As Karnataka gears up for the assembly poll on May 10, businessline analysed the performance of the state economy under the incumbent government through key fiscal indicators. To be fair to the government, the last three fiscal years have been most challenging as Covid-19 ravaged the world.

But Karnataka’s position as India’s IT powerhouse has helped it make the most of the growth in digitally-enabled services during the pandemic.

The State has also been fiscally prudent in reducing its fiscal deficit from the Covid-high although its market borrowings made during the pandemic have raised its interest burden. The State is the best performer when it comes to meeting its targeted capital expenditure.

Also read: Karnataka Elections 2023: Most ministers see hefty growth in wealth in last 5 years

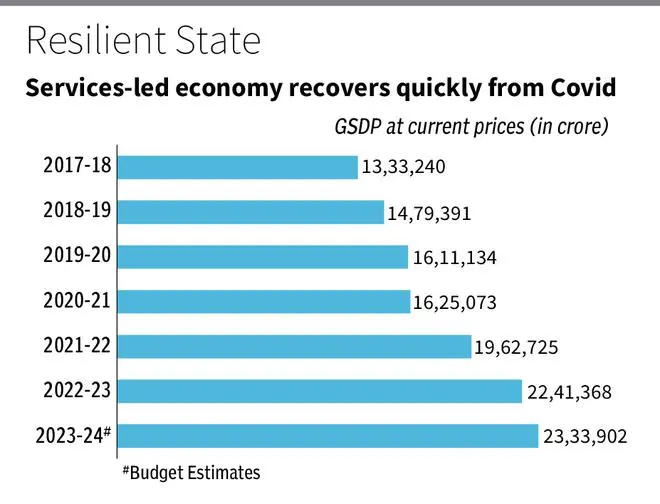

GSDP growth

Karnataka has been registering strong growth in recent years with its services-led economy managing to navigate Covid-19 with panache. This has helped the State move to third place in FY22, after Maharashtra and Tamil Nadu. Karnataka was trailing at fifth spot between FY19 and FY21 with Uttar Pradesh and Gujarat in the third and fourth places, respectively.

From 9 per cent growth in FY20, the State’s GSDP growth fell to 1 per cent in FY21 hit by the pandemic. Thanks to the resilience in services, the State bounced back quickly to record double-digit GSDP growth in the following two years as the post-Covid boom in the digital economy from software and services to edtech and gig economy lifted the State’s output.

Services account for the highest share of Karnataka’s Gross State Value Added (GSVA) at 64 per cent followed by industries (21 per cent) and agriculture (15 per cent). The State is also leading the surge in services exports in the country as it occupies the top rank in software/ service exports and fourth in merchandise exports. During FY23, the share of Karnataka’s GSDP in all India’s GDP stood at 8.2 per cent.

As per the latest budget estimates, Karnataka’s GSDP will reach ₹23.34 lakh crore by FY24 against Maharashtra’s GSDP projection of ₹38.80-lakh crore and Tamil Nadu’s ₹28.3 lakh crore.

Also read: Budget 2023: Poll-bound Karnataka gets ₹5,300 crore for irrigation project

