Finance Minister Nirmala Sitharaman’s fifth consecutive budget is notable for its conservatism, commitment to fiscal prudence, accent on quality of expenditure and transparency. These have come to be the hallmark traits of the recent budgets put together by the team at North Block.

Sitharaman’s Budget for 2023-24 rests on seven Cs or Saptarishis, if you may- Conservatism, Consolidation, Control, Capex, Concessions, Corrections, and Co-operatives.

Enthused by the Finance Minister’s proposals, stock market indices soared but fell later, caught in their own woes over the allegations surrounding the Adani group.

Conservatism and Consolidation

Resisting the urge to turn populist ahead of an election year, Sitharaman has continued on the promised glide path setting the fiscal deficit for 2023-24 at 5.9 per cent of GDP, down from 6.4 per cent set for this fiscal, which she has promised to meet. And this has been achieved without shocking the markets-- gross borrowings at ₹15.43 lakh crore are well below market expectations.

The projections for revenue are believable even if they are not underestimated, as they deliberately were in the last budget. Tax revenues --corporate and income tax-- are expected to grow at 10.5%, which is the same as nominal GDP growth in 2023-24, thus translating into a buoyancy of 1, which is quite conservative. Though the economy has been chugging along even in the face of unforeseen hurdles, it may be difficult for the corporate sector to repeat its profit performance of the last year.

Also read

Disinvestment revenue, that regular under-achiever, is set at ₹51,000 crore, well below the 2022-23 estimate of ₹65,000 crore and slightly above the revised estimate of ₹50,000 crore. But even this may be difficult to achieve unless the Government sets the ball rolling early in the fiscal. The Budget also factors in a difficult year for the Reserve Bank of India, accounting for a dividend of ₹48,000 crore only, against the actual receipt of ₹40,953 crore in the current fiscal.

Control and Capex

Sitharaman has been tight-fisted in expenditure through her tenure, eschewing populism, and that continues in the latest budget as well. Total expenditure at ₹45.03 lakh crore is up 7.5 per cent compared to the last budget but if one considers expenditure minus interest payments, which is what is under her control, the increase is only 5.43 per cent. Incidentally, interest payments now account for 3.5% of GDP at ₹10.8 lakh crore.

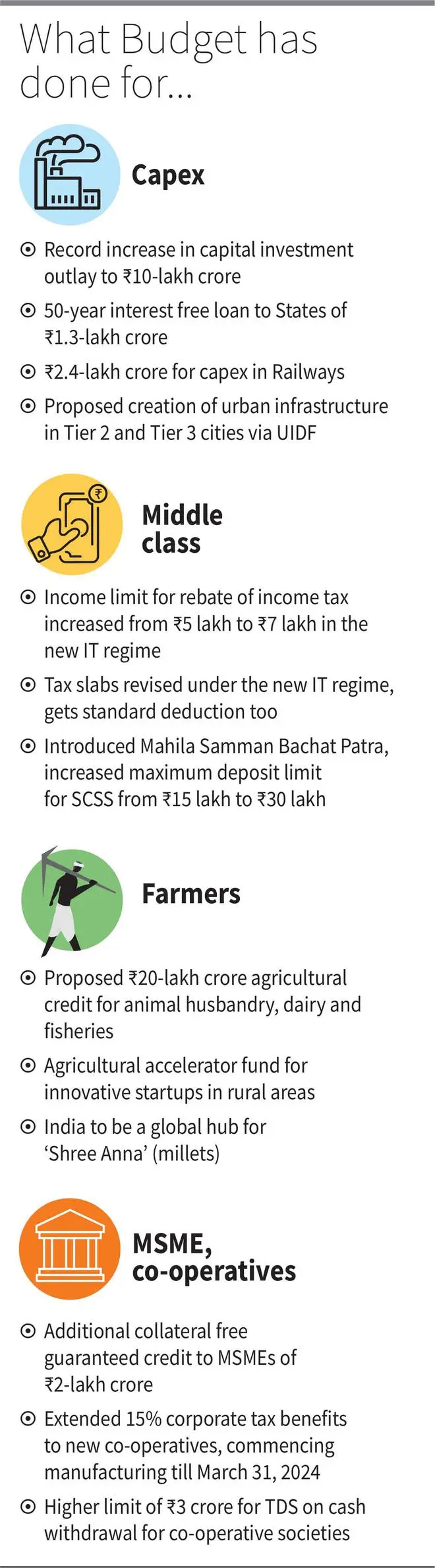

Continuing with the template of the last couple of years, the budget is big on capital expenditure, which is up by a whopping 37 per cent at ₹10 lakh crore, accounting for 3.3 per cent of GDP. This is despite the Government not meeting its capex target in 2022-23. A large part of this allocation is accounted for by Railways, which sees its highest ever capital support of ₹2.40 lakh crore, roads and highways (₹1.62 lakh crore) and PM Awas Yojana (₹ 79,000 crore). States will be allowed a 50-year loan of ₹1.30 lakh crore for spending on capital projects, subject to conditions.

Also read:Budget 2023: First Budget of Amrit Kaal prioritises infrastructure with focus on roads & railways

Sitharaman has endeavoured to control subsidies with a drastic fall across allocations for fertilizer, food, and petroleum. Whether these numbers hold at the end of the year needs to be watched as in the current fiscal, actual expenses have shot well past the budgeted estimates.

In what could raise the hackles of the Opposition and activists, allocations for NREGA are down by a third at 60,000 crore, compared to actuals this fiscal. This can either mean that there is no demand for work due to pick-up in the economy, as the government has been claiming, or it could mean that the allocations have been cut despite demand, as activists claim.

Also read:Budget 2023: Allocation cut by a third, Govt wants mangrove plantation via MGNREGS fund

Concessions and Corrections

Sitharaman has attempted to make the new tax regime attractive to taxpayers who have shunned it till now by re-arranging slabs to reduce tax, allowing standard deduction, increasing the rebate to 7 lakh and reducing the surcharge on the peak tax rate. While these measures bridge the gap between the old and the new tax regimes, it is doubtful if assessees with home loans and tax saving investments will move to the new regime as they stand to benefit in the old one.

Senior citizens may bless the Finance Minister for her proposal to increase the limits on the Senior Citizens Savings Scheme and the Monthly Income Scheme, which offer superior returns and allow tax-breaks. She has endeavoured to plug loopholes and correct provisions that enabled the affluent tax payers to save taxes by taking recourse to high-value insurance policies. Sitharaman has also tweaked capital gains tax provisions to cap the benefit for the rich tax payers and increase the tax collected at source (TCS) on foreign remittances for purposes other than education and medical treatment.

Also read:Budget 2023: Education budget rises by 13%, record allocation of ₹1.12 lakh crore

Co-operatives

The Budget is notable for a sharp focus on cooperative societies with some tweaks in tax laws that govern these entities, allowing them to withdraw cash up to 3 crore in a year without paying TDS, allowing deposits and loans in cash up to 2 lakh in a year without attracting penalties and a special concession to sugar cooperatives for expense write-off. Importantly, cooperatives will now pay just 15 per cent tax on their income.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.