With all the hype around investing, it can be difficult to choose the right investment type for yourself, your loved ones, and your finances. Fundamentally, many would like an investment that brings them guaranteed and stable returns. Hence, you always have the option of fixed income instruments like FDs.

In an FD, you essentially allow a bank or NBFC (Non-banking Financial Company) access to a certain amount from your funds or savings. In return, the bank or NBFC pays you an interest. Then, these interest returns are added to your initial deposit amount to formulate a maturity amount, through cumulative returns or compounded returns.

What is an FD Calculator?

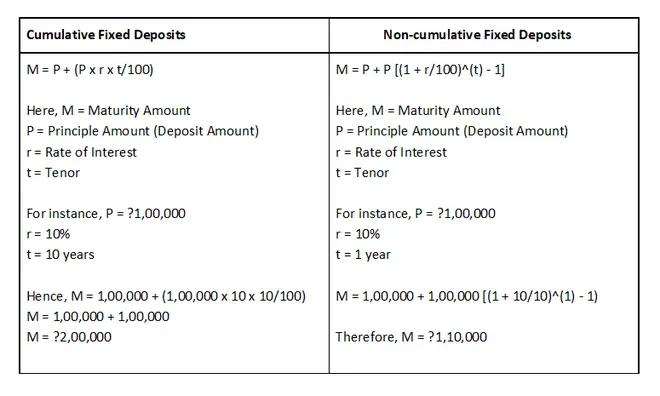

When it comes to calculating the maturity amount of an FD, you could use two formulae based on the frequency of interest payouts you’d like to choose. You could use the cumulative payout formula (M = P + (P x r x t/100)) or the non-cumulative/compounded payout formula (M = P + P [(1 + r/100)^(t) - 1]).

Here’s an example:

However, carrying out these calculations manually is a difficult and time-consuming task. Hence, the FD interest calculator or FD calculator can come to your rescue.

An FD calculator can derive the estimated maturity amount within seconds. It can make swift calculations, given that you provide it with a deposit amount value, interest rate, tenor, and type of FD.

How Can an FD Calculator Help You?

FDs aren’t affected by market volatilities or fluctuations. Hence, the returns one can earn are guaranteed and stable in nature. It is perfect for those wary of the stock/equity market’s aggressiveness. Considering how low-risk FDs are, it is understandable that you’d like to pick the safer option.

Along with being stable and safe, FDs are also predictable. The uncertainty that comes with other investment fields is eliminated in the case of FDs. The interest rate is fixed before the FD is locked until maturity. The payout frequency is picked by you and you know what your deposit amount and tenor is. All these factors combined can give you full control over your savings and financial decisions.

When you use the FD interest calculator to make a time-efficient and hassle-free calculation, you use these factors to derive an estimated maturity amount. That can tell you, as clear as day, if a particular bank/NBFC, offering you a particular interest rate, can offer you big returns and support your financial future.

- The FD calculator can be used to compare prevailing interest rates

- You can decide an ideal amount that can bring you big returns

- The FD interest calculator can help you understand if the FD lives up to your benchmark

- This component is available on many websites for free

- You can use it as many times as you’d like to

- You can derive a maturity amount through an FD interest calculator within seconds

- You can not only efficiently plan for the future but also manage your current budget smoothly

How to Use an FD Calculator

You can find an FD interest calculator on many finance websites across the web. Most calculators follow a process similar to the steps given below.

● Step 1

Access any website that holds a free and unlimited FD interest calculator component.

● Step 2

Enter an deposit amount.

● Step 3

Choose from the given tenor and interest rate ranges.

● Step 4

Select a ‘Calculate Now’ (or an option similar to it, if present)

Your estimated maturity amount and interest returns should be displayed on your screen.

Conclusion

An FD interest calculator can prove to be very beneficial when it comes to your financial planning. If you are to book an FD soon, this tool can help you stay prepared with all the right calculations and strategies in your arsenal. This is a special one since not many investments come with a set of tools that can help you make the best of a guaranteed fixed income scheme.

Use the FD interest calculator to remain crystal clear about all the possibilities surrounding your FD returns. This is your chance to understand FD calculations and how they affect your finances. With an FDs stable returns and an FD interest calculator’s unending support, you can make it big with FDs.

“This article is part of sponsored content programme.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.