Nifty 50, Sensex and the Nifty Bank index fell last week in line with our expectation. Indeed, the benchmark indices fell well beyond the levels that we had mentioned last week. Sensex and Nifty were down over 1.5 per cent each. Nifty Bank index fell 2 per cent. On Friday, the indices made a sharp bounce from their lows, recovering some of the loss.

The price action this week is going to be very crucial. A strong follow-through rise is needed from here to bring back the bullishness. Else, another leg of fall cannot be ruled out. As such, we suggest market participants to remain very cautious. We prefer to stay out of the market this week and just watch the movement to get clarity on the next move.

All sectoral indices ended in red last week. The BSE IT index was beaten down the most. It fell 4.6 per cent last week. The BSE Realty, BSE Healthcare were down 2.79 per cent and 2.38 per cent respectively.

FPIs sell-off

The foreign portfolio investors (FPIs) sold Indian equities heavily last week. The equity segment witnessed an outflow of about $2.23 billion. The FPI action in the coming weeks will need a close watch. If the sell-off intensifies further, then the Nifty and Sensex can be knocked down badly.

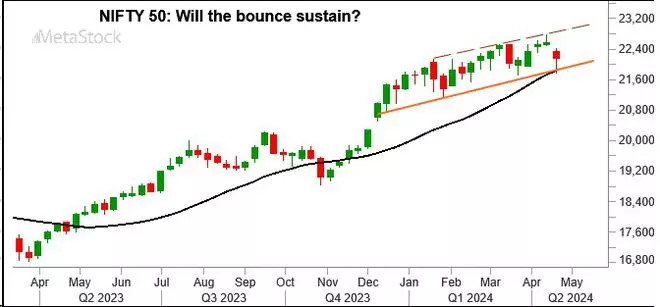

Nifty 50 (22,147)

Nifty fell all through the week. It tumbled to a low of 21,777.65 on Friday and then had bounced back well, recovering some of the loss. The index has closed at 22,147, down 1.65 per cent.

Short-term view: Last week, we had expected a bounce from around 21,900. Instead, this bounce has happened from 21,777. Supports for this week are at 21,700 and 21,500. Resistance is around 22,500. A strong break above 22,500 is needed to bring back the bullishness again. In that case, Nifty can rise to 23,000 in the short term.

Failure to rise past 22,500 can take the Nifty down to 21,700 and 21,500 this week. A break below 21,500 will intensify the sell-off and drag the Nifty down to 21,000 and even lower in the short term.

Graph Source: MetaStock

Medium-term view: Nifty has to rise above 22,500 from here to keep the chances of seeing 23,200 and 23,650 alive. Thereafter, we can get a strong correction targeting 22,000-21,500 first. A break below 21,500 can drag it down to 20,000 and 19,500. Such a fall to 20,000-19,500 will be a very good buying opportunity from a long-term perspective.

On the other hand, if a break below 21,500 happens from here itself, the fall to 20,000 and lower levels can happen immediately. That will negate the rise 23,200-23,650.

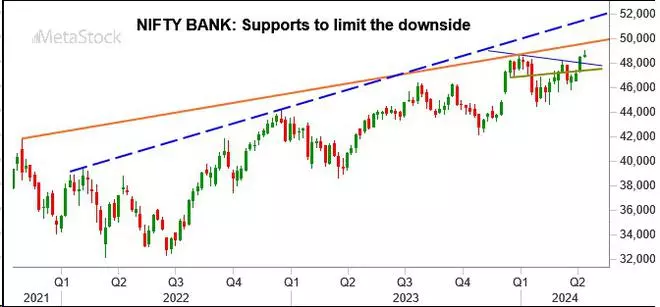

Nifty Bank (47,574.15)

Our view of seeing a bounce from 48,000 mentioned last week has gone wrong. The Nifty Bank index broke below 48,000 and fell to a low of 46,579.05. The index has bounced back well from this low, recovering some of the loss on Friday. It has closed the week at 47,574.15, down 2.04 per cent.

Short-term view: The near-term outlook is slightly mixed. Support is around 46,700. Resistance is around 48,000. A breakout on either side of these levels will determine the next move.

A break above 48,000 will be bullish to see 49,000 and 49,500 on the upside. On the other hand, a break below 46,700 will increase the downside pressure. Such a break can drag the index down to 46,000 and 45,800-45,700 in the short term.

Graph Source: MetaStock

Medium-term view: The broader trend is still up. Nifty Bank index has strong supports at 46,000 and 44,500. So, if there is a strong sell-off dragging the index below 46,000 in the coming days, then the fall to 44,500 can be a good buying opportunity.

The upside is open to test 52,000 and even 53,000. Thereafter, a corrective fall to 50,000 and even lower can be seen.

At the moment, it is not very clear on which side the index will go first from here. A rise to 52,000-53,000 or a fall to 44,500? We will have to wait and watch.

Sensex (73,088.33)

The fall to 72,000 happened in line with our expectation last week. Sensex fell to a low of 71,816.46 and then has risen back recovering some of the loss. The index has closed at 73,088.33, down 1.56 per cent.

Short-term view: Resistances are at 73,450 and 73,800. Sensex has to get a sustained break above 73,800 to move back up to 75,000 and higher again.

Support is around 71,850. A break below it can take the index down to 71,200 initially. A further break below 71,200 can drag the index down to 71,000 and 70,500 this week.

Graph Source: MetaStock

Medium-term view: Sensex has to sustain above 71,850 to keep the chances of seeing 78,000 on the upside alive. If the fall to 71,000 mentioned above happens from here itself, then that would negate the rise to 78,000. It will then turn the outlook bearish for a fall to 70,000-69,500 and even lower. We will have to wait and watch.

Dow Jones (37,986.40)

The Dow Jones Industrial Average was stable and range bound last week. The index oscillated up and down between 37,600 and 38,400 all through last week. It has closed on a flat note at 37,986.40.

Graph Source: MetaStock

Outlook: The range bound move last week could be a pause before a fresh fall is seen. The region between 38,200 and 38,500 will be a strong resistance. A bearish moving average cross-over on the daily chart leaves the bias negative. As such, the chances are high for the Dow Jones to break 37,600 and fall to 37,200 and 37,000 in the short term.

The price action around 37,000 will need a close watch. A bounce from there can take the Dow Jones up to 38,000 and higher again. But a break below 37,000 will intensify the sell-off. That will drag the index down to 36,500 and lower.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.