India’s sugar production dipped by over 14 per cent in the past month after over 131 mills ended crushing operations in Maharashtra and Karnataka earlier than normal. It impacted the overall output in the country, which reported a fall for the first time this season after positive growth every fortnight during in the five months since October.

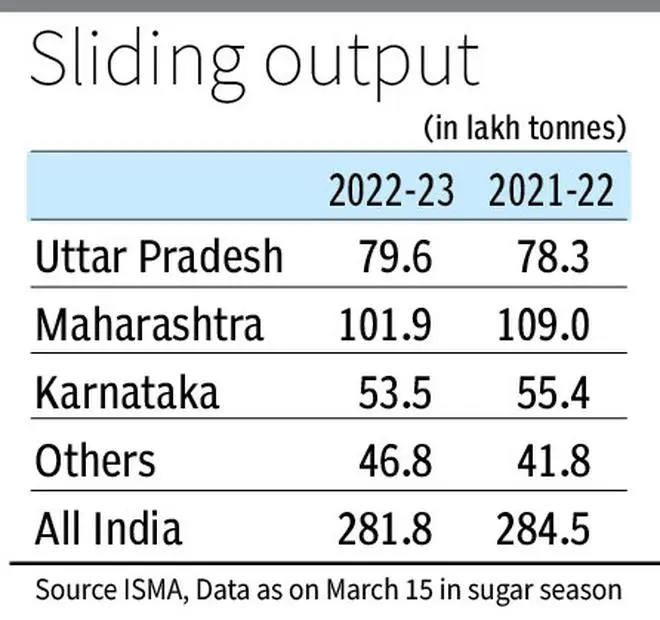

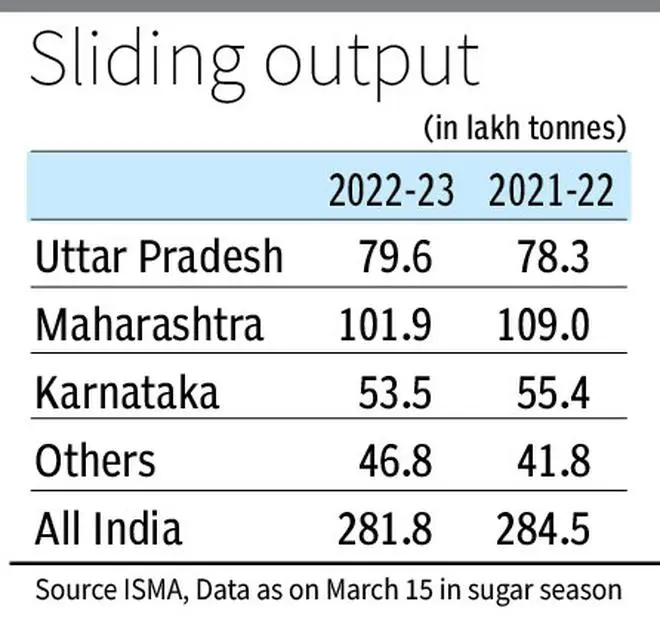

According to Indian Sugar Mills Association (ISMA), sugar production in the current season starting October 2022 was 281.8 lakh tonnes (lt) as of March 15 against 284.5 lt during the same period a year ago, down by 1 per cent.

The production during October-February 15 of the current season was nearly 3 per cent higher. The output between February 16 and March 15 was 53.4 lt against 62.3 lt year-ago.

Mills may benefit

Lower production is good for the sugar companies as it may help improve prices in the short term and also aid the overall financial position of the sector, which is controlled by the government, said a Delhi-based expert. Many of the listed companies like Triveni Engineering and Balrampur Chini Mills, who have their factories in Uttar Pradesh, will get the benefit of price increase since the number of operating mills is almost at year-ago level, the expert said.

As many as 108 mills were in operation as on March 15 against 104 factories in Uttar Pradesh, the second biggest producer, ISMA data showed. On the other hand, 113 factories were crushing against 184 mills in the largest sugar-producing state of Maharashtra and 20 mills against 49 mills in Karnataka, the third largest State in sugar production.

“The decline in production is not a concern as supply exceeds demand and the government has been insisting on diverting more (sugarcane) towards ethanol than to produce sugar. But, if there is a big drop in production from last year, it may push prices marginally because of sentiments,” said an industry official.

Currently, the ex-mill prices of sugar in UP is about ₹34/kg and in Maharashtra ₹32-32.50 whereas the government stipulated minimum selling price (MSP) is ₹31. The sugar industry has been requesting the government to increase MSP to ₹35-36, same as cost of production.

Glut avoided

“We will assess the production in our next meeting, which is likely around April 25, as by that time there will be a fair idea on the production. By mid-April, crushing will be over in Maharashtra and Karnataka and most of the mills in Uttar Pradesh will also close plants,” said Aditya Jhunjhunwala., President, ISMA. The industry body has estimated current year output at 340 lakh tonnes, while the country produced 357.6 lt in 2021-22. The annual domestic consumption is pegged at 275 lt.

It is good that the glut situation has been avoided by diverting more sugarcane towards ethanol, otherwise the government would have to bail out the industry with subsidy, Jhunjhunwala said. The priorities are clearly laid out with domestic consumption at the top followed by ethanol and export, he added.

According to ISMA data, the pan-India diversion (in terms of sugar) towards the production of ethanol was 31.1 lt between October 1 and March 15 of the current season against 25.4 lt year-ago, up by over 22 per cent. The estimated diversion for the production of ethanol in Maharashtra was 9.7 lt against 8.6 lt year-ago, in UP at 11.1 lt against 9.1 lt and in Karnataka 9.2 lt against 6.9 lt.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.