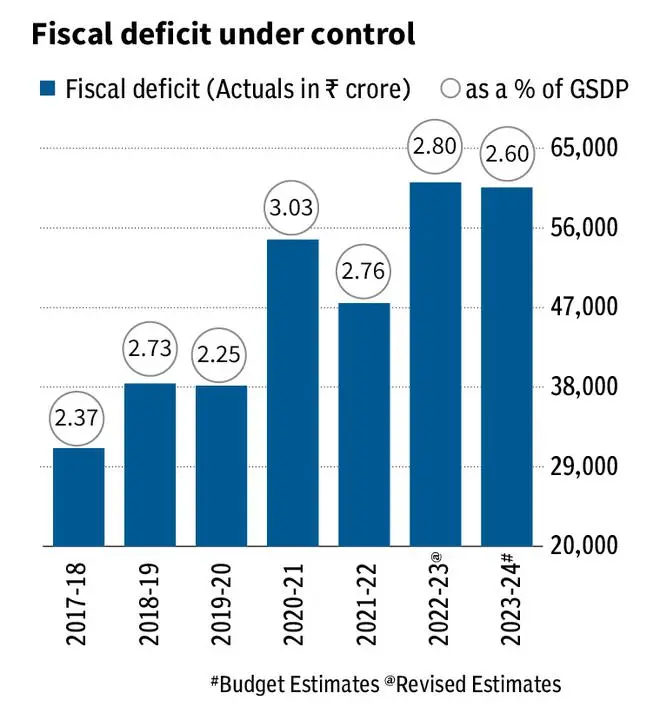

Fiscal deficit

As with all other States, Karnataka’s finances were ruptured by the pandemic with dwindling revenue and a spike in healthcare expenditure. From 2.37 per cent of GSDP in FY18, the State’s fiscal deficit zoomed to 3.03 per cent in FY21.

However, the State has since then been reining the fiscal deficit by containing the revenue deficit.

The boom in software services in recent years has helped in record strong growth in tax revenue. The consumption of premium goods and services in urban areas has boosted its GST revenue as well.

In FY23, the State managed to reduce its fiscal deficit by ₹8,703, compared with the previous fiscal. Consequently, it revised the fiscal deficit to 2.8 per cent of GSDP for FY23 against budget estimates of 2.82 per cent.

For FY24, the State has projected a fiscal deficit of ₹60,581 crore or 2.6 per cent of GSDP, well below the 4 per cent cap allowed by the Finance Commission.

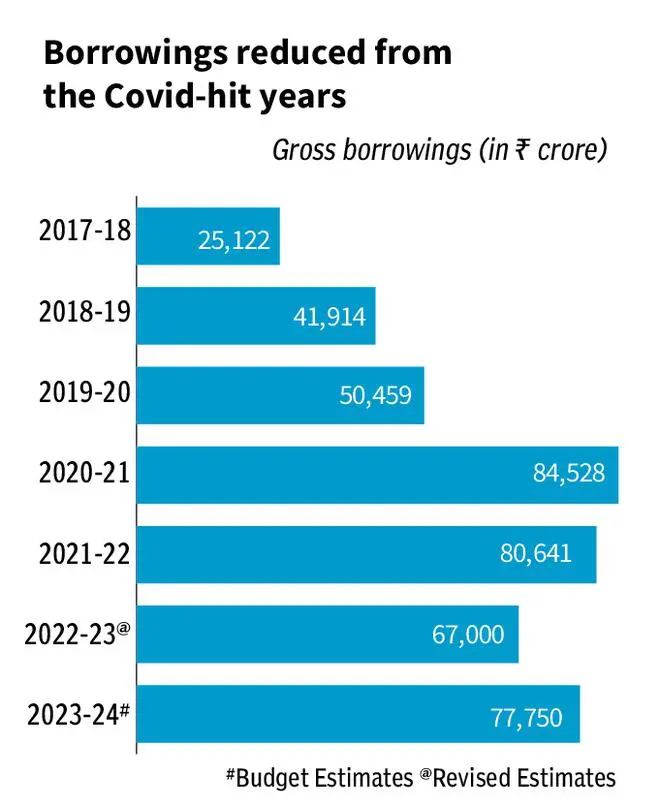

Borrowings

From ₹25,122 crore in FY18, the State’s borrowings ballooned to ₹84,528 crore in the pandemic-hit FY21. But the State debt declined thereafter. For FY23, the State revised its borrowing estimates to ₹67,000 crore from the budget estimates of ₹72,000 crore.

However, the State’s Fiscal Management Review Committee observed that borrowings made prior to and during Covid-19 coupled with rising interest rates on market borrowings has resulted in higher interest payment liabilities.

As a result, interest payments as a percentage of revenues receipts have gone up from 10.6 per cent in FY20 to 15.1 percent of BE FY24. “This calls for urgent measures to improve revenue receipts and to reduce future borrowings,” the Committee noted.

Market borrowings account for 70 per cent of Karnataka’s total liabilities. The total outstanding liabilities of Karnataka are estimated to increase from ₹5.13-lakh crore in RE FY23 to ₹5.65-lakh crore in BE FY24. Total outstanding liabilities as a percentage of GSDP is 24.2 per cent for BE 2023-24.

