In a bid to drive efficiency and cut operational cost, Tata Steel has decided to merge seven subsidiaries, including four listed entities with itself. The Board of Directors of all the Tata Steel group companies have approved the schemes for the proposed amalgamation.

Reacting to the development, the four listed companies that are being merged into Tata Steel tanked between 5-12 per cent on Friday. Tata Steel Long Products fell by 12 per cent to ₹659, while TRF and Tata Metaliks were down five per cent each at ₹356 and ₹763. Tinplate Company dipped six per cent at ₹318. However, shares of Tata Steel closed flat with a gain of one per cent at ₹104.

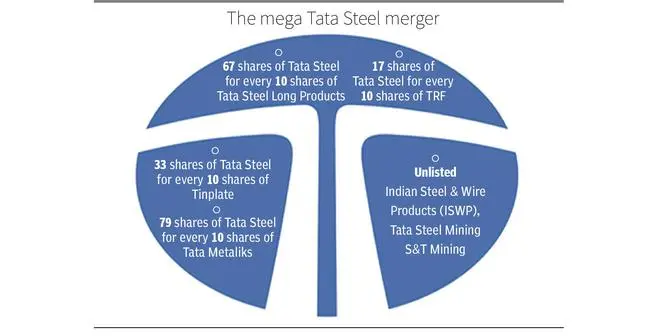

The subsidiaries are all majority owned by Tata Steel and include Tata Steel Long Products (74.91 per cent equity holding), The Tinplate Company of India (74.96 per cent), Tata Metaliks (60.03 per cent), The Indian Steel & Wire Products (95.01 per cent), Tata Steel Mining and S&T Mining Company (both wholly owned subsidiaries). TRF Ltd, which is 34 per cent owned by Tata Steel, is termed as associate company.

Related Stories

Tata Steel amalgamation : What’s in it for shareholders?

The proposed amalgamation is a positive for Tata Steel shareholders in the long runEach scheme of amalgamation will now move into a defined regulatory approval process, which includes approval by stock exchanges and the NCLT, said the Tata Steel.

Based on independent valuer report, Tata Steel Long Products investors will get 67 shares of Tata Steel for every 10 shares held.

Similarly, for every 10 shares of the Tinplate Company of India, 33 shares of Tata Steel will be issued.

Ten shares of Tata Metaliks will fetch 79 shares of Tata Steel and TRF Ltd investors will get 17 shares of Tata Steel for every 10 shares held.

Related Stories

Why should you hold Tata Steel stock

The stock is available at reasonable valuation with narrowing spreads priced in; stock is currently trading at ₹105.75Jatin Damania, Vice President, Kotak Securities said the merger will simplify the corporate structure, plug leakage of addition royalty payments on inter-company iron ore transfers, reduce corporate overheads, drive business growth with additional financial flexibility and bring in further operational, procurement and tax synergies.

“We estimate ₹750-800 crore of annual savings, equity dilution of 2.2 per cent and potential EPS accretion of 1.5-2 per cent and is likely to completed by end of FY’24,” he said.

Amalgamations to push growth

The proposed amalgamations will enhance management efficiency, drive sharper strategic focus and improve agility across businesses based on the strong parental support from Tata Steel leadership, said the company.

In line with Tata Steel’s long-term strategy, the consolidation of the downstream operations will enable growth in value added segments by leveraging Tata Steel’s marketing and sales network. The amalgamations will also drive synergies through raw material security, centralised procurement, optimisation of inventories, reduced logistics costs, and better facility utilisation.

On completion, there will be further opportunities towards reduction of overhead and corporate costs. Each of the proposed amalgamations will be value-accretive for shareholders, it said.

The proposed amalgamation is a part of Tata Steel’s initiative to simplify the group holding structure. Since 2019, Tata Steel has reduced 116 associated entities. Its 72 subsidiaries have ceased to exist, 20 Associates and JVs have been eliminated and 24 companies are currently under liquidation.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.