A few months after Natarajan Chandrasekaran became the Chairman of Tata Sons in 2017, Tata Motors launched a daring mission in the electric vehicle (EV) space. It wanted to win the prestigious order of supplying electric cars to Energy Efficiency Services (EESL), the State-owned company that promotes sustainability.

But there was one knotty problem. While the intent to bag the ₹1,120 crore, 10,000-vehicle order was ambitious, Tata Motors did not have a single electric car in its arsenal. On the other hand, rival Mahindra & Mahindra (M&M) had a ready electric car (e-Verito) running on Indian roads since 2016.

Former Tata Motors MD, Guenter Butschek, had noted, “We had a jumpstart to get into electric (vehicles) in 2017, albeit with a low voltage solution.” That jumpstart was the combination of Chandrasekaran’s appointment and the EESL order. Tata Motors offered the electric version of the compact sedan Tigor as its bid for the tender, which it developed in just three months.

Not only was the car built in record time, it was priced lower than M&M’s offering, thereby making Tata Motors the L1 bidder for the prestigious tender. In December that year, or less than three months after being declared as the winner of the tender, Tata Motors handed over the first batch of electric Tigors to EESL.

The present

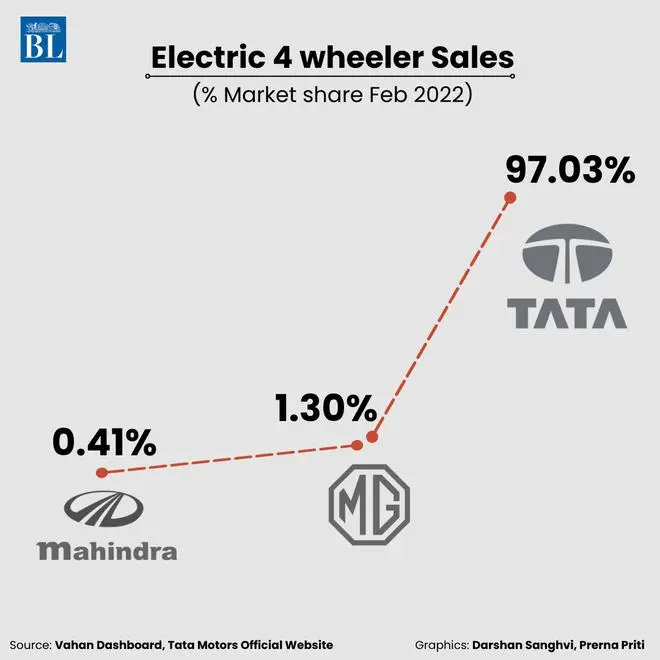

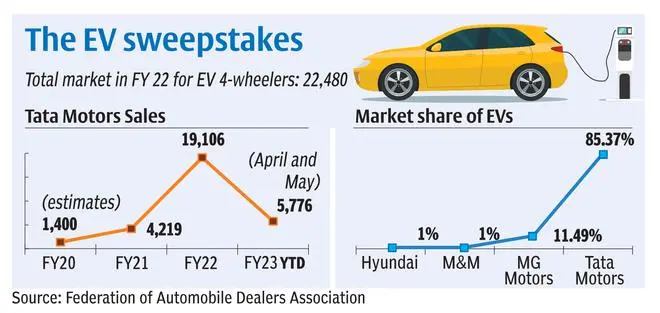

By the end of May 2022, Tata Motors clocked a cumulative sale of 30,500 electric cars, with 80 per cent of those coming in the last 14 months itself. The company has a market share of more than 85 per cent in the EV space, open bookings estimated to be around 15,000-18,000 and a waiting period of five to six months on its EV offerings, but Chandrasekaran is far from being satisfied.

“We are benchmarking to be the best, whether it is in terms of software, electric and electronic architecture or intuitive experience. We have high aspirations. Our goal is to go global eventually,” Chandrasekaran said at the unveiling of the Avinya, a Generation 3 concept vehicle, which is the first by the company as an electric-exclusive model.

Avinya’s unveiling, however, was not a one-off. Just days before that, Tata Motors had showcased the Curvv, a Generation 2 concept electric sports utility vehicle (SUV), which will have petrol/diesel siblings subsequently. Both Curvv and Avinya (both concept names), offering nearly double the drive range than its current best-seller, Nexon EV, will debut in 2024 and 2025, respectively.

Tata Curvv | Photo Credit: Bijoy Ghosh

These unveilings were only preceded by the ₹3,750 crore that Tata Motors received in March as the first tranche of the ₹7,500 crore investment committed by TPG Rise and ADQ against stakes in the newly incorporated EV subsidiary, Tata Passenger Electric Mobility (TPEML). The deal which was signed in October, 2021, made TPEML the most valued EV company in India, having a valuation of $9.1 billion.

