After falling for three straight weeks in March, the last two weeks brought cheer to the Indian market thanks to consecutive gains. Bellwether indices S&P BSE Sensex and Nifty closed the week by gaining about 1.43 and 1.38 per cent, respectively.

The indices ended green for all three sessions on the back of better-than-expected auto sales, FIIs turning positive and RBI’s decision to keep the repo rate unchanged.

Except for BSE Power (-0.33 per cent), all other sector indices gained during the week, the highest being BSE Realty (4.29 per cent), BSE Capital Goods (3.29 per cent) and BSE Auto (1.78 per cent).

The top three gainers in the BSE 500 index have been Brightcomm Group (up 26.98 per cent), IEX ( up 17.9 per cent) and Tata Teleservices (Maharashtra) (up 15.73 per cent).

While the CERC order seemed to have led to IEX gaining during the week, gains in the other two stocks didn’t appear to have a fundamental reason. However, the stocks of Cholamandalam Investment and Finance Ltd and IndraprasthaGas, among the major moves last week,have had positive news.

IEX

Indian Energy Exchange (IEX) provides an automated trading platform for physically delivering electricity, renewables and certificates.

The stock of IEX surged about 18 per cent over the last week. As per the Central Electricity Regulatory Commission (CERC) order, the IEX and other two exchanges have been allowed to charge a transaction fee of up to 2 paise/kWh. IEX, in July 2022, had petitioned the CERC to approve a transaction fee ceiling of 2 paise/kWh.

There was an overhang here because there could have been a reduction in the transaction fee when it comes to trading on the platform, while CERC has maintained the status quo at 2 paise per kilowatt on either side of the transaction.

The favourable order from CERC led to about 10 per cent rise in the stock price on April 6, 2023. The stock currently trades at around a trailing P/E of 44 times.

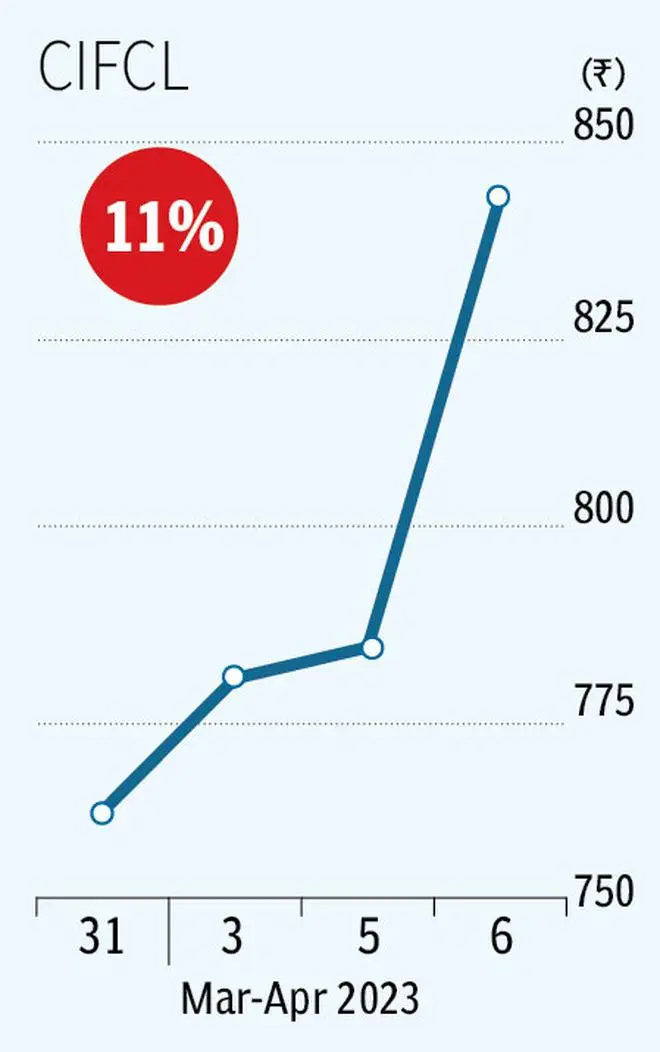

Cholamandalam Investment and Finance

The stock of Cholamandalam Investment and Finance (CIFCL), the financial services arm of Murugappa group, hit a 52- week high on Thursday by surging close to 7.66 per cent on that day. The stock gained about 10.51 per cent last week. The stock performance was driven by its strong Q4FY23 results.

CIFCL’s disbursements during the quarter grew about 65 per cent y-o-y to ₹21,020 crore mainly on account of growth in disbursements in MSME (127 per cent) and Home Loans segments (156 per cent).

The collection efficiency on billing stood at about 130 per cent during the quarter. The stock is currently trading at a trailing P/B of around 5.87 times.

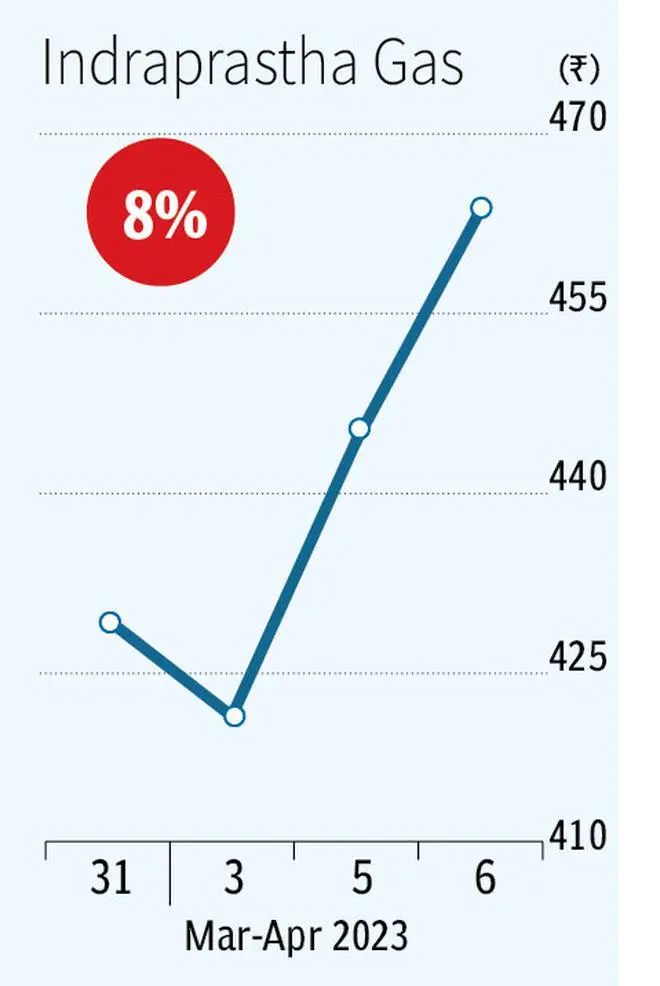

Indraprastha Gas

As per the Union Cabinet directive on Thursday, natural gas produced from legacy or old fields, known as APM (Administered Price Mechanism) gas, will now be indexed to the price of imported crude oil instead of benchmarking it to gas prices in four surplus nations such as the US, Canada and Russia.

The rate arrived will be capped at $6.5 per million British thermal units, while the floor shall cost $4. The ceiling price is lower than the current price of $8.57. This bodes well for city gas distribution company Indraprastha Gas which sources about 80 per cent of its volumes from APM, and hence it can lead to a reduction in its input cost.

Because of this development, IGL stock shot up by around 4.5 per cent that day, leading to its weekly gain of about 7.9 per cent. The stock of IGL trades at a trailing P/E of 21.55 times.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.