Mahindra and Mahindra reported a 79 per cent rise in standalone net profit in the September quarter on revenue that rose 17 per cent on year, buoyed by its core automotive segment, while the farm sector was under pressure.

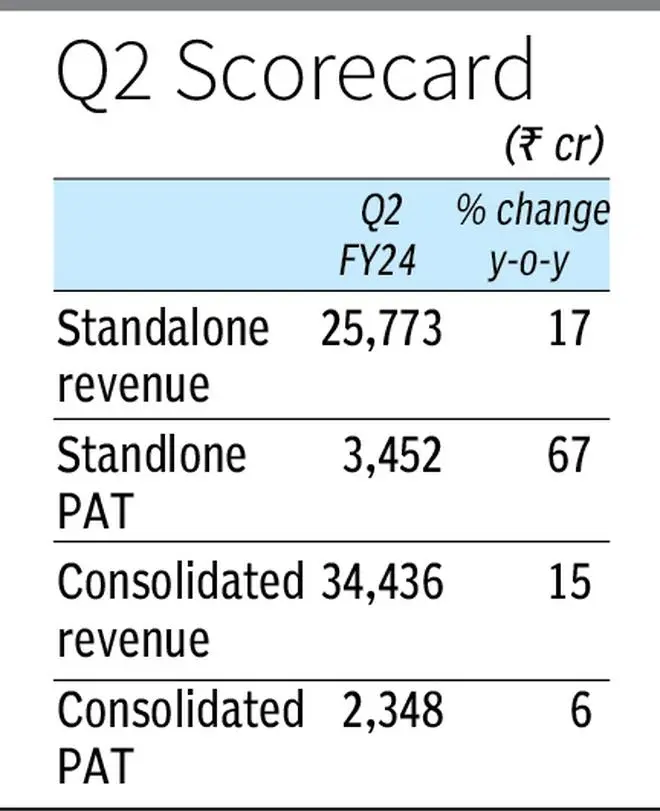

The company reported a standalone net profit of ₹3452 crore on revenue of Rs 25,773 crore. Automotive sales saw the highest quarterly volume at 2.1 lakh units, and revenue in this segment rose a fifth to Rs 18,869 crore. It also doubled operating profit.

Within the auto vertical, revenue from SUVs was up 28 per cent in the quarter. Market share gained 90 basis points to 19.9 per cent. Open bookings of SUVs were at 2.9 lakh units as of November 1.

Volumes of electric three-wheelers rose 74 per cent, and the market share was over 61 per cent.

While the tractor segment did gain market share by 150 bps to 41.6 per cent at the end of the quarter, executive director and CEO of Auto & Farm Sector, Rajesh Jejurikar, said that the segment is expected to show flat growth in volumes, as the monsoon this year has been less than normal. Last quarter, the company said it saw growth in the low single digit.

The company ended the quarter with cash reserves of ₹16,000 crore. Managing Director and CEO Anish Shah said during a media interaction that the cash would be used to invest in the various businesses to meet growth targets and expansion plans.

When asked whether acquisitions figured anywhere in its immediate plans, especially in autos, where it has had some unfortunate experiences in the past, Shah said that acquisitions would be undertaken only if they fit the overall strategy and if it could deliver on its commitments.

Consolidated performance

On a consolidated basis, the company reported a 6 per cent rise in net profit at ₹2,348 crore (excluding Swaraj Engines), and revenue was 15 per cent higher at ₹34,436 crore, driven by growth across all its businesses except Tech Mahindra.

Transformation initiatives are being undertaken at Tech Mahindra with a view to starting its turnaround, but a detailed plan will be developed when the new CEO, Mohit Joshi, takes over the reins of the software developer in December.

The turnaround of M&M Financial Services was also on track, with improvements seen in asset quality, a higher share of digital loans, and diversifying the loan base. Shah said that the company was also exploring potential partnerships.

In its hospitality business, a plan to boost revenue by five times by FY30 is being developed, while logistics revenue is targeted to rise to ₹10,000 crore by FY26.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.