The four-week consolidation in the Sensex and Nifty 50 has come to an end. The Indian benchmark indices declined sharply last week breaking their range on the downside. Both the Sensex and Nifty 50 were down over 2 per cent each last week. This has turned the short-term outlook bearish for the Sensex and Nifty 50. Though there is room to fall more from here, crucial supports are coming up that can halt the current fall. The price action this week is going to be very important.

The much-awaited Union Budget 2023 is on Wednesday. Will this event come to rescue the market and trigger a reversal? We will have to wait and watch.

Among the sectors, the BSE Power and the BSE Oil & Gas indices were beaten down the most. They were down 10.44 and 7.17 per cent respectively. The BSE Auto index outperformed by rising 2.79 per cent.

FPIs sell

The Foreign Portfolio Investors (FPIs) continue to sell the Indian equities. They sold $218.85 million last week in the equity segment. The month of January has seen a net outflow of $2.07 billion so far. This could keep the Sensex and Nifty under pressure.

Nifty 50 (17,604.35)

Nifty managed to stay above 18,000 in the first half of the week. However, the index came under huge selling pressure towards the end and tumbled breaking below the key support level of 17,775 on Friday. Nifty touched low of 17,493.55 and recovered slightly to close the week at 17,604.35, down 2.35 per cent.

The week ahead: The short-term outlook is negative. The region between 17,750 and 17,800 will be a good resistance for the week. As long as the index stays below 17,800, it can fall further towards 17,400 and 17,300 this week.

This 17,400-17,300 is a very crucial support zone. We expect the Nifty to bounce from this support zone and move back up to 17,750-17,800 again. A rise past 17,800 will open doors to revisit 18,000-18,200 levels.

On the other hand, if Nifty declines below 17,300, though less likely, it can extend the downmove up to 17,000.

Graph Source: MetaStock

Medium-term outlook: Crucial supports to watch are 17,400-17,300 and 16,850 – the 100-Week Moving Average. A break below 17,300 and an extended fall to 16,850 could be an initial sign of the medium-term trend turning bearish. In that case, our earlier bullish view of seeing 20,000-20,500 on the upside will come under threat. Such a fall to 16,850 can keep the Nifty under pressure to see 16,000 on the downside over the medium term.

However, for now we expect the 17,400-17,300 support zone to limit the downside. As long as the Nifty sustains above 17,300, we retain our overall bullish view of seeing 19,800-20,200 over the medium term.

Sensex (59,330.90)

The struggle for the Sensex to breach 61,000 continued last week also. Sensex made a high of 61,266.60 on Tuesday and then fell back sharply giving back all the initial gains. The index tumbled breaking below the key support level of 59,500 and made a low of 58,794.70. Sensex has recovered slightly from this low and closed the week at 59,330.90, down 2.13 per cent.

The week ahead: The fall below 59,500 is a negative. Strong resistance will now be in the 59,500-60,000 reigon. As long as the Sensex trades below 60,000, the short-term outlook is bearish. Sensex has room to fall further towards 58,500-58,000 in the short term.

The region between 58,500 and 58,000 is a strong support zone. We expect Sensex to sustain above this support zone and bounce back towards 59,500 and 60,000.

Sensex will have to rise past 60,000 now to ease the downside pressure and bring back the positive sentiment.

Graph Source: MetaStock

Medium-term outlook: As mentioned last week, 58,500 and 57,500 are crucial long-term support. We will retain our overall bullish view of seeing a rise to 65,500-66,000 over the medium term as long as the Sensex sustains above the 58,500-57,500 supports.

This bullish view will go wrong if the Sensex declines below 57,500 decisively. In that case, the outlook will turn bearish and the Sensex can target 56,500 and 55,000 on the downside.

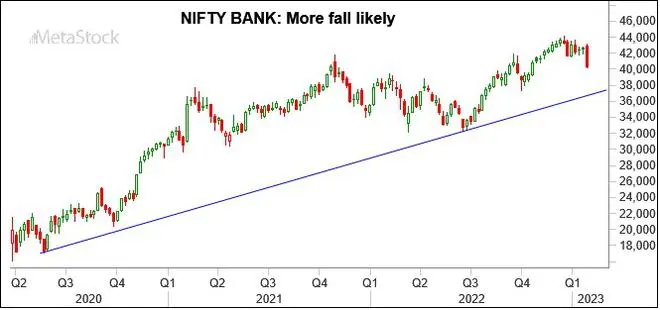

Nifty Bank (40,345.30)

Our bullish view of seeing a break above 43,000 and a rise to 44,000-44,500 has gone wrong. On the contrary, the Nifty Bank index failed to breach 43,000 and tumbled below 41,000. The Nifty Bank index fell to a low of 40,148.80 before closing the week at 40,345.30, down 5.09 per cent for the week.

The short-term outlook is bearish. Nifty Bank index has a crucial support at 39,750 which can be tested this week. Whether the index manages to sustain above this support or not will determine the next leg of move. A strong bounce from 39,750 can take the Nifty Bank index up to 41,500-42,000 again.

Graph Source: MetaStock

On the other hand, if the Nifty Bank index breaks below 39,750, it can intensify the selling pressure. In that case, the chances are high for the index to see a steeper fall to 37,500-37,000 going forward.

Dow Jones (33,978.08)

The Dow Jones Industrial Average has recovered well last week after having fallen over 2 per cent in the week earlier. The view of seeing a fall to 32,500 or 31,700 before a reversal mentioned last week has not happened. The bounce last week keeps the overall bullish view intact.

Graph Source: MetaStock

The price action last week also strengthens the bullish case. The Dow Jones got strong support around 33,300 all-through the week. In addition to this, there is a possibility of an inverted head and shoulder pattern formation on the daily chart. These factors leave the bias bullish for the Dow Jones to break above the upcoming resistances at 34,200-34,500 and 34,800. Such a break can take the index up to 35,500 in the short term.

Inability to breach 34,500 can keep the index in the range of 33,000-34,500 for a few weeks. The bias will however continue to remain bullish to break 34,500 and rise to 35,500.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.