Even as input cost inflation eases, service sector output expanded at a slower pace in March, the results of a survey among purchasing managers of 400 firms by S&P Global, showed on Wednesday. Another piece of bad news is that there was no notable development on the job scenario.

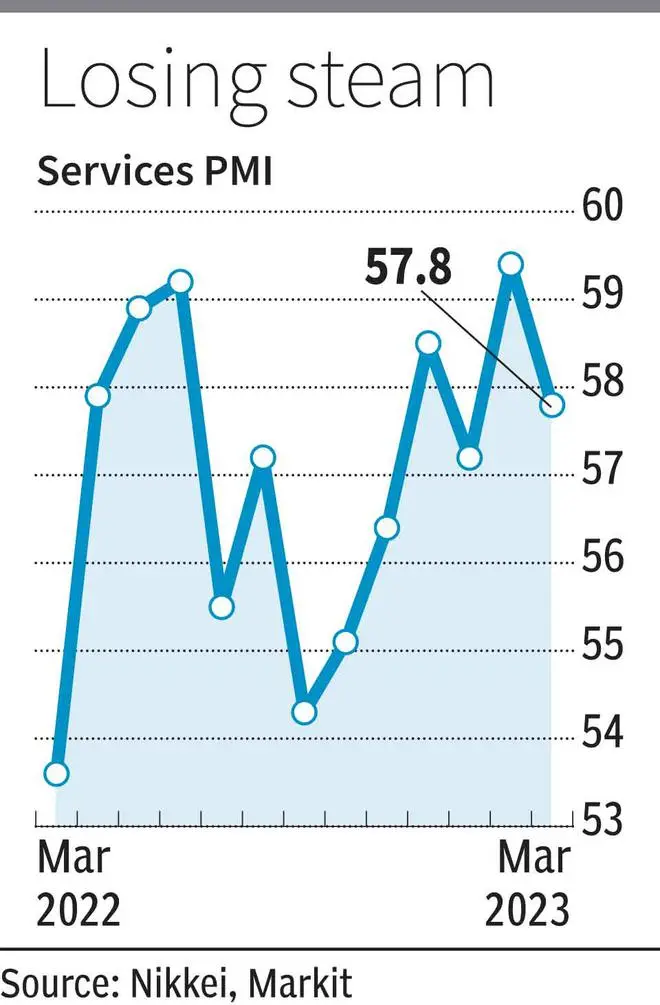

The survey results showed that the Purchasing Managers’ Index (PMI) slipped to 57.8 in March as against 59.4 in February. Favourable demand conditions and new business gains helped in expansion, though at a slower pace. The service sector commands the biggest share (over 50 per cent) of Gross Value Added (GVA) of the Indian economy.

Pollyanna De Lima, Economics Associate Director at S&P Global Market Intelligence, said input price pressures in the service economy continued to subside, alongside the trend seen in manufacturing. Hence, the aggregate rate of input cost inflation moderated to a two-and-a-half-year low.

“Still, a sizeable proportion of services firms hiked their selling prices to hedge against rising costs, emboldened by favourable demand conditions. The rate of charge inflation was moderate, but has quickened since February, a trend that was matched by manufacturing,” she said.

Expansion (above 50 mark) in PMI, albeit at slower pace, has been recorded for 12 successive months. The sector saw an upturn in new work intake at the end of the last fiscal quarter. Hence, business activity rose further. In both cases, rates of expansion remained substantial, despite easing from February. With adequate capacity to meet current requirements, there was no job creation.

“Weakness was seen with regard to jobs, with no change in employment seen either in services or in manufacturing, as a general lack of pressure on operating capacities and diminished confidence towards growth prospects prevented hiring activity. More firms in both sectors anticipate no change in future output from the present levels,” De Lima said. Close to 98 per cent of survey participants left payroll numbers unchanged amid sufficient staff levels for current requirements.

Upward revision in selling price

Backed by demand buoyancy, service providers shared part of their additional cost burden with clients through an upward revision to selling price. The rate of charge inflation picked up to a three-month high, but was moderate and below that seen for input prices. Capacity pressures remained mild overall, as signalled by a slight increase in outstanding business volumes. The rise in backlogs nevertheless took the current stretch of accumulation to 15 months.

Service providers were on average optimistic that output would expand in the year ahead. Demand strength and marketing efforts were the main reasons supporting business confidence. Nevertheless, “the overall level of positive sentiment fell to an eight-month low as several firms foresee no change in activity from present levels,” the survey results said.

On Monday, S&P Global reported that manufacturing PMI closed the fiscal year at 56.4 as against 55.3 in February. The manufacturing sector has a share of over 15 per cent in Gross Value Added (GVA) and is considered a job multiplier.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.