The financial markets — rupee, government securities (G-Secs/GS) and equities — were buoyed on Monday amid weakness in the dollar, the likelihood of the Reserve Bank of India turning less hawkish, healthy corporate earnings and a surge in GST collection, among others.

After gaining 60 paise last week, the rupee (INR) appreciated 23 paise on the day as exporters brought in dollars, fearing they could lose out on currency gains. Also, what added to the positive sentiment for the rupee were a renewed interest in foreign portfolio investors (FPIs) to invest in Indian markets, the dollar’s broad-based weakness against major currencies and RBI’s aggressive intervention last week.

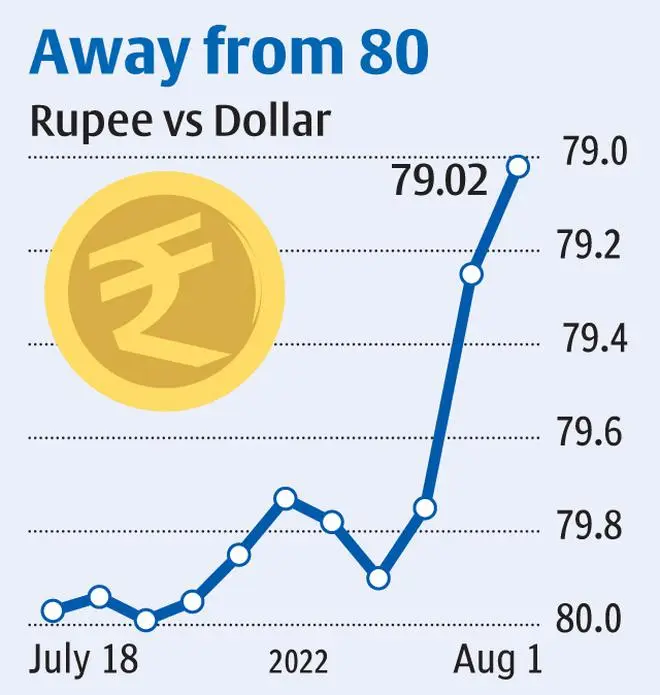

The rupee closed at 79.025 per dollar against the previous close of 79.255.

RK Gurumurthy, Head-Treasury, Dhanlaxmi Bank, said: “After a reasonably long time, we saw the spectacle of “all market rally” domestically. A less hawkish Fed, with risks of 75-100 basis points hikes in the meetings ahead removed, dollar’s corrective pullback from its multi-decade highs, US treasury and equity markets holding on to post FOMC rally are primarily the drivers for the rally in asset classes and currency in India.”

G-Sec yields thaw

Yields of widely traded G-Secs dropped 7-8 basis points on expectations that the monetary policy committee (MPC) may go in for a lower quantum of repo rate hike. Yield of the 10-year benchmark G-Sec (coupon rate: 6.54 per cent) closed down about 8 basis points at 7.2402 per cent (previous close: 7.3196 per cent). Price of the aforementioned security jumped 52 paise to close at ₹95.26 (₹94.74).

Equity markets

Aided by robust corporate earnings, a surge in GST collections and pick up in momentum in passenger vehicle sales, the bellwether 30-share BSE Sensex closed at 58,115.50, up 0.95 per cent (or by 545.25 points) over the previous close. The NSE Nifty 50 closed at 17,340.05, up 1.06 per cent (or by 181.80 points) over the previous close.

Siddhartha Khemka, Head-Retail Research, Motilal Oswal Financial Services Ltd., observed that the broader market’s outperformance was supported by strong results and FIIs turning buyers in the previous two trading sessions. “Auto sector was the top performer today (Monday) on the back of strong monthly sales data, record bookings for new models and healthy earnings reported last week. On the economic front, India’s manufacturing activity improved in July and rose to an eight-month high of 56.4 levels. Further, GST collection grew by 28 per cent y-o-y to ₹1.49-lakh crore in July – the second-highest ever collection,” he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.