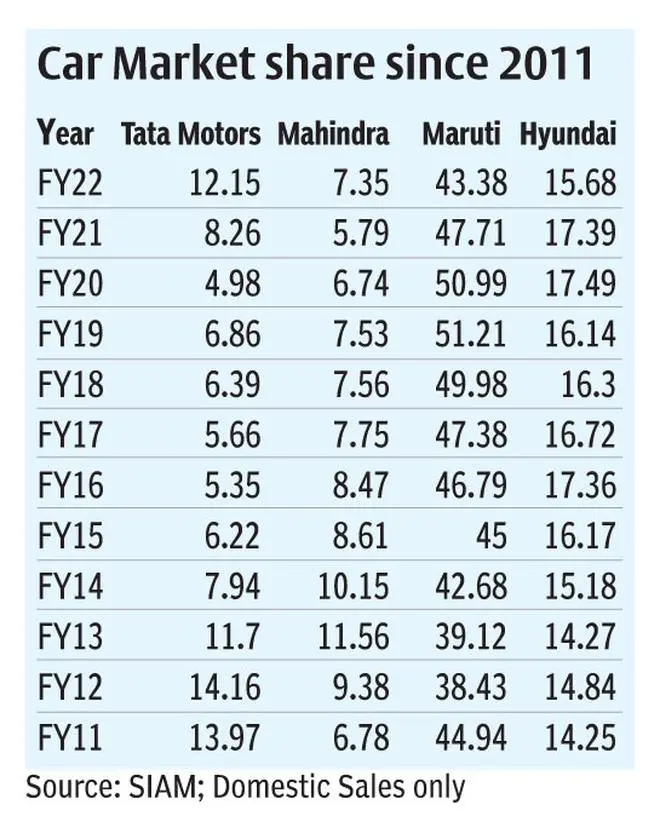

When Shailesh Chandra was appointed head of Tata Motors’ passenger vehicle (PV) division two years ago, the company’s position in PVs was at its worst, with market share dipping below five per cent. The last two years, though, has been a dramatic turnaround for Tata Motors, with its market share more than doubling and two of its cars now featuring in the top ten bestsellers’ list. Chandra would be a satisfied man today, for under him, Tata Motors ended FY22 with a share of 12.15 per cent, the highest in a decade. The jump in Tata Motors’ market share was the steepest ever by the company in a single year.

A year after Chandra assumed charge, there was a leadership change at another Indian automotive brand, Mahindra & Mahindra (M&M). Anish Shah took over as MD and CEO of M&M at the beginning of FY22. Under Shah, M&M’s market share hit a three-year high at 7.35 per cent, according to data shared by the Society of Indian Automobile Manufacturers (SIAM).

Slow gear

The surge in share of the Indian brands has meant a fall in share of competition. During FY22, the market share of car market leader Maruti Suzuki saw its biggest-ever single year fall, closing at 43.38 per cent, a decline of 4.33 percentage points. The country’s second largest carmaker, Hyundai’s FY22 share was the worst since FY14 at 15.68 per cent.

One in every five passenger vehicles sold in India last year was made by an Indian company. Cars and utility vehicles sold by Tata Motors and M&M controlled nearly 20 per cent of the country’s PV market, making it the best in nine years. Tata Motors and M&M are the only two large volume Indian automotive companies in the country from a total of 15 companies, who control little over 3.06 million PVs as of FY22, making India one of the top five PV markets in the world.

India’s top four carmakers — Maruti Suzuki, Hyundai, Tata Motors and M&M — control 80 percent of the domestic market, while the balance share is split between 13 companies, including global heavyweights like Volkswagen and Toyota. Shailesh Chandra, Managing Director, Tata Motors Passenger Vehicle and Tata Passenger Electric Mobility, said the company’s FY22 sales would have been even higher if there were adequate supplies of semiconductors.

