The Indian benchmark indices, the Sensex and Nifty 50, snapped their four-week rally last week. Both the indices remained stable and were stuck in a sideways range. Sensex and Nifty 50 have closed the week marginally lower by 0.21 and 0.23 per cent respectively.

The movement in the past week suggests that the indices have just paused within their broader uptrend. Although there is room to see a corrective fall from current levels, that is likely to be short-lived. Sensex and Nifty have strong supports that can limit the downside and keep overall uptrend intact.

Among the sectors, the BSE Power and BSE Consumer Durables fell the most by 3.38 and 2.4 per cent respectively last week. The BSE Bankex and BSE IT managed to stay afloat. The indices closed the week up 0.92 and 0.32 per cent respectively.

FPIs buy more

The Foreign Portfolio Investors (FPIs) are continuing to buy the Indian equities. The FPIs bought about $1.41 billion in the equity segment last week. For the month of November, the equity segment has seen an inflow of about $3.71 billion so far. As the FPIs continue to buy, the Sensex and Nifty can remain supported. As such, any dip in the coming days could be short-lived.

Nifty 50 (18,307.65)

The price action last week indicates lack of strong follow-through buyers above 18,400 on the Nifty. The index struggled to sustain above 18,400 and fell from the high of 18,442.15. Nifty has closed the week at 18,307.65, down 0.23 per cent.

The week ahead: The immediate outlook is mixed. Failure to sustain above 18,400 keeps the chances alive for seeing a short-lived correction in the near term. Series of supports are at 18,100, 18,000 and 17,900. Inability to bounce above 18,400 immediately from here can take the Nifty down to 18,100-18,000 this week. However, such a fall will be a good buying opportunity from a long-term perspective.

Resistance is at 18,450-18,500; Nifty has to breach 18,500 decisively in order to regain the bullish momentum. Such a break can take it up to 18,700-18,800 initially and then to 19,000-19,100 eventually in the short term

Chart Source: MetaStock

Medium-term outlook: The broader picture is still positive. Strong supports are at 17,900 and then in the 17,600-17,500 region. As long as the Nifty stays above 17,500, the medium-term outlook is bullish. We expect the Nifty to rally to 19,400-19,500 over the medium term.

From a long-term perspective, we retain our bullish view of the Nifty targeting 20,500 in the coming months.

Trading strategy: Last week, we had suggested to go long at 18,350 for a minimum holding period of three months. Follow the same strategy. Accumulate on dips at 18,150 and 18,050. Buy more at 17,700 if a steeper fall below 18,000 is seen. Keep a stop-loss at 17,200. Trail the stop-loss up to 18,600 as soon as the index moves up to 19,100. Move the stop-loss further up to 19,100 when the index rallies to 19,950. Book profits at 20,100.

Sensex (61,663.48)

The break above 62,000, witnessed in the initial part of the week, failed to sustain. Sensex made a high of 62,052.57 and fell giving back all the gains. It has closed the week at 61,663.48, down 0.21 per cent.

The week ahead: An immediate support is at 61,330, which has held very well on Friday last week. If Sensex breaks below this support, a corrective fall to 60,800-60,700 is possible. The level of 60,700 is a strong support and is likely to limit the downside. A bounce from the 60,800-60,700 support zone can take the Sensex back up to 62,000 in the near term.

A sustained break above 62,000 will be bullish for the Sensex to test 63,300-63,500 on the upside in the short term.

Chart Source: MetaStock

Medium-term outlook: The bigger picture is still bullish. Cluster of supports are poised in the broad 60,000-59,000 region. As long as the Sensex trades above this support zone, the trend will remain up. Sensex can test 64,000 initially. From a long-term perspective, Sensex has the potential to target 66,000 in the coming months.

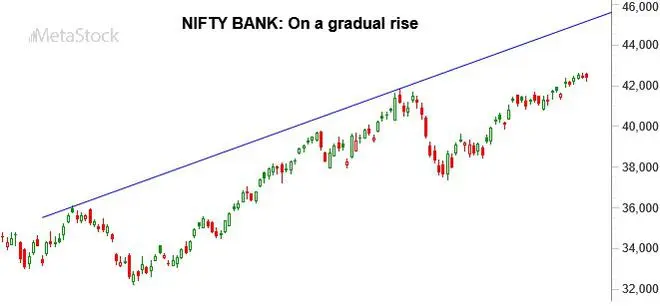

Nifty Bank (42,437.45)

The support at 41,950 mentioned last week has held very well. However, the Nifty Bank index is yet to breach the intermediate resistance at 42,500. The index attempted to break above 42,500, but failed to sustain. It made a high of 42,622.75 and had come off from there. The Nifty Bank index has closed the week at 42,437.45, up 0.71 per cent.

Chart Source: MetaStock

The overall picture remains positive. Nifty Bank index can test 43,300 on the upside in the short term. A sustained break above 42,500 will pave the way for this rise. A corrective fall from 43,300 to 42,000 cannot be ruled out. However, a further fall below 42,000 will be less probable.

The medium-term picture is bullish with strong supports at 42,000 and 41,500. Nifty Bank index can target 45,000-45,300 over the medium term.

Global cues

The Dow Jones Industrial Average (33,745.69) failed to break above 34,000 last week. It made a high of 33,987.06 on Tuesday and fell sharply to make a low of 33,239.75 on Thursday. The index has managed to bounce back well from this low towards the end of the week recovering all the loss. The Dow has closed the week on a flat note at 33,745.69.

The support at 33,250 mentioned last week has held very well. This keeps the broader bullish bias intact. The strong bounce towards the end of last week keeps the chances high for the Dow to break above 34,000 in the coming days. Such a break can take the index up to 34,500 initially and then to 34,700-35,000 eventually in the coming weeks.

The levels of 33,250 and 33,170 are strong support. If the Dow breaks below 33,170, a corrective fall to 32,800-32,700 can be seen.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.