Global equities are under pressure. The US Federal Reserve projecting another 125-basis points (bps) rate hike for the rest of the year after increasing rates by 75 bps last week has triggered a strong sell-off in the US equities. The Dow Jones Industrial Average had tumbled about 4 per cent last week. The fall in the Indian benchmark indices were not as bad as the Dow. Sensex and Nifty 50 fell 1.26 and 1.16 per cent respectively last week. The Indian indices continue to show resilience but will remain subdued for some time as the Dow still has room on the downside to fall further.

Among the sectors, the BSE FMCG index outperformed by surging 3.68 per cent last week. The BSE Power index, down 5.1 per cent was beaten down the most.

FPI action

The Foreign Portfolio Investors (FPIs) have turned net sellers of equity after having bought for nine consecutive weeks. The FPIs had sold $428.2 million in the equity segment last week. However, for the month they are net buyers and have injected just over a billion dollars into the Indian equities.

Nifty 50 (17,327.35)

The strong bounce from Monday’s low of 17,429.70 failed to sustain. Nifty made a high of 17,919.3 and then has declined sharply. A test of 17,350 mentioned last week has happened. The index has closed at 17,327.35, down 1.16 per cent.

Graph Source: MetaStock

The week ahead: Immediate support is at 17,150. Below that 17,000 is the next important support for this week. If Nifty manages to hold above 17,000, a bounce to 17,600-17,700 can be seen this week.

But a break below 17,000 can increase the downside pressure. Such a break can take the Nifty down to 16,700 — the 21-week moving average (WMA) initially and even to the trendline supports of 16,410 and 16,300 eventually in the short term.

Medium-term outlook: The level of 16,300 mentioned and the 100-WMA at 16,095 are the crucial supports to watch from a medium-term perspective. The chances are high for the Nifty to reverse higher either from 16,300 itself or from the 100-WMA support.

That will keep the bigger picture bullish to see a break above 18,100 eventually over the medium term. Such a break will pave way for a rise to 19,500-19,700 initially and then to 20,000-20,200 eventually in the coming months.

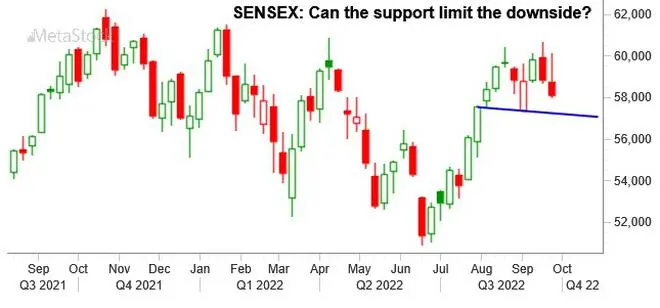

Sensex (58,098.92)

Sensex failed to get a strong follow-through rise above 60,000 last week. It made a high of 60,105.79 and has declined sharply breaking below the trendline support at 58,800. The index has closed the week at 58,098.92, down 1.26 per cent.

Graph Source: MetaStock

The week ahead: Immediate supports are at 57,800 and 57,300. A bounce from 57,300 can keep the Sensex in a broad range of 57,300 and 60,500 for a few weeks.

The index will come under more selling pressure if it breaks below 57,300. Such a break can take it down to 56,000 and even 55,000 in the coming weeks. The chances of seeing a bounce from 56,000-55,000 towards 57,000 is a possibility thereafter.

Medium-term outlook: Strong supports to watch are 55,000 and 54,000. Sensex is likely to hold above 54,000. That will keep the bigger picture bullish to break above 60,500 eventually in the coming months. Such a break will pave the way for a test of 64,000 over the medium term.

The medium-term outlook will turn bearish only if Sensex breaks below 54,000. Only in that case the chances of a fall to 50,000-49,000 will come back into the picture.

Nifty Bank (39,546.25)

The Nifty Bank index came under pressure in the second half of last week. The index fell back sharply after making a high of 41,677.65 on Tuesday. The index tumbled 3 per cent to close the week at 39,546.25.

Graph Source: MetaStock

Immediate support is at 39,300. The index has to necessarily bounce from this support to keep the bullish view alive of seeing 42,000 on the upside.

A break below 39,300 will be bearish. Such a break can take the index down to 38,275-38,200 this week. Thereafter, a bounce-back move to 39,400-39,500 can be seen. However, if the index breaks below 38,200, the chances for which are less though, there can be an extended fall to 37,000 in the coming weeks.

Trading strategy: Last week, we had recommended to go long 40,450, 40,150 and 39,650. The average entry level is at 40,083. Retain the same strategy. Keep the stop-loss at 38,870. Trail the stop-loss up to 41,100 as soon as the index moves up to 41,700. Move the stop-loss further up to 41,850 when the index touches 42,100. Book profits at 42,300.

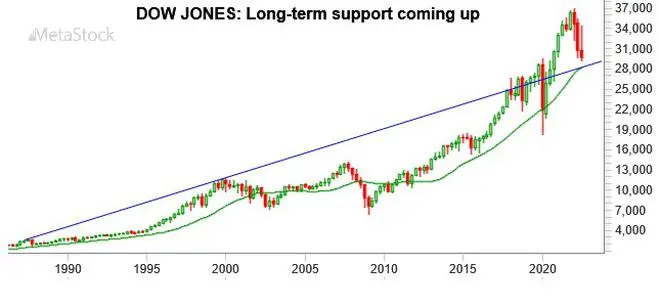

Global cues

The Dow Jones Industrial Average (29,590.41) continues to get beaten down. The index was down 4 per cent last week. The fall to 29,500 has happened as expected.

Graph Source: MetaStock

Now, immediate support is at 28,900. It will have to be seen if the Dow manages to bounce from here. If it does, a relief rally to 30,500-31,000 is possible. But a break below 28,900 can see a steeper fall to 28,200.

From a big picture perspective, 28,200 is a strong long-term trend support. As such, the chances are high for the Dow to find a bottom around 28,200. A strong bounce from there will indicate the beginning of a fresh long-term rally.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.