“Today volumes are limited not due to capacity but because of semiconductor shortage. Despite ramping up Nexon’s production to 13,000 a month (from 5,000 a month) there is still a waiting period of three to four months on it. We can increase our capacity by another 20-25 per cent through debottlenecking,” Chandra added. Launched in 2017, the Nexon has been a sleeper hit for Tata Motors, becoming the country’s highest-selling SUV in March.

Not just the Nexon, but almost all Tata Motors’ models are unavailable for spot delivery. The Punch, Safari, Altroz and Tiago, in addition to the Nexon EV and Tigor EV, are making buyers wait for two to six months. The waiting is despite the company more than doubling its monthly production over the last two years to over 40,000 units, with the supply chain issue plaguing the industry. M&M’s growth in comparison was lower, but it managed to make competition sit up and take notice of its launches. Despite its premium price tag, the XUV700 became a runaway success just like the company’s previous launch, Thar. While the XUV700 received 50,000 bookings within two days of launch, the Thar continues to be the most popular product in M&M’s portfolio with the waiting period stretching to a year. The Anand Mahindra-led company was one of the earliest to have been hit by chip shortage, leading to the company undertaking unscheduled production holidays, even though bookings continued to pile up with dealers. Maruti Suzuki India (MSIL), in which Japan’s Suzuki Motor Company holds 56 per cent stake, says its market share suffered due to chip shortage and not because of competition. September and October were the worst months for the company as its plants operated at half their normal monthly production levels.

Maruti’s defence

Shashank Srivastava, Senior Executive Director, Marketing and Sales, MSIL said, “It is not true that increased competition has led to market share loss. Last year, our non-SUV market share increased to the highest-ever. From 58 per cent four years ago , our share in the non-SUV segment increased to 67 per cent, where there is presence of competition as well.”

With just two SUVs (S-Presso and Brezza), MSIL’s offering is well short of competition, which is also the reason behind its market share slide. The company claims it has pending orders of 3,25,000, which is not only the highest in its near 40-year history, but covers over two months of domestic sales. Neither the industry nor Maruti Suzuki has any clear visibility with regards to normalisation of semiconductor supplies. “Clearly the problem lies with the overall supply chain and secondly the SUV segment. In SUVs, our market share is 11-12 per cent and that brings our overall market share down,” Srivastava added. Despite multiple product launches, Korean car brand Hyundai’s share in Indian PV segment has remained below 16 per cent over the last 11 years. Industry sources point out that India is just one of the several big markets where Hyundai has a presence and a comparison between Indian car brands and Hyundai may not be totally appropriate.

Hyundai’s rebuttal

A Hyundai spokesperson also points to semi-conductor part supply issue. “We are doing our best to manage optimum levels of production. Prior to the semi-conductor crisis, we had registered the highest-ever market share of 17.4 per cent since inception in the CY 20. Currently, we are holding over 1.2 lakh pending customer bookings and we are doing our best to serve our customers at the earliest possible.

According to Puneet Gupta, Director, S&P Global , “The baggage traditional companies carry like those of Maruti Suzuki and Hyundai, is the biggest bottleneck for them. These can be old plants, old technology, investments, existing engine plants and their agility to move forward. They need to reframe their strategy from “zero base”. Another vital aspect that might have played a role in swaying buyer decision away from Maruti and Hyundai is vehicle safety. The Global NCAP list of top six safest cars sold in India is dominated by models made by Tata Motors and M&M. None of the Maruti Suzuki and Hyundai models have ever come in the top ten list. Saurav Kumar, Managing Director, Protiviti Member Firm for India, explains, “Safety assurance has become a prerequisite for Indian consumers. Several models of Maruti, Hyundai and Honda have scored low values of three and below (out of five) in the Global NCAP Crash Tests, while Indian brands like Tata and Mahindra have been rated four and above consistently, which results in shift of sales towards these brands.”

There is no denying that the Indian challengers are really accelerating — can Maruti Suzuki and Hyundai get past the baggage and rev up?

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.