The collection from the surcharge on direct and indirect taxes is estimated to grow more than four times in the current fiscal year (2022-23) and the next fiscal year (2023-24) as compared to the fiscal year 2021-22, data presented in the Rajya Sabha on Tuesday showed. This is despite the fact that surcharge rates have remained unchanged between fiscal years 2019–20 and 2022-23. Experts attribute the surge to a combination of better compliance and buoyancy in direct tax collection.

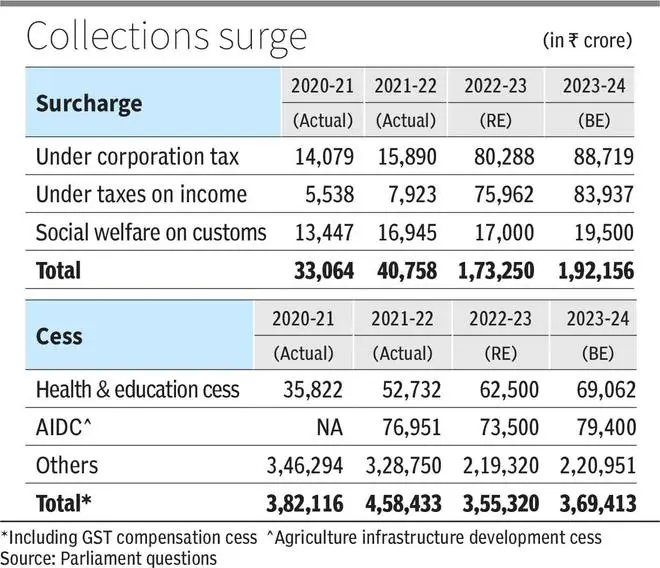

Data presented along with a written response by Minister of State for Finance, Pankaj Chaudhary showed that actual collection from surcharges (corporate tax, taxes on income, social welfare, and custom) in the fiscal year 2021–22 was around ₹40,758 crore. Now, in the revised estimate for fiscal year 2022–23, it is pegged at ₹1.73 lakh crore, showing a growth of around 325 per cent. Similarly, it is estimated at ₹1.92 lakh crore in FY24, which is around 374 per cent over the actual collection in FY22.

Surcharges and cess are levied by the Centre for the purposes of the union under Article 271 of the Indian Constitution. The proceeds of such surcharges and a cess go towards meeting certain specific needs. Article 270 of the Indian Constitution excludes the surcharge on taxes and duties referred to in Article 271 and any cess levied for specific purposes under any law made by Parliament from the distribution between the Union and the States. While a surcharge is levied on entities with income above a certain level, cess is levied on all irrespective of income of an entity.

Higher scope

Till FY23 (Assessment Year 2023–24), the rate of surcharge is between 15 and 37 per cent, and individuals with an annual income over ₹50 lakh per annum are required to pay surcharge. Now, from the next assessment year, the highest rate of surcharge would be 25 per cent. Still, there is higher estimate for collection.

Sandeep Jhunjhjnwala, Partner, Nangia Andersen LLP, said the substantial increase in surcharge collections on income taxes is a direct corollary of the heightened tax collections. The gross tax collections in FY 2022–23 (till March 10, 2023) have exceeded the tax collections by 22.58 per cent compared to the corresponding period of the previous year. The emphasis on digitisation and the exchange of information has skyrocketed, leaving very little room for non-disclosure or non-payment of taxes both by corporates and individual taxpayers.

A noteworthy development in this space is the Annual Information Statement, which has evolved to capture every microscopic detail of transactions entered into by the taxpayer, making them more vigilant about fully disclosing corresponding income and profits and appropriately paying taxes thereon. “The limited or nil scope for clandestine endeavours has resulted in enhanced tax bases and a resultant increase in surcharge collections. For corporates, the irreversible option of exercising the concessional tax regime could have resulted in the lost benefit of deductions outweighing the benefit of the concessional tax rates,” he said.

Cess collection

Collection through cess has also seen growth, but not like surcharge. Also, a key factor is that the increase is mainly due to the GST compensation cess. The share of cesses and surcharges was 8.16 per cent of gross tax revenue in 2011–12 and 28.08 per cent of gross tax revenue in 2021–22. A major reason is the imposition of the GST Compensation Cess.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.