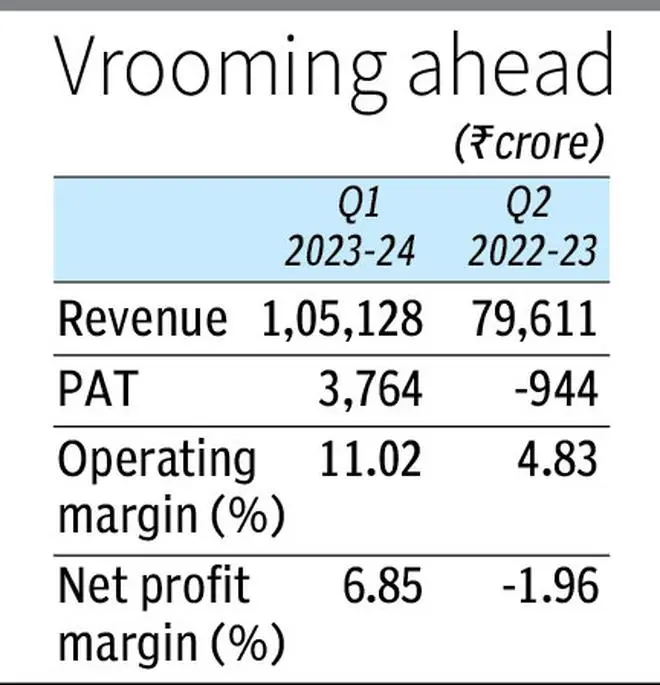

Pick-up in volumes in the domestic market, softening commodity prices, JLR’s volume ramp-up, and improved operating leverage helped Tata Motors post a net profit of ₹3,764 crore during the second quarter ended September 30, 2023. It had posted a net loss of ₹944 crore in the corresponding quarter last year.

Revenue rose 32 per cent to ₹1,05,128 crore during the second quarter. JLR revenues improved 30.4 per cent to £6.9 billion. Passenger vehicle revenues were marginally down 3 per cent, impacted by the transition to the new launches while EBIT margins improved 140 bps to 1.8 per cent due to savings in commodity costs.

Stronger H2

The company said it remains optimistic on demand despite external challenges and anticipate a moderate inflationary environment. Tata Motors aims to deliver a stronger performance in H2, due to a healthy order book at JLR, strong demand for heavy trucks in commercial vehicle segment and new-generation products in PV. The auto major said it expects its financial performance to improve further owing to a richer mix, continued low-break-even in JLR, execution of demand-pull strategy in CV and improving profitability in PV/EV.

PB Balaji, Group Chief Financial Officer, Tata Motors, said, “It is pleasing to see all the businesses deliver on their well differentiated plans this quarter. With a strong product pipeline, a seasonally stronger H2 and continued focus on cash accretive growth, we are confident of sustaining this momentum.”

In Q2 FY24, domestic wholesale CV volumes were 99,300 units, up 6 per cent y-o-y. Exports continued to remain subdued at 4,900 units, down 27 per cent y-o-y because of weaker economic conditions in overseas markets. Revenues improved 22.3 per cent to ₹20,100 crore on account of improved mix and better market operating price.

“Going forward, with improvement in consumption, onset of festive season and range bound inflation, we expect these tailwinds to continue while closely monitoring any emerging headwinds in rural demand due to the below average rainfall,” Girish Wagh, Executive Director Tata Motors Ltd said.

The PV volumes were at 139,000 units (-2.7 per cent yoy) as supplies of outgoing models were proactively managed to facilitate a smooth transition to their next gen versions. “Overall, demand trends for PV and EV business look healthy with the onset of festive season, new product launches and strengthening electrification trend. We will continue to leverage our aspirational portfolio and alternate powertrains to drive up market shares and drive EV penetration further. A structured margin improvement program has been initiated to drive up our contribution margins. With these, the business is confident of delivering market beating growth and achieving its financial targets,” the company said in a statement

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.