On January 18, in a now widely-read LinkedIn post, Amit Bhasin, Co-Founder of GoMechanic, a tech-enabled car service chain, confessed to accounting issues at the firm, saying, “We made errors in judgment as we followed growth at all costs,” after the unravelling of grave financial irregularities at the company.

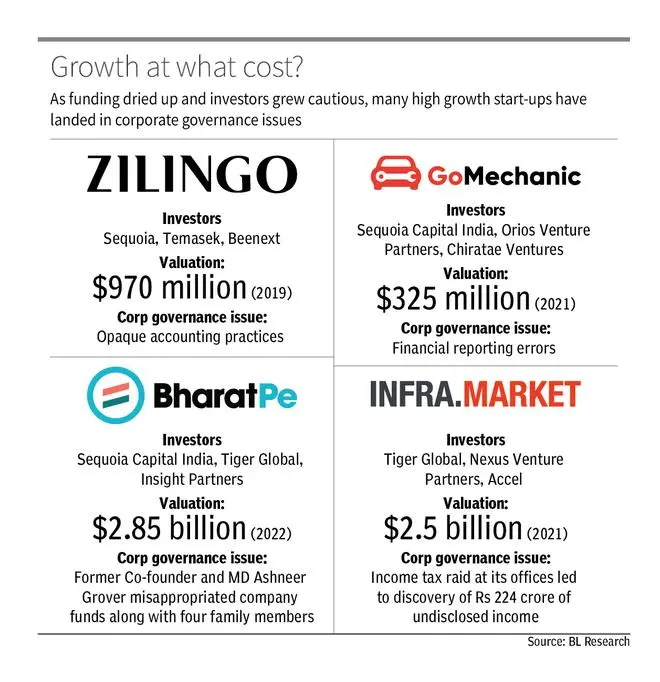

GoMechanic is not alone in the list of start-ups facing corporate governance issues. As funding dried up and investors grew cautious in H2 2022, many high-growth start-ups such as GoMechanic, BharatPe, Zilingo, Infra.Market and Trell have found themselves at the centre of corporate governance issues and forensic audits. This has led to concerns around the ‘growth at all costs’ mentality in the Indian start-up ecosystem, the third largest in the world.

Take BharatPe, for example. The company’s former Co-Founder and MD, Ashneer Grover, has been accused of misappropriating company funds. However, Grover has called these allegations “baseless” and referred to them as “targeted attacks” on him and his family.

Singapore-based Zilingo too terminated its Founder, Ankiti Bose, following an investigation into complaints of financial irregularities at the company. Bose later called her termination a “witch-hunt.”

Onus on founders?

All these companies are backed by marquee investors with rigorous due diligence processes. Yet all their investors have maintained that they were not aware of financial irregularities taking place.

More often than not, corporate governance issues end in the termination of start-up founders. But does the onus rest with the founders alone?

“The founders are a cross-section of the community. We can’t expect them to always be ethical and fair unless there are checks and balances in the system itself. A founder is ‘expected’ to be a risk taker. The traits expected from a founder and the basic principles of corporate governance usually don’t match. Many a time, they are contrasting.” Nandu R Kumar, Founder and CEO of ScaleX Business Pvt Ltd told businessline.

As Bhasin took the responsibility for the financial irregularities that took place at GoMechanic, his words — “we made errors in judgment”; “we followed growth at all costs” and “our passion took the better of us” — started making rounds on social media. It prompted a sea of posts by investors and founders speaking against the VC-induced growth at all costs mentality.

Co-founder of Inflection Point Ventures and KayEss Square Consulting Pvt Ltd, Sathya Pramod, believes that this VC-induced drive for fast growth is a big reason for the rise in corporate mis-governance cases in the start-up ecosystem.

“VCs raise money from LPs (Limited Partners) and give it to the start-ups. So, the pressure is always there for the start-up to grow at all costs. Typically, these financial irregularities start with a small manipulation that the founder thinks they can get rid of, once things get better. However, the pressure to grow is so much that it never gets better,” he added.

However, Pramod also notes VC money is very important for any company to grow. Especially if they are operating in the business-to-consumer space. “When a company is trying to disrupt the market, it requires a serious amount of cash but the problem starts when founders raise money at unjustifiable valuations,” he added

Adding to this, Shriram Subramaniam, InGovern Research Services, says, “With the rise of start-ups and VCs fanning start-ups to grow at any cost, company valuations have started trumping fundamental values. People have started to give more importance to company valuation than business processes.”

ScaleX’s Kumar also notes that “it doesn’t matter to a VC if a company is successful or not in the long run. It’s very similar to the fact that a banker is least worried about how you conduct your business as long as the mortgaged security covers the risk and the EMIs come on time. VCs get their exits predominantly from secondary sales. So, if the founder can take the start-up to next rounds of funding, the VCs on the cap table are happy, irrespective of the sales, performance, corporate governance, accountability and so on.

“The market may see many more failures like these before VCs say that stakeholder accountability is equally important to the return on investments.”

What can be done better?

Kumar argues that we cannot expect the start-up founders to be experts in every aspect of the business — from tech and product to legal and finance. The scale at which a start-up grows is exponential after the stage of ‘product market fit’ and VC money.

Stakeholder transparency and governance controls should also reciprocate this growth. In reality, this doesn’t always happen. “The start-up continues to be a founder-centric organisation. I will not be surprised if a start-up would expect a founder whose core competency is technology to take a call on critical finance, valuation, or legal matters,” said Kumar.

Pramod also endorses Kumar’s arguments and says, “VCs should be realistic and bring in the relevant experts for various functions. As a founder, one is not Superman to know everything. Founders can probably build one of the best products and operations but finance may not be his/her forte. So it should be left to the experts.”

Building for long term

He also noted that founders should not get too pressurised by what is happening in the ecosystem. “Founders should remember that competitors’ valuation has nothing to do with their product quality. In fact, customers don’t even care about valuations. Founders should focus on building a sustainable business rather than building value,” explains Pramod.

Commenting on corporate governance issues and balancing the pressures of the market, Kunal Shah, Founder of CRED and Freecharge, says, “Values are not something that changes based on the market environment. I believe that some things are written in permanent marker but the rest is in pencil. Values are one of them. Majority of CRED’s investors also invested in Freecharge. When someone backs you again and again, it comes from you holding very high values. I am building for the long term, and the long term is about values.”

Sumit Keshan, Managing Partner, Wipro Consumer Care Ventures, also believes that governance is a journey. It has taken Wipro years to become the well-governed organisation that it is today. It doesn’t happen overnight. “From a start-up point of view, they want to focus on how they grow and see governance as a burden. Whereas what we tell our portfolio is that governance is an enabler,” he adds.

As Keshan puts it, even though there are checks and balances being put in place, there is no guarantee that such cases will not emerge in the future. However, it is important to note that these highlighted cases are an exception and not the rule. For every corporate governance case written about in the media, there are hundreds of other start-ups that have been running sound businesses with strong controls and processes. That’s the counter-point.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.