When Covid-19 was raging across the world and lockdowns restricted movements, people spent more time on their sofas and beds, and decided they wanted very comfortable mattresses. Sales of beddings spiked.

Typically, mattresses are products that people buy for a period of 5-8 years and compared to other furnishings occupy low mindspace. But the pandemic woke up the segment as people started researching on various sorts of foams. Branded players scented a big opportunity in the ₹13,000-crore mattress market in India that currently is dominated by the unorganised sector with a 55-60 per cent share.

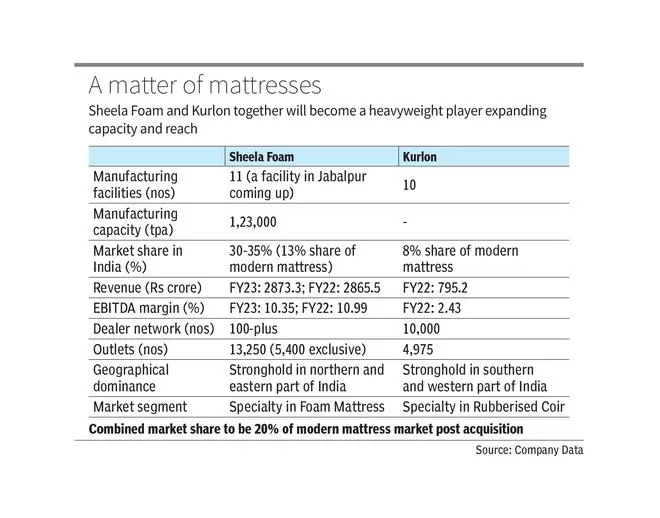

Consolidation in the sector has been waiting to happen and the acquisition of a majority stake of Kurlon Enterprises (run by the Pai family in Karnataka) by Sheela Foam, which owns the brand Sleepwell, is a start in that direction. The deal will give Noida-based Sheela Foam (named after its founder, Sheela Gautam) not only a major share in the branded market segment, but also a wider product selection pan India. As a forward integration initiative, the company has also acquired a minority stake in furniture maker Furlenco.

businessline caught up with Sheela Foam’s CMD, Rahul Gautam, for more colour on the transaction and insights into the mattress market.

It has taken you a long time to make an acquisition, why?

Acquisitions are not that easy. It needs to be appropriate, it has to fit in culturally, it has to make business sense. I guess it only happens when both sides are ready.

We looked at the whole gamut of players, but some were very small, they would not have fitted well. Some were mid-level and would have been possible, but the fitment was just not working out. It just shows that the segment is reaching a point in the curve where consolidation has to happen or will happen.

Could you explain the rationale for the transaction and your expectations?

India is an extremely diverse country and we have done well to have a good consumer brand with us, but for us to be able to cater to the entire country with just one brand is an impossibility. There are diversities of distribution, geography, price segment, and therefore an acquisition like this — a horizontal one, with another well established consumer brand who’s in fact older than us — augurs well and it fits well into our portfolio.

The other synergies will impact the cost part of it — when you procure materials, there would be extra volumes and therefore ability to get volume advantages will be there. The places of manufacturing which they have and which we have … there are no co-locations at all, they are in different cities.

At the front end, starting from supply, logistics and all that, it can definitely improve with innovations. As far as the channels of distribution are concerned, we can get a consolidated supplier, better terms and it will also be a cost savings for the supplier too.

The consumer is, of course, the best beneficiary of all this. Right now, if you look at any consumer who buys a mattress, the biggest pain area is finding the right product. Now the consumer will have a sharp, focused, positioned product and brand, and therefore, the choice-making will be easier.

You are also planning to reposition Kurlon’s brands

The roots for Kurlon are on the rubberised coir side, and for Sheela Foam on the polyurethane foam side. However as both companies have progressed, everyone has tried to do everything, so Kurlon also makes foam, spring mattress. Similarly, we may have nothing to do with rubberised coir, we may not understand it, but we make them and also spring mattresses. The base segmentation exists, but we have tried to muddle it up, because everyone just wanted to do everything. But now, with this acquisition, we will be able to segregate them and give a sharper focus to the products.

Both Sheela Foam and Kurlon have been seeing muted sales recently. This seems rather surprising considering the demand resurgence for homes. How do you plan to accelerate sales?

In the Covid and post-Covid times, people looked for lower average purchase prices and therefore, the unorganised sector got a little impetus. But this is reversing. The other part is that demand for furnishing comes with a lag. As more homes are sold, the demand for mattresses will come in. Definitely, during the coming months, we would expect much better performance — lower input costs, easy availability of raw materials, markets getting buoyant, footfalls happening, plus the festival season around the corner — it should get better.

And how would you explain your stake-buy in Furlenco?

Furlenco deals in furniture. At the moment its presence is mainly in the rental part of it, although, they have started designing, manufacturing and even beginning to retail. For Sheela Foam, it will be a big step in the direction of making our presence felt in branded furniture. PUF and furniture are two big segments and that is the reason for the acquisition.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.