoi Hotels announced joint management of three hotel properties in India and the UK. Meanwhile, ITC is listing its hotels business on the bourses around November-December next year.

Three, EIH’s plan to double rooms by 2030 will involve debt (the company is now net cash positive) as recently indicated by management. Unless EIH signs a steady number of hotels regularly, a good number of its 50 hotels might come online 4 to 5 years down the line, by when the current upcycle would be over.

Valuation

Given all of the above, we believe EIH has the potential to perform, but the upside may be limited. The stock is relatively fairly valued (30X PE) compared to peers such as market leader Indian Hotels (48 times) and high-growth Lemon Tree (54 times) based on FY24 estimates.

Investors should note that the hotel sector is susceptible to external shocks — terror attacks, adverse weather events, and large-scale outbreaks of infectious diseases, which could swiftly change the picture.

There are two main risks to our ‘hold’ call. One, if high growth for EIH in FY25-27 sustains, in which case the stock could outperform. On the other end of the spectrum, if the upcycle in the hotel business weakens accompanied by modest growth in demand, decline in occupancies, and consequently, room rates (move down with a 3-6 month lag), EIH stock could witness subdued performance. In conclusion, long-term investors could hold on to the stock at the current juncture.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.