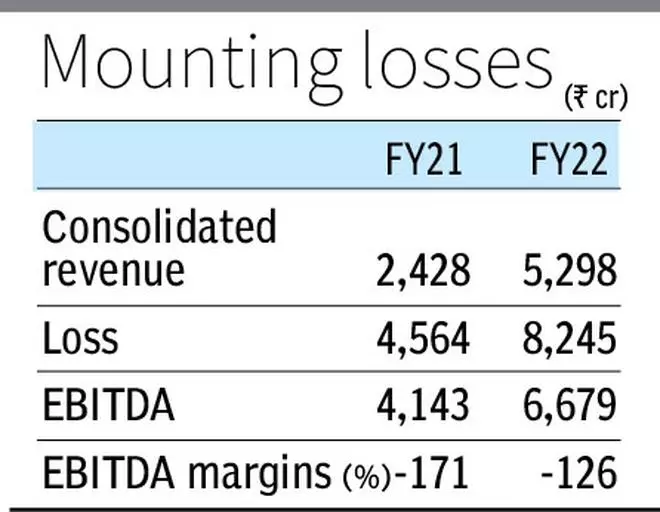

Embattled edtech major Byju’s filed its FY22 financials with the Ministry of Corporate Affairs, and has said that losses ballooned to ₹8,245 crore in FY22 from ₹4,564 crore in FY21.

businessline had earlier reported that the FY22 financials tabled during the company’s annual general meeting in December 2023, showed that consolidated revenue from operations stood at around ₹5,000 crore, with losses crossing ₹8,200 crore.

Earlier in November 2023, the company revealed that its standalone revenue from core business rose to ₹3,569 crore, while it recorded an EBITDA loss of ₹2,253 crore.

Byju’s consolidated revenue jumped 118 per cent to ₹5,298 crore in FY22 (₹2,428 crore).

Auditor’s concern

In the FY22 financials, the Byju’s auditor cautioned that a material uncertainty exists due to its large losses and a $1.2-billion loan that may cast significant doubt on the group’s ability to continue as a going concern.

The auditor said, “However, as explained in the Note, the management has undertaken various measures to improve its operating financial condition, is also in the process of securing necessary funding arrangements and exploring sale of assets as needed, and hence is confident regarding the future viability of the group.”

“Basis a legal opinion, the management is of the view that it is unlikely that the TLB loan will be required to be paid in the foreseeable future. Accordingly, these financial statements for the year ended March 31, 2022, have been prepared on a going-concern basis,” it added.

Byju’s FY22 financials showed that 69 per cent or ₹3,464 crore of the company’s operating revenue of ₹5,014 crore came from domestic sales, whereas the rest came from exports.

“Our subscriber base has grown 125 per cent in the year from FY21. While we are happy that our total income has grown 2.2X, we are also aware of our underperforming businesses like Whitehat Jr and OSMO which contribute to 45 per cent of the losses. We have taken various measures to improve our operating financial conditions. These businesses were scaled down significantly to cut losses in the subsequent years, while other businesses continue to see growth,” said Nitin Golani, Chief Financial Officer.

Valuation cuts

Recently, the edtech major has seen valuation cuts as global investment management firm BlackRock, which holds less than 1 per cent stake in Byju’s, has cut down the firm’s valuation to $1 billion from the high of $22 billion it fetched in early 2022.

In November 2023, tech investor Prosus marked down the value of its stake in Byju’s, resulting in a company valuation of less than $3 billion, representing an 86 per cent decline from the previous valuation of $22 billion.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.