In July 2021, Northern Arc Capital filed a draft prospectus with SEBI for a ₹1,800-crore initial public offering (IPO). The Chennai-based NBFC was looking to raise ₹300 crore in fresh issue, and the remaining through an offer for sale, to enable an exit for investors such as LeapFrog, Accion, Augusta, Eight Roads, Dvara Trust, and IIFL Special Opportunities Fund.

The company received the market regulator’s nod for its IPO on September 3, 2021. Nearly two years after filing the prospectus, Northern Arc not only failed to make its public market debut, but also let SEBI’s approval to expire in FY23.

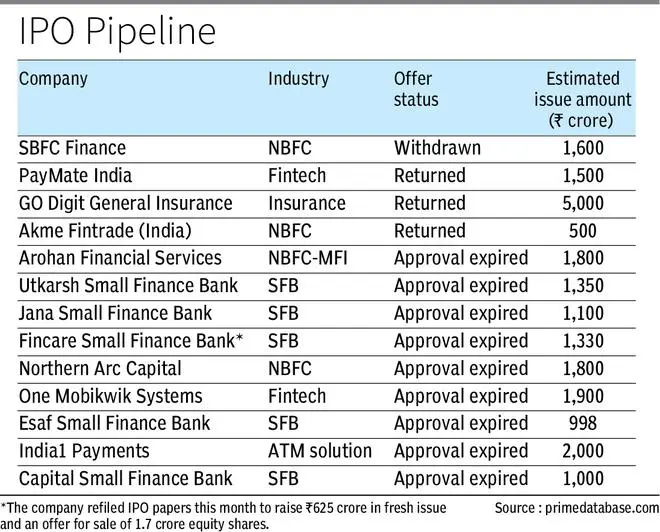

Northern Arc isn’t alone. Data from PRIME Database reveal that a total of 39 companies looking to raise ₹55,210 crore via IPO have let their approval lapse in FY23. While another dozen companies looking to raise ₹10,386 crore have withdrawn their offer documents and offer documents of 10 companies looking to raise about ₹20,830 crore through capital market found their documents returned by SEBI.

Interestingly, companies in the financial services, ranging from fintechs to insurtech to start-ups, NBFCs and MFIs accounted for a fourth of ₹86,426 crore of IPO in FY23. Shyam Sekhar, an investor and founder of iThought, a registered investment advisor (RIA) and PMS firm, attributes the diminishing investor appetite towards highly-valued companies as the primary reasons for the slowdown in IPOs in the financial services space. “When established players like HDFC Bank or Kotak Mahindra Bank are at the lower-end of their valuation band, getting a capital at a higher-end of valuation for a small finance bank or a payments bank or an NBFC will be a tall ask,” he explained.

“Valuations are always a challenge,” agrees Nilesh Shah, MD & CEO of Mumbai-based investment management firm, Envision Capital. Earlier markets were fine with elevated valuations because if an IPO is oversubscribed, then investors were confident of making some listing gains in the secondary market. But that momentum is now dwindling as reality sets in.

With rising global interest rates and monetary tightening, foreign portfolio investors (FPIs) tunred their back to indian equities in FY22. “Normally, the vibrancy of the IPO market depends on the vibrancy of the stock market. But, the secondary markets have been range bound for the last 18 months,” Shah adds.

Star Health Insurance, Fino Payments Bank, Aptus Value Housing, Five Star Business Finance, LIC and Tamilnad Mercantile Bank, which are among the prominent IPOs in the financial services space, listed at a discount to their issue price and some continue to languish below their issue price.

“The era of paying high premium for lending is over,” said Sekhar, adding that rising interest rates and technology are disrupting the spread and business growth of lenders.

“Today, if you cannot get your qualified institutional buyers (QIB) book full then it is difficult to push through any IPO,” he added.

Cutting down the IPO size to ensure successful listing is another trend we saw with Star Health Insurance and Five Star Business Finance. Recently, non-banking lender SBFC refiled for IPO by reducing its IPO size to ₹1,200 crore from ₹1,600 crore.

Shah attributes this trend as a mandatory one to meet investor expectations. “When companies raise so much money by issuing equity, they are sitting on liquidity and which dilutes the return on equity. So, investors are questioning the need for such high capital,” he added.

A tug of war

Shekar makes an equally interesting observation. “QIBs are not going to agree on higher valuation and investment bankers, or the company will not settle for lower valuation. If the expectations of all stakeholders are not converging, then it is difficult to put through any transaction”. Ultimately, its boiling to a tug of war between the three factions. Only entities with real need for capital or an investor group in need of an exit may do what it takes to end the logjam.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.