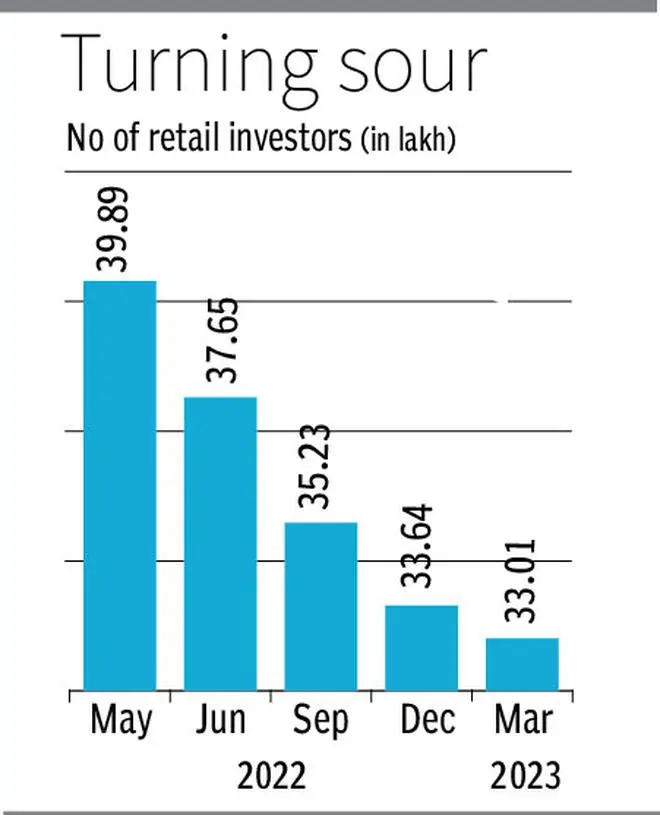

Exodus of retail investors from underperforming Life Insurance Corporation of India has continued in January-March period as well, as the stock continues to disappoint investors. The latest shareholding pattern ending March 2023 has revealed that another 62,668 small investors - who hold share capital up to ₹2 lakh - have exited from LIC.

With this, 6.87 lakh shareholders have exited from LIC since its listing of shares on May 17, as the stock continues to slide. As against the IPO price of ₹904 (for retail investors), the stock has slumped to a low