The government, technology players, and banks will pull out all the stops in a bid to help MSMEs realise their true growth potential and resolve all the issues faced by the sector, which serves as the backbone of the over $3 trillion Indian economy, according to the participants at The Hindu BusinessLine’s ‘MSME Growth Conclave’ in Bengaluru on June 27.

While the Karnataka government promised to sharpen focus and provide policy support to Micro, small, and Medium Enterprises, technology players such as SAP, Microsoft, and IBM are reimagining the way Indian MSMEs adopt cloud and Artificial Intelligence-powered solutions to boost growth.

The lending community, including Canara Bank and Kinara Capital, are looking at ways to help MSMEs with financing solutions amid a sharp rise in interest rates. Raghuvir Srinivasan, Editor of businessline, welcomed the guests and stressed the importance of the MSME sector in a growing economy such as ours.

Toolkit for MSMEs

The Karnataka government has decided to provide a toolkit for MSMEs in the State to improve their efficiency, said MB Patil, Large and Medium Industries and Infrastructure Development Minister, Government of Karnataka.

He said the state government, headed by Chief Minister Siddaramaiah, will work as a team to address and resolve all the issues faced by MSMEs.

Patil noted that tech adoption, export promotion, collaboration, and networking are important for MSMEs, who may lack the resources of larger players, but have contributed in a big way in terms of employment generation, economic activity, and investments.

Panel discussion

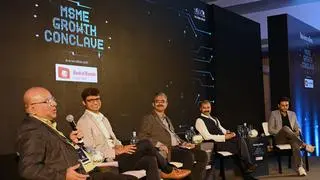

In the panel discussion on ‘Leveraging Cloud and AI for Digital Transformation in MSMEs’, Rajeev Singh, VP & Business Head, Midmarket and Emerging Business, SAP Indian Subcontinent; Siddesh Naik, Country Leader, Data, AI & Automation, Software, Technology Sales, IBM India & South Asia; Samik Roy, Executive Director, Corporate, Medium, and Small Business, Microsoft India; and Rajat Shikar, Co-founder and CPO, Dealshare, discussed the innovative initiatives tech players are bringing to pump prime MSMEs’ growth and the perceptible outcomes that are being witnessed in how MSMEs better serve customers, drive efficiencies, and narrow the competition gap with larger players. The panel was moderated by Venkatesha Babu, Bengaluru, Chief of Bureau, businessline.

The ‘Interest Rates and Growth of MSMEs’ panel saw lively exchanges involving MSME players and the lending community against the backdrop of surging interest rate hikes by the RBI. The panelists were Aiswarya Ravi, CFO, Kinara Capital; Shashidhar Shetty, President, KASSIA; JR Bangera, National MSME Board Member; Former President, FKCCI; and Sudhanshu Suman, GM, MSME Wing, Canara Bank, Bengaluru.

- Also read: MSMEs call for better financing alternatives, reduction in escalating interest rates to boost sector

MSMEs, which operate on wafer-thin margins, voiced the need for special considerations amid a double whammy of rising input prices and costlier loans due to the sustained pace of rate hikes by the central bank to control inflation. The panel discussion was moderated by Lokeshwarri SK, Data Editor, businessline

The one-day conclave, in association with Bank of Baroda Credit Cards, Canara Bank, and Aashirvaad as associate partners, was powered by the State partner, the Government of West Bengal, Department of Micro, Small, and Medium Enterprises, and Textiles. Mahindra was the electric mobility partner, and NewsX was the broadcast partner.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.