Ahead of the long-awaited international wind energy conference and expo Windergy India 2022 (scheduled for April 27-29), the Indian industry has made a case for a re-think on tariff discovery.

Its pitch is simple. Back in 2017, when the central government brought in capacity auctions — the entity that offered to sell power cheapest would get a power purchase contract — it was well understood that the tariffs would fall because of competition.

They did. Until then, wind energy companies sold electricity under fixed ‘feed-in tariffs’e determined by the respective state electricity regulator. The lowest feed-in tariff at that time was ₹4.16 a kWhr, in Tamil Nadu. But after the first capacity auction in February 2017, the tariff fell to ₹3.46 a kWhr. This would fall further to ₹2.44 in subsequent auctions.

The broad understanding was that the industry would be compensated for the low prices by higher volumes — but this never happened.

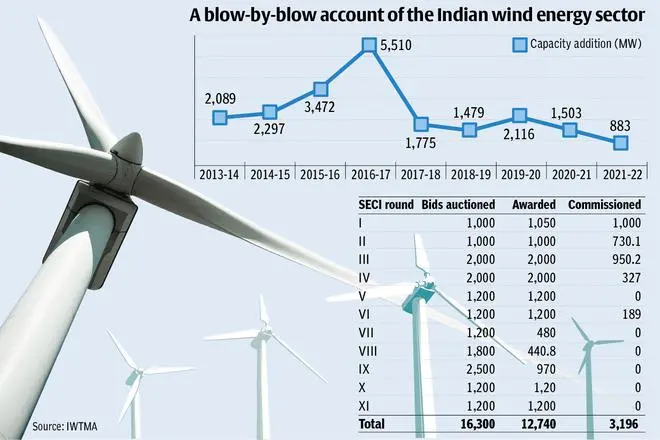

Here is a telling statistic: Total capacity tendered out (by the government-owned company SECI) is 16,300 MW, of which 12,470 MW has been awarded. But only 3,196 MW has been commissioned.

“It is true that getting land and connection to the grid have been issues,” says DV Giri, Secretary General of the Indian Wind Turbine Manufacturers’ Association (IWTMA), a leading voice in the industry, “but one big reason for the poor execution of projects is that the aggressive bidding does not have any cushion for uncertainties.”

Of the awarded capacity, about 1,520 MW has been surrendered and another 1,000 MW is likely to be surrendered too, according to industry sources.

Competitive tariff bidding had another fallout. Earlier, companies that were in other businesses such as textiles or engineering would put up small capacities, say 5-10 MW, for depreciation benefits or as a green effortr.

Competitive bidding, however, set the minimum at 50 MW. The small-capacity guys could not compete with the biggies. Nor could they sell to the electricity distribution utilities, which preferred the cheaper power that SECI had bought through auctions.

The bottom line is this: the competitive bidding mechanism, though well-intentioned, has not delivered.

What next?

A return to fixed feed-in tariffs seems unfeasible, for reasons of both economics and politics, given the poor health of the state-owned electricity distribution utilities (discoms), which are the major buyers of wind power.

The industry is clear that it has to move away from discoms. Fortunately, there are options. Selling directly to customers, particularly in the ‘commercial and industry (C&I)’ category, is lucrative because they pay the utilities far more than what the wind industry would charge them.

Another option is to sell through the energy exchange IEX for a remunerative price.

The industry, therefore, has one ask of the government: make it easier and cheaper for us to sell directly to customers. This essentially entails two things — waiver of inter-state transmission charges (which could be as high as ₹2 a kWhr) and allowing wind companies to bank their power with the grid for (say) three months. Currently, inter-state transmission charges are waived until 2025; IWTMA wants it extended up to 2030. Banking would enable the wind company to park its electricity in the grid and draw it later, when there is demand.

Looking up

While on one hand the annual wind power installation numbers are dismal, on the other, one senses a revival of optimism in the industry — not in the least because two big business houses with deep pockets, Adani and ReNew, are getting into the wind energy sector.

Both are opting for an integrated, manufacture-and-supply model. Adani (perhaps through Adani Green Power) is readying to put up a 5.2 MW prototype in-house, with technology from W2E Wind Energy of Germany. The machine is likely to be manufactured by a company set up by the promoters of the Adani group; the turbine will be set up at Mundra, a windy coastal town. Once proven, Adani will proceed to mass manufacture the turbines, self-consume and also export.

ReNew is in the process of taking over the insolvent turbine manufacturer Regen Powertech. It is also talking to the Chinese turbine maker Goldwind to buy 3.4 MW machines; it has placed an order for 600 MW from another Chinese company, Envision (which, incidentally, has bagged 1,900 MW worth of orders from India).

Talk to wind industry insiders and you will find that the despondency of a year ago has lifted now. More clarity on the future is likely to emerge at Windergy 2022.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.