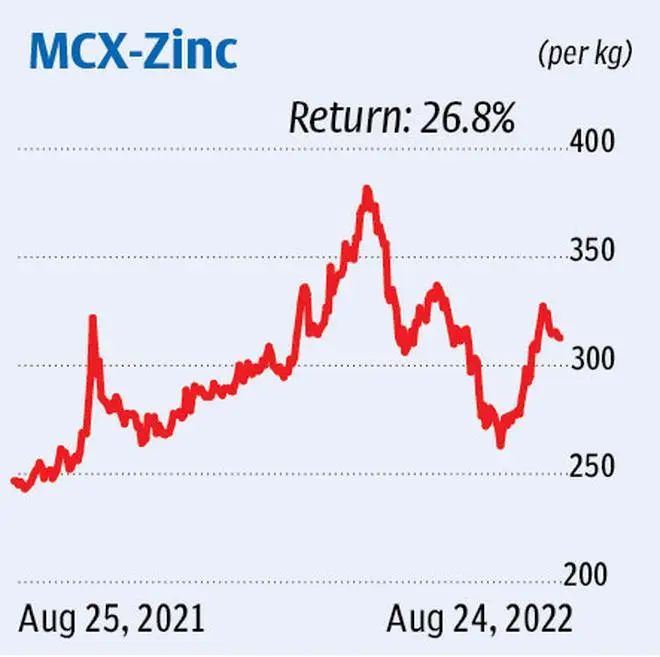

The continuous zinc futures on the MCX (Multi Commodity Exchange), which has been rallying since mid-July, faced resistance at ₹340 and has fallen to ₹317. The price band of ₹330-340 is a strong barrier to be breached and there is a possibility of it declining further.

Supporting the bearish bias, the contract has formed an inverted hammer candlestick pattern – a bearish reversal – on the weekly chart.

We, therefore, expect the contract to fall from here. While ₹300 can be a minor support, the zinc futures might drop below this level and decline to the support band of ₹292-286.

On the other hand, if the contract manages to break out of the resistance at ₹340, it can rally to ₹360, and then possibly to ₹380.

Strategy: The outlook is bearish as long as the contract remains below ₹340. Hence, traders can consider fresh short positions at ₹317 and add more shorts if the price rises to ₹330. Place the initial stop-loss at ₹350. When the price touches ₹300, revise the stop-loss down to ₹315. Exit all the shorts at ₹292.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.