Cipla’sstock has run up over a fourth in the last 30 days and this could give private equity firms circling the promoter stake in the company some heartburn with respect to the valuation of the stake. It will also test the response to an open offer if the price is below the market rate.

US alternatives asset manager Blackstone is one of the private equity firms learnt to be keen to buy the stake. Lukewarm responses to open offers in the past in the case of R Systems International and Mphasis would make it wary of a repeat in Cipla, sources said. The deal would also be more expensive.

Surging stock price

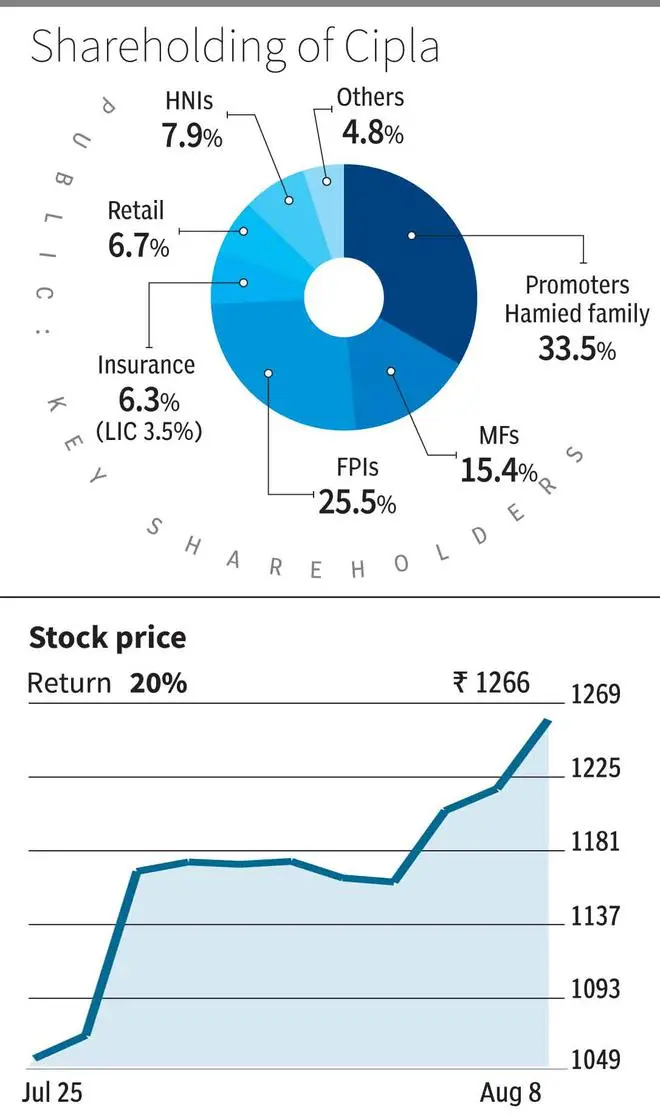

The stock of the pharmaceutical major has appreciated 18 per cent since July 26, when news of a possible stake sale by the promoters first broke out. Its market capitalisation has already moved to over $12 billion from around $10 billion then. At the current price, the Hamied family’s stake is valued at ₹34,143 crore or over $4 billion.

Blackstone is interested in acquiring a majority controlling stake in the pharma company. If it acquires the Hamied family’s 33.47 per cent stake, it will have to make an open offer for at least 26 per cent taking its holding close to 60 per cent.

The private equity firm was unsuccessful with its delisting exercise for R Systems earlier this year as it could not garner the required number of shares in the open offer, falling far short of the 48.3 per cent stake it wanted to acquire, even though it had raised the offer price. In 2016, its open offer for a 26 per cent stake in Mphasis failed with only 0.001 per cent stake being tendered, primarily because the market price surged, making the open offer price unattractive.

Blackstone had started working on the Cipla deal a short while back, but in the last one month the price of the stock has surged, reminiscent of the Mphasis experience.

Also read: Concerns arise over Cipla legacy of affordable drugs amid reports of ‘impending takeover’

The Cipla Value

Cipla has earned its global reputation from selling quality and affordable HIV and AIDS drugs in South Africa. With 43 per cent of revenues from India and 26 per cent from North America, Cipla has a strong respiratory portfolio and bolstered its presence in the diabetes segment, with strategic acquisitions and agreements.

In addition to getting access to an Indian pharma stalwart, a prospective buyer will also get a robust drugmaker with a strong business in India, the US, and South Africa.

Last month, with healthy cash flows and a revival in the North American market, the management guided for a 1 percentage point rise in the FY24 EBITDA margin.

The icing on the cake is its uninterrupted dividend-paying record from 2007 onwards. It fits in nicely with Blackstone’s ethos to buy profitable businesses and build them for long-term value.

The acquisition now hinges on the pricing, valuation, and how the deal is structured.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.