Also read: Karnataka Elections 2023: State always fared well in social parameters, unemployment rate quite low

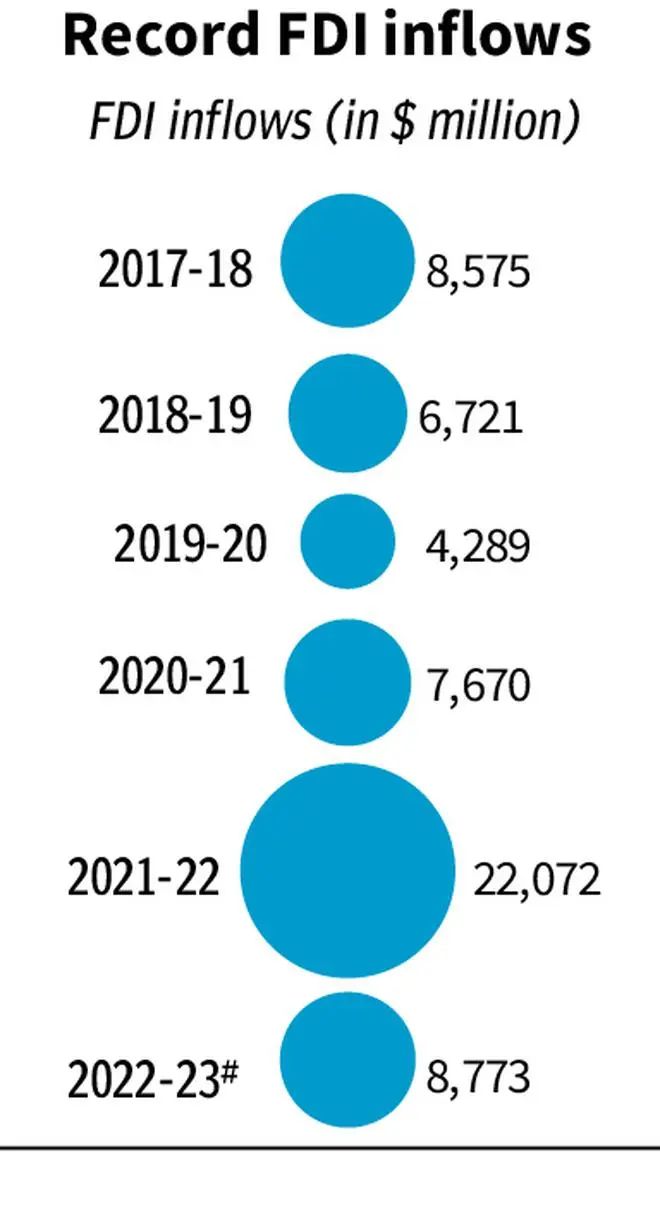

Attracting FDIs

Karnataka accounts for a significant share of India’s total FDI inflows. Thanks to its diversified industries ranging from software & services to Information and Communication Technology (ICT) and manufacturing besides being a home to thousands of start-ups, the State was able to attract large-scale private investments both from India and abroad.

Karnataka received the highest ever FDI inflows across any State of $22.07 billion in FY22. The State received $42.8 billion in FDI between October 2019 and December 2022, accounting for 24 per cent of total FDI inflows into India during this period. The State stands next only next to Maharashtra, which received $49.93 billion during this period.

