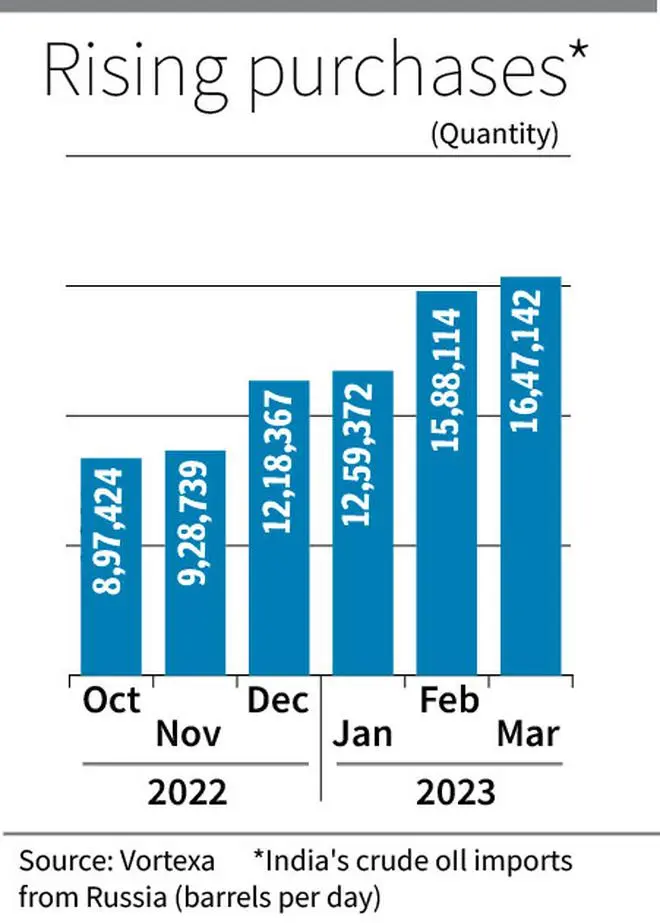

India purchased a record 51.15 million barrels, or 1.65 million barrels per day (mbd), of crude oil from Russia making it the largest buyer of seaborne crude from the erstwhile Soviet Union, surpassing China for the fourth consecutive month.

Private refiners Reliance Industries (RIL) and Russian state-run oil giant Rosneft-backed Nayara Energy accounted for around 858,000 barrels per day, or more than half, of the total imports from Russia, energy intelligence firm Vortexa said.

“India imported 1.65 mbd of Russian crude in March 2023, up from 1.58 mbd in February. India surpassed China as the largest importer of Russian crude in December 2022, with 1.22 mbd of Russian crude discharging into the country,” Serena Huang, Head of APAC Analysis at Vortexa told businessline.

Asked about private refineries’ share, she said, “In March 2023, private refiners (Reliance and Nayara Energy) imported 52 per cent of the total Russian crude discharged into India.”

Also read

Diversifying blends

Vortexa data show that 70 per cent of the imports from Russia were the medium sour grade Urals blend, followed by lighter blends such as Sokol (10 per cent), Varandey & ESPO (6 per cent each), Arco (2 per cent) and Novy Port Light & Siberian Light (2 per cent each).

India maintained its imports of medium-sour Russian Urals in February and March, while raising purchases of lower sulphur grades like Sokol and Novy Port Light, Huang pointed out.

“The plateauing of India’s imports of medium-sour Russian Urals could indicate a soft limit on its ability to take in more sour crude, given its need to fulfill its term contracts with Mideast Gulf producers. But domestic refiners do have room to increase their purchases of sweeter grades like Sokol, ESPO blend and Novy Port Light, in the interest of maintaining refining runs high in lieu of the robust domestic and export demand,” she explained.

Payment mechanism

Trade sources said that for lighter grades such as Sokol there are instances when the G7 price cap of $60 per barrel is breached and Indian refiners are paying in UAE’s Dirhams and to some extent in Russian Roubles. Indian banks with little exposure to the US such as the UCO Bank are also being used to make payments.

Asked whether the alternate payment mechanism to the US dollar will continue, Vortexa’s Huang was optimistic.

“Yes, especially when Russia and India are working towards a term supply of Russian crude to India, they would be keen to establish an alternate mechanism that reduces risks of interference by the West,” she added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.