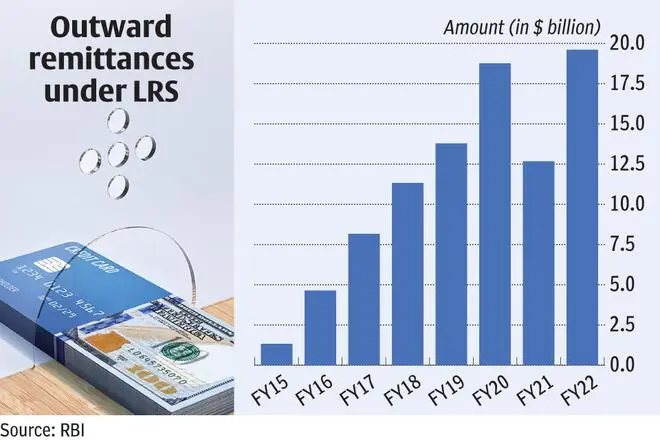

Outward forex remittances under the Reserve Bank of India’s (RBI) Liberalised Remittance Scheme (LRS) has hit an all-time high in FY22 as Indians splurged more money on overseas education and international travel in the previous fiscal.

According to the latest data of the RBI, Indians have sent $19.61 billion abroad in the previous financial year, surpassing even the pre-Covid high of $18.76 billion remitted in FY20. In FY21, outward remittances declined to $12.68 billion as the Covid-19 pandemic and the consequent travel restrictions hit overseas travel and education.

Under LRS, resident individuals (including minors) are allowed to remit up to $2,50,000 per financial year for permissible current or capital account transactions, or a combination of both. Remittances are allowed for various purposes including overseas education, international travel, maintenance of close relatives, medical treatment, purchase of immovable properties and investment in equity/debt, gift or donation among others.

Overseas education and travel

Remittances towards travel accounted for the highest share of outward remittances in FY22 at $6.91 billion as international travel picked up post opening up of international borders.

Travel remittances in FY22 was a shade lower than $6.95 billion spent in pre-Covid FY20. Similarly, remittances towards overseas education have even surpassed the pre-Covid levels in FY22. Indians have spent $5.17 billion in FY22 as against $4.99 billion in FY20.

‘Gifts’ and ‘maintenance’

Not just splurging on leisure travel and overseas education, Indians were also generous when it comes to gifting their beloved ones abroad. Outward remittances towards ‘gift’ saw the highest increase in FY22 as compared to FY20.

Outward gift remittances in FY22 stood at $2.34 billion against $1.59 billion in FY20. Indians have also sent $3.3 billion toward ‘maintenance of close relatives’ in FY22. Remittances towards deposits in FY22 stood at $830 million ($623 million in FY20), while investment in equity/debt in FY22 stood at $747 million ($431 million).

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.