Even while the south-west monsoon has been playing truant, it has been raining money at the primary issuances counter on the Small and Medium Enterprises-dedicated exchanges of NSE Emerge and BSE SME platforms, with issues getting massively oversubscribed and good listing gains.

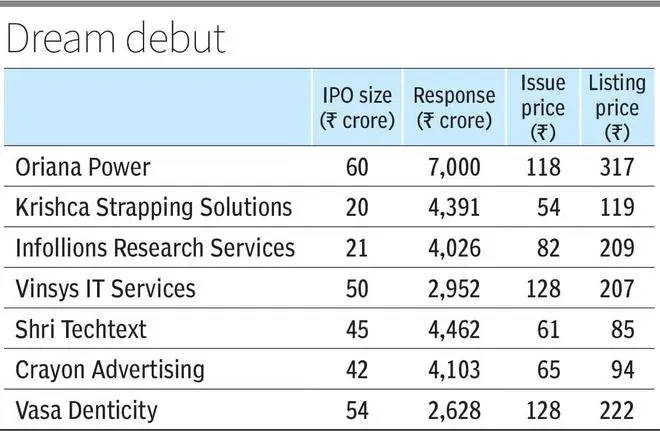

The recent initial public offering of Oriana Power, which provides solar energy solutions to industrial and commercial customers, has received a bid worth a stunning ₹7,000 crore for an issue size of ₹60 crore.

Its anchor investors include marque investors such as Morgan Stanley Asia (Singapore) PTE, India-Ahead Venture Fund and Aryabhata Global Asset Funds.

True to the run-away response, Oriana Power shares made a dream debut to list at ₹302 a piece on NSE Emerge against the issue price of ₹118. An investment of ₹1.41 lakh in one lot of 1,200 shares had fetched investors Rs 3.62 lakh. It closed at Rs 301 last Monday.

Similarly, Shri Techtex and Vinsys IT Services had hit the SME IPOs market to raise ₹45 crore and ₹50 crore but got ₹4,462 crore and ₹2,952 crore subscriptions.

Krishca Strapping Solutions, a manufacturer of high-tensile steel straps and seals, mopped up a response of Rs 4,391 crore against an issue size of ₹20 crore. The stock which was sold at ₹54 a piece got listed at ₹119 and is now trading at ₹220.

Manish Chowdhury, Head of Research, StoxBox said the attractive valuation of SME companies compared to similar companies on the main board an an opportunity to invest in new age and non-conventional businesses play a key role in the huge demand for SME IPOs.

Though SME issues look lucrative, investors with only a high-risk appetite and long-term perspective should venture into these due to liquidity constraints on the SME platform and the smaller scale of operations of these companies, he added.

Shripal Shah, Director of Aryaman Financial Services, said the SME IPO space had delivered strong returns for investors and attracted the participation of the alternative investment community, including family office funds, UHNIs and AIFs.

The trend of SME IPOs being broadly subscribed by a vast investor base has just begun. If the quality of issuances, including that of fundamentals and pricing are maintained, this trend may grow further, he added.

VK Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said investors’ confidence in IPOs on the main bourses was rattled after incurring heavy losses in digital companies such as Paytm, Zomato and Nykaa as these stocks crashed on the listing.

Most of these retail investors have moved to invest in IPO on SME Exchange as the issues there are rightly priced, and the listing gains have been an icing on the cake, but the euphoria may not last long, he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.