Tata products

Tata Motors has enjoyed a limitless demand run in the market, thanks to almost zero competition.

Instead of a regular production car, the Mahindra e-Verito, which competed in the EESL tender, became a made-to-order vehicle, while M&M’s first EV, the e20, got withdrawn due to poor demand a few years ago.

Maruti Suzuki, the market leader in passenger cars, has not shown the same level of enthusiasm towards EVs. Its first EV is not expected to debut before 2025, by which time Tata Motors will have 10 EVs in the market.

Hyundai did not make any additions to its EV portfolio beyond the premium priced Kona electric SUV. Other global players like Honda, Volkswagen and Toyota have remained cold to India’s faster-than-expected demand shift to electric vehicles.

“EV penetration is at around one per cent for passenger vehicles, up from 0.4-0.5 per cent levels last year. Tata Motors has a significant lead in the niche EV market, given limited model variants in the market, and at “reasonable price points”, said a report by Bank of America.

Tata Motors has promised to launch two EVs every year till 2025. These do not include variants within the line-up. For instance, the company launched an extended range variant of the Nexon EV recently, which is not among the ten launches promised by the company. An electric version of the Altroz and the Punch are in the offing beside the likely return of the Sierra.

Capacity and charging infra

TPEML does not have its own car manufacturing plant at present. The newly formed company builds EVs using Tata Motors’ production lines and therefore has free access to the 600,000 units per year capacity of Tata Motors. But TPEML does not have to rely on Tata Motors’ installed capacity forever.

On May 30, 2022, TPEML and Ford India signed a MoU with the Government of Gujarat for the potential acquisition of Ford’s Gujarat-based vehicle manufacturing plant. With further investments, TPEML would establish an installed capacity of 300,000 units per annum, scalable to more than 400,000 units.

With this potential acquisition, Tata Motors has perhaps altered its strategy for TPEML since the new company had earlier decided to remain an asset-light company, with no manufacturing plants under its direct ownership.

Compared to its rivals, Tata Motors did have an upper hand in the beginning. The company had access to all of the vehicle charging stations installed by Tata Group company, Tata Power. This arrangement helped in bringing down consumer anxiety with regards to vehicle charging availability, especially where consumers were not willing to depend on government-backed charging infrastructure.

Tata Power currently has over 1,500 public and semi-public EV chargers installed and another 550-plus chargers are in various stages of installation. It also has a network of 13,000-plus home chargers for private use. Recently, Hyundai partnered with Tata Power to install fast chargers at 34 EV dealers of the company and install home chargers for Hyundai customers.

Tata Motors also stands to benefit from other Tata Group companies for its other crucial needs. According to Chandrasekaran, the group is exploring possibilities of manufacturing battery cells and battery packs as well as semiconductors. Through this, Tata Motors can safeguard itself from the vagaries of the import market, which are now also rapidly influenced by the geo-political situation.

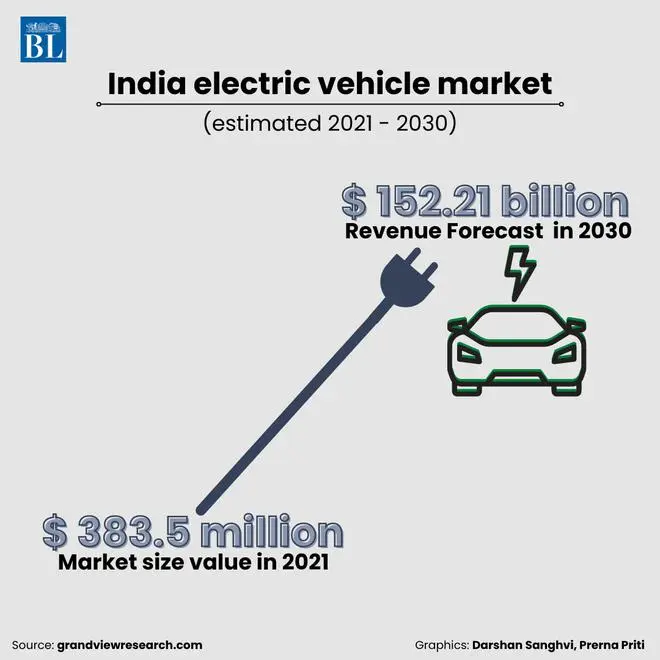

Electric mobility in India in the passenger vehicles space is expected to hit 30 per cent by 2030, with continued backing of the government, development of an enabling ecosystem for manufacturing of EVs and supporting charging infrastructure. Tata Motors has stated its EV vision more clearly than any of its competitors for the moment. Can the company hang on to its lead?

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.