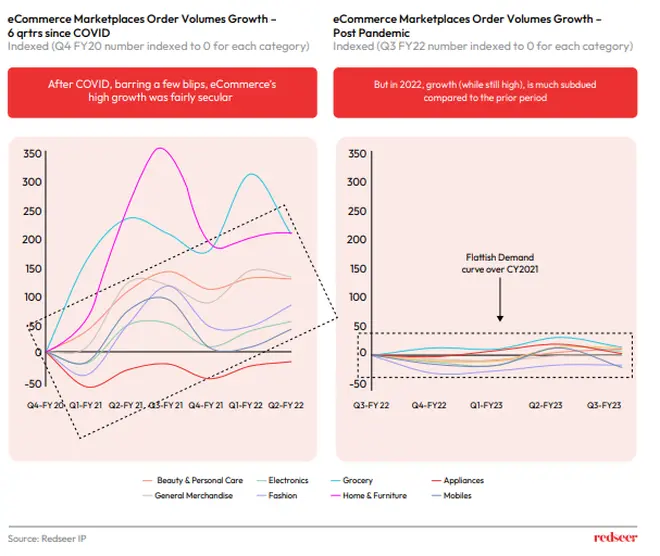

Following the euphoria of 2021, e-commerce marketplaces recorded subdued customer demand in 2022, a trend that strategy Redseer Consulting expects to continue for next few quarters.

“Growth in e-commerce during Covid-19, apart from a few minor dips, remained relatively secular due to the consumer shift towards digital channels. However, the subsequent slowdown in consumer demand led to order volumes for e-commerce being subdued in CY22. The impact has been slightly lower compared to that on the FMCG player, as e-commerce is less reliant on price-elastic rural demand,” said Abhijit Routray, engagement manager at Redseer.

Routray added that consumer demand is expected to stay low over the coming quarters, with sticky inflation going over 6.5 per cent in January 2023. “There is an ongoing risk of further escalation in the war on Ukraine and the current wheat crop being impacted by hot weather conditions. Consumer perception of the general economic condition continues to be pessimistic as per RBI’s Consumer Confidence Survey of January 2023, where over 50 per cent of consumers reported it to have worsened,” he added.

Also read: RBI survey shows overall improvement in economic parameters

Redseer expects consumer demand to stay subdued for the near future, with high inflation, unemployment in the urban organised sector, and falling real wages in rural areas. This comes at a time when start-ups are dealing with a funding slowdown and have limited ability to drive growth through discounts and other strategies. Routray noted that start-ups must focus on efficient unit economics and improving profitability by sticking to their core offerings.

Also read: Fledgling start-ups dodge ‘funding winter’

“One strategy that has worked for FMCG players in the face of shrinkflation has been the push towards smaller SKUs. Bharat-focused start-ups, too, need to look at revamping their SKU strategy to fit the tighter wallets of the mass-market consumers. The second strategy is to double down on the premium categories, which have lower price elasticity and have performed well against market pressures across sectors,” he added.

According to Routray, 2023 is not the year for start-ups to chase high growth but an “opportunity to tighten the operations and shift the lens from product-market fit to profit-market fit.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.