Companies in sunrise sectors — that have strong macro factors in their favour — with early mover and other unique advantages sometimes see their stock price languish. Wonderla Holidays, India’s largest amusement park chain with a proven track record, is one such instance.

Since listing in 2014 at over ₹200 per share, its price has been a bit of a non-wonder. After touching a low of about ₹120 during the early phase of the Covid pandemic, the roller coaster ride has been on an upswing since April 2021. With impressive Q3 FY23 results, the stock has been seeing action recently and trades near ₹425 currently.

While the current quarter’s stellar performance is in no way indicative of the splash the company can make consistently in the seasonal business, Wonderla’s long track record with its parks, expansion plans, improving profitability and unique moat make it a good bet for investors. Given the recent sharp price jump and the small market cap (about ₹2,400 crore), investors can consider accumulating the stock with a three- to five- year time horizon for returns.

Operational track record

Wonderla started in 2000 with an amusement park in Kochi and has added two more — in Bengaluru and Hyderabad. It also operates a 3-star luxury resort (84 rooms) in its Bengaluru park. The business has a good moat, as acquiring land, setting up and operating it safely requires a specific skill set that is not easy to develop quickly. Wonderla has built its brand over the years and has navigated the severe Covid lockdowns.

The company also manufactures some of the rides at its facility in Kochi. The in-house production saves cost compared to importing them and paying for external maintenance, thereby boosting margin.

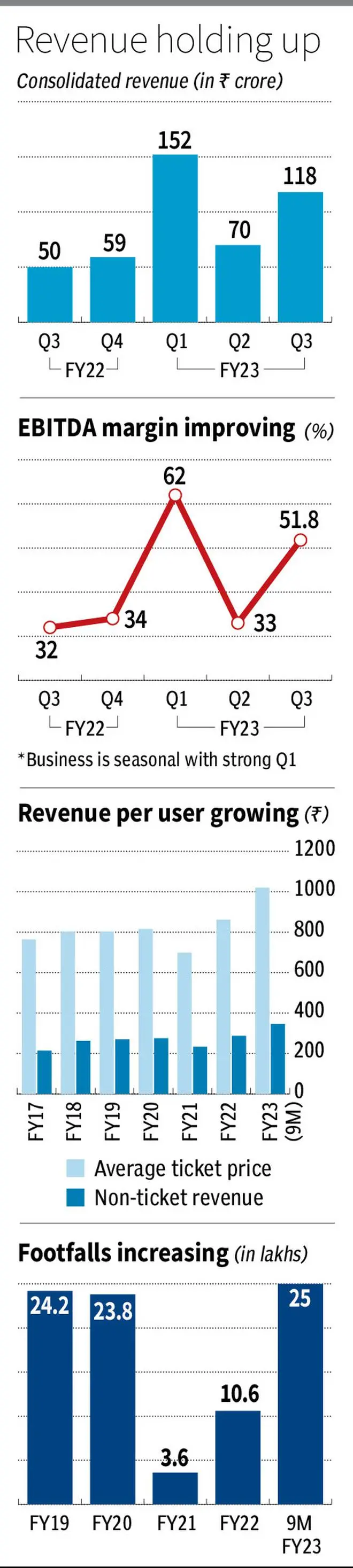

However, the key contributor to revenue and profit is the number of visitors. The parks have a capacity of over 10,000 guests per day, but the business is seasonal, due to monsoon and holidays; also, the activity, being discretionary, sees a pullback due to events such as demonetisation and price hikes due to GST. Footfalls have only grown at an anaemic pace (of about 4 per cent on average per year) from 2009 to 2019. The company has worked on organising events — such as music festivals, New Year celebrations — to attract crowds after regular park visiting hours. Data from the recent Q3 2023 quarter shows that this has improved footfalls.

Wonderla is also doing digital marketing and deploying wearables, to reduce cost, get more insights and improve user experience. Besides, the mix of ticket and non-ticket revenue is around 75-25, compared to 60-40 globally and the management expects there is room to improve this mix over time to 65-35. Digital analytics can aid non-ticket revenue such as from food and beverage, as the company can shift the focus from group ticket purchases to attracting retail customers (who typically provide higher average revenue).

Comfortable risk-return

Compared to other listed park operators such as Adlabs Imagica and Nicco Parks, Wonderla has a more geographically diverse footprint. Its revenue is higher than its peers’ and its PE multiple (of about 19.5), is lower than Nicco’s (about 23). Even with the recent jump in price, Wonderla’s stock price is lower than its pre-Covid historic average of about 25.

With the learnings from its existing parks, Wonderla is gearing up to expand and capitalise on the post-Covid tourism revival. Setting up a park in Bhubaneswar (estimated to start by FY25) and another in Chennai is actively in the works and these facilities are expected to be operational, with a few others in discussions.

Wonderla is debt-free and plans to fund expansions through cash accruals. Also, rather than buy, the company plans to enter into long-term land lease agreements with the government in its new park, such as the one in Orissa. This asset-light model will reduce capex (by up to 40 per cent) and aid faster returns. That said, there have been undue delays in the past with new projects — the Chennai one has been talked about for many years already.

Wonderla also raised ticket prices in 2022 multiple times (to 20 to 25 per cent higher than pre-Covid levels). This was well absorbed as seen from the 25 lakh footfall in the nine months of FY23 — the highest ever, surpassing the count for the full year of FY20 (FY21 and FY22 saw dips due to the pandemic). The young population of the country, and increasing disposable income as the economy gains steam, could aid long-term growth.

Promoters hold 70 per cent stake with no shares pledged.

Financials

In the recent December quarter of FY23, revenue jumped 62 per cent over Q3 FY20 (pre-pandemic) to ₹113 crore. EBIDTA margins were at 52 per cent, versus 35 per cent in Q3 FY20. Average revenue per user (ARPU) grew 14 per cent in the nine months of FY23 to ₹1,263 over the same period in FY20. Revenue and EBITDA grew 44 per cent and 64 per cent in this period to ₹328 crore and ₹178 crore respectively in the nine months of FY23.

The management expects margin to moderate to 45 per cent, going forward. Revenue growth will be aided by a moderate increase (6-8 per cent) in footfalls and higher spending per customer (10 per cent, from higher ticket prices and improved non-ticket spending), giving a revenue growth of over 15 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.