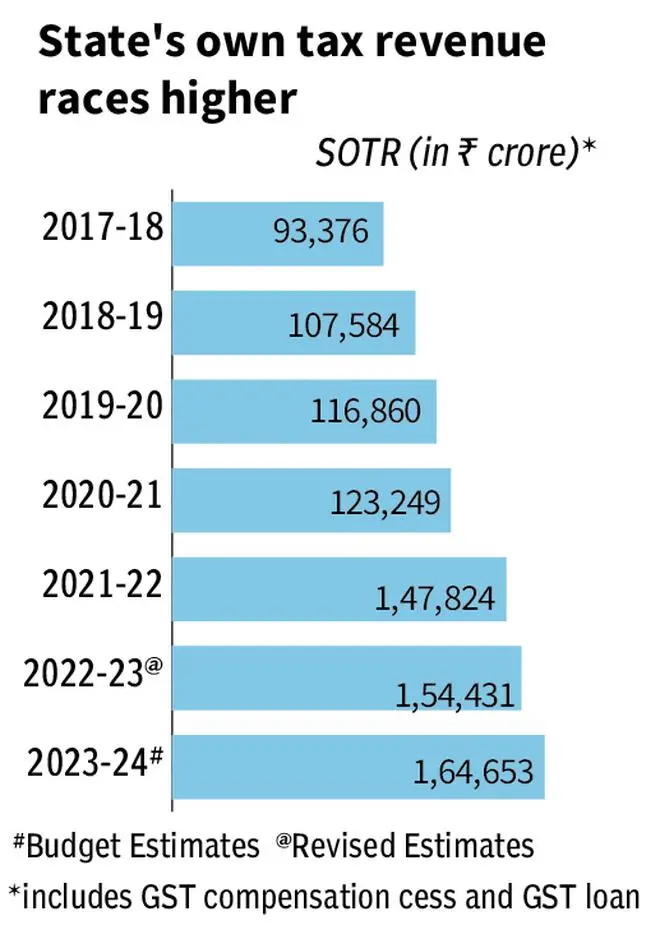

Own Tax revenues

Karnataka’s own tax revenue collections have been robust due to overall growth in economic activity, resulting in increased GST collections, excise duty, motor vehicle tax, and stamp and registration duty.

From ₹93,376 crore in FY18, the State’s own tax revenues nearly doubled to ₹1.47-lakh crore in FY22. The State also revised its excise duty slabs and stamp duties and registration fees in FY22 increasing revenue collections.

In FY23, the State revised its own tax collection projection upwards of ₹20,000 crore against the budget estimates of ₹1.32-lakh crore. For the current fiscal, the State has budgeted ₹1.65-lakh crore in its own tax projections.

Also read: Can States hit the $1-trillion jackpot?

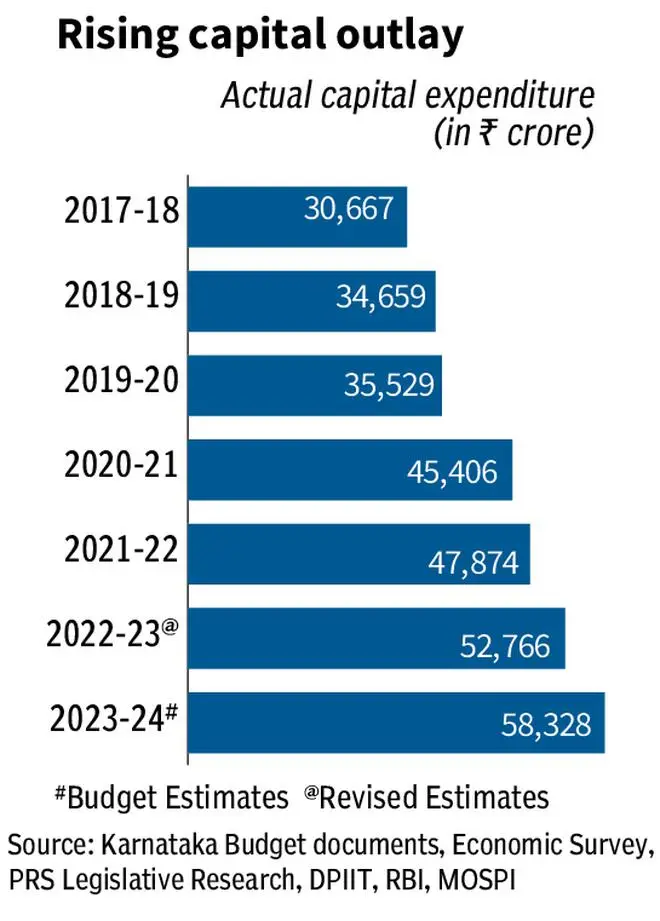

Capex outlay

Higher GSDP growth and own tax revenue collections enabled the State to consistently increase its outlay for capital expenditure. Karnataka’s capital outlay almost doubled from ₹30,667 crore in FY18 to ₹52,766 crore as per revised estimates for FY23.

It is to be noted that in the first eleven months of FY23, only Karnataka achieved 95 per cent of its annual capex target of ₹43,573 crore while industrial states like Tamil Nadu and Maharashtra achieved only 61 per cent and 39 per cent of their annual targets respectively.

For FY24, Karnataka further increased the capital outlay to ₹58,328 crore. Maharashtra has projected a capital outlay of ₹73,901 crore for FY24, while Tamil Nadu has projected ₹44,366 crore of capital expenditure for the current fiscal.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.