The RBI’s rate setting panel, as was widely anticipated, stood pat on the policy repo rate in its first meeting of FY25 on Friday to ensure that volatile food prices don’t impede the ongoing disinflation process and retail inflation aligns with its 4 per cent target.

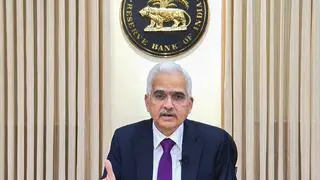

Governor Shaktikanta Das emphasised that the elephant (retail inflation), which has now gone out for a walk and appears to be returning to the forest, has to return to the forest and remain there on a durable basis. He said that though inflation has come down significantly, it remains above the 4 per cent target

Therefore, Monetary Policy Committee (MPC) members decided by a 5 to 1 majority to keep the policy repo rate (the interest rate at which banks borrow funds from RBI to overcome short-term mismatches) unchanged at 6.50 per cent. MPC had maintained status quo on repo rate in all six meetings in FY24.

The members also decided by a similar majority to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

Das underscored that “It is essential, in the best interest of the economy, that CPI inflation (which eased to 5.1 per cent during January and February 2024 from 5.7 per cent in December 2023) continues to moderate and aligns to the target on a durable basis. Till this is achieved, our task remains unfinished.”

Also read

Keeping vigil

Looking ahead, the Governor observed that robust growth prospects provide the policy space to remain focused on inflation and ensure its descent to the target of 4 per cent. RBI has projected CPI for FY25 at 4.5 per cent.

“As the uncertainties in food prices continue to pose challenges, the MPC remains vigilant to the upside risks to inflation that might derail the path of disinflation.

“Under these circumstances, monetary policy must continue to be actively disinflationary to ensure anchoring of inflation expectations and fuller transmission of the past actions,” Das said.

Rates cuts expected from Oct

Referring to RBI retaining its FY25 retail inflation projection at 4.50 per cent, SBI Chief Economic Adviser Soumya Kanti Ghosh opined that the outlook for inflation will largely be shaped by food price uncertainties (indications of a normal monsoon on one side while increasing incidence of climate shocks on other side).

“The good thing, however, is that with 4 per cent inflation target in FY26, the RBI is possibly guiding the market with a prolonged rate cut cycle.

“...We expect a series of rate cuts beginning October 2024, followed by another in December 2024 and possibly in February 2025. The stance change can happen in October itself,” Ghosh said.

Abheek Barua, Chief Economist and Executive Vice-President, HDFC Bank, observed that given the recent global resilience in economic activity, there has been a tendency to keep monetary policy tight to take on the last mile challenge on inflation by global central banks. The RBI seems to be moving in lock step with that.

Inflationary pressure

Crisil’s Chief Economist Dharmakirti Joshi and Senior Economist Pankhuri Tandon observed that the “transmission impact of rate hikes since May 2022 and regulatory measures on risky lending are still playing out. This, coupled with fiscal consolidation, could lead to some moderation in GDP growth this fiscal,” they said.