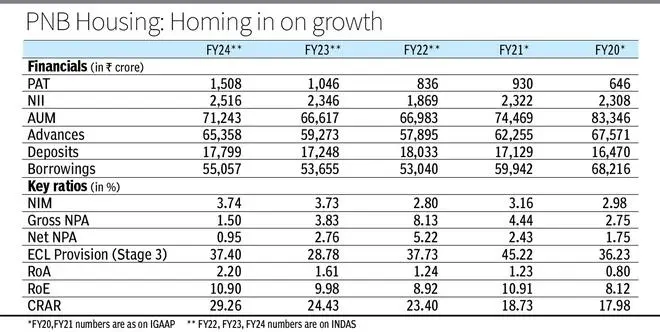

Financial year 2024 was a period of growth for most financial services. Even so, a standout was PNB Housing Finance, which saw significant improvement in financials to bring it on par with peers after nearly four years of struggle. Plagued by legacy corporate accounts, it focused on shrinking the corporate portfolio and improving asset quality, which led to muted overall growth.

“We’re ready for the next level of growth. We see good opportunity in affordable and emerging segments, but also in the prime segment,” says MD and CEO Girish Kousgi.

In FY24, the housing financier pared down the corporate loan book to ₹2,052 crore, with wholesale gross non-performing assets (NPA) declining from 22.3 per cent a year ago to 3.3 per cent as of March 31, that too from one small account alone. This account is expected to be resolved in the next few months. On the other hand, the retail portfolio — which remained static for a “prolonged” period — grew 14 per cent in FY24, raising the share of retail book to 97 per cent as of March 2024.

Growth in retail assets was aided by two new businesses — the emerging segment and the affordable housing business under the ‘Roshni’ scheme, where the housing financier built up a ₹1,790-crore portfolio in 15 months. Enthused by the bright FY24 showing, a report by analysts at Motilal Oswal Financial Services says: “We expect the company to deliver a healthy 18 per cent CAGR [compound annual growth rate] in AUM [assets under management] and 26 per cent CAGR in PAT [profit after tax] over FY24-26, with an RoA [return on assets] of 2.4 per cent and RoE [return on equity] of 13.0 per cent by FY26.” Kousgi prefers to play safe, pegging FY25’s RoA at 2.1 per cent as against 2.2 per cent in FY24.

But as the lender expands its reach and presence, the Street is cognisant of an increase in operating expenses in FY25. The company is developing its affordable housing vertical, largely by investing in branches and manpower. Further, competition and loss of interest income from the sharp rundown in the corporate loan book may weigh on margins.

Bolstering margins

Meanwhile, it has tinkered its liabilities side of the balance sheet, which was under pressure post 2018’s IL&FS debacle. The company raised ₹2,494 crore in May 2023 through a rights issue and ₹3,000 crore from National Housing Bank. It increased the share of market borrowing through non-convertible debentures and commercial papers following a credit rating upgrade from ‘AA’ to ‘AA+’, which helped contain cost of funds.

Kousgi is optimistic that the higher yielding segments will support margins, pegged at 3.5 per cent in FY25. “We’re looking at 17 per cent retail growth in FY25,” he says, adding that the emerging markets and affordable business verticals should account for 40 per cent of disbursements in FY25.

The yield on advances under the affordable segment is seen at over 12.5 per cent and for the emerging segment at 10.2-10.5 per cent. Currently, the average yield on the overall portfolio is over 10 per cent.

While the targets seem high and promising, sustaining them would be a challenge, given the ongoing loan book clean-up. Kousgi expects gross NPA ratio to fall to 1-1.1 per cent from 1.5 per cent in March 2024. Credit cost is expected to ease to 0.3 per cent.

“Margins are likely to remain steady for near term due to changing products mix. Credit costs outlook remains positive given a large pool of recoveries expected in coming quarters,” says a report by JM Financial.

PNB Housing is now mulling revisiting its corporate loans strategy in the second half of FY25. “But it will be in a small way and pure construction finance,” Kousgi assures.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.