A few years ago, global investors thought the $150 billion stressed asset market in India presented a golden opportunity for takeover through the Insolvency and Bankruptcy Code (IBC). But with legacy issues haunting even the done deals, prospective bidders are getting increasingly discouraged.

Take the Bhushan Power and Steel case. Two years after taking over the beleaguered company for ₹19,350 crore and turning it around, JSW Steel is still waiting for final approval from the Supreme Court.

Promoter interference

On March 26, 2021 JSW Steel had completed the acquisition of BPSL by implementing a resolution plan approved under the IBC Code and the asset delivered an EBITDA of ₹6,423 crore last fiscal.

As a precursor to the BPSL deal, JSW Steel had moved the National Company Law Appellate Tribunal (NCLAT) seeking immunity from investigations against the erstwhile promoter of the company, Sanjay Singal. NCLAT provided immunity and approved the resolution plan.

However, the Enforcement Directorate moved the Supreme Court, challenging NCLAT’s authority to provide immunity in a case against Singal under the Prevention of Money Laundering Act. But the Supreme Court, in a different case, had upheld NCLAT’s authority to provide immunity to acquirers of assets in insolvency cases. Following this, JSW Steel closed the BPSL deal on the condition that lenders would have to repay the money if the Apex court ruled against the deal.

Similarly, Tata Steel has faced many hurdles while taking over Bhushan Steel, one of the oldest insolvency cases filed in 2017.

After taking control in 2018, Tata Steel wanted the erstwhile promoters, Neeraj Singal and Brij Bhushan Singal, to sell their 2.5 crore shares at ₹2 a piece as per the resolution plan. However, the promoters challenged the demand in NCLAT which dismissed their plea in October, 2021. Finally, only in March 2022, did NCLAT uphold Tata Steel’s move.

TV Narendran, Managing Director, Tata Steel, said the company is still dealing with few issues as some demands on past dues keep cropping up while the whole (IBC) concept was on a clean slate basis.

Challenges galore

Nadiya Sarguroh, Senior Associate, MZM Legal, said while the IBC ecosystem is built on reviving stressed businesses through successful resolution, in reality, the applicants who bid for the assets face a number of challenges.

These range from litigation challenges to implementation of the resolution plan. The erstwhile promoters keep making pleas under Section 12A while investigating authorities vie for a piece of the cake by charging “proceeds of crime” on the stressed asset, he said. As examples, Sarguroh points to the marathon resolution processes of Essar Steel, Jet Airways, Bhushan Power and Ruchi Soya.

Lengthy process

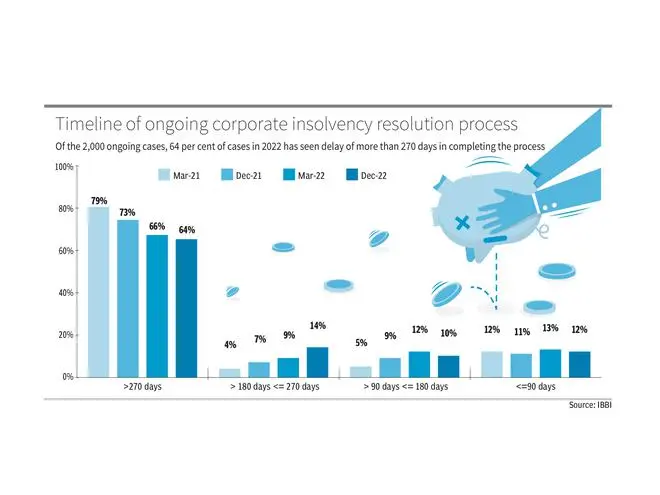

The prolonged delay in the resolution process has already taken a toll on many assets. Of the 2,000 ongoing cases, about 1,280 cases have crossed the outer limit of 270 days while another 280 are about 180-270 days old, and 440 cases are 180 days old. After slowing down in the pandemic period of FY21 and FY22, the number of insolvency cases increased by 25 per cent in the December quarter to 6,199 against 4,946 in the same period last year. However, despite the increase, the number of cases admitted to the insolvency process continued to be lower compared to earlier quarters in FY19/20.

The lenders have taken a haircut of 70 per cent in IBC cases till the December quarter and the recovery rate in December quarter stood at 23 per cent.

Raj Bhalla, Partner, MV Kini Law Firm, said the major difficulty in the implementation of resolution plans is usually related to Employees’ Provident Funds, Gratuity Fund and Pension Fund during the due diligence of the corporate debtor. It was the case with Moser Baer Solar, Rainbow Papers and Jet Airways.

In the matter of Jet Airways, the Apex Court held that the successful applicant would have to pay the entire liability of the provident fund, irrespective of it being part of the resolution plan or not.

Air Pockets

The growing delay in resolution has posed a major challenge for bidders. For instance, the insolvency resolution of Jet Airways hit an air pocket more than two years after the Jalan-Kalrock consortium’s (JKC) plan was approved by the committee of creditors in October, 2020. The airline was dragged to insolvency proceedings in June, 2019 by its lenders’ consortium led by SBI for defaulting on loans worth over ₹40,000 crore. Of this, only about ₹22,000 crore claim was admitted with financial creditors claim of ₹7,800 crore.

In October 2020, the committee of creditors voted for JKC resolution plan to infuse ₹900 crore in capex and ₹475 crore to settle claims.

Lenders were to also receive a 9.5 per cent stake in the airline and a part of the payment to lenders was from the sale of property owned by Jet Airways. That meant a 95 per cent cut from their total admitted claims of ₹7,800 crore.

At its peak, Jet had employed 16,000 people and this dipped to 12,000 when the operations were suspended in 2019. Today, JKC employs about 200 people. The Supreme Court recently upheld the NCLAT direction to the consortium to pay unpaid provident fund and gratuity dues of ₹200 crore to employees.

However, lenders of Jet Airways had filed an appeal in the NCLAT against implementation of the resolution plan as they claimed that JKC failed to meet the pre-conditions for implementation of the plan.

The conditions precedent included getting the air operator’s certificate, approval of the business plan from the Directorate General of Civil Aviation and the Ministry of Civil Aviation, slot allotment approval, international traffic rights and approval of the demerger of the ground handling business into Airjet Ground Services Ltd (AGSL), a subsidiary of Jet Airways. Lenders now want the plan to be circled back to the committee of creditors for fresh consideration. In the last two years, since Jet Airline attempted to fly again, the competition has intensified in the skies with Air India under the Tata Group and brand-new Akasa Airlines.

All this is putting off some of the large investors from bidding for fresh assets that are coming under insolvency. For example, Blackstone, which has investments worth $50 billion in India, is hesitant about entering the stressed assets space. Jonathan Gray, President and Chief Operating Officer of Blackstone, said bankruptcy laws in the country and the entire process needs more clarity with firmer timelines before they could think of serious investments. “It would not be a major area of focus for us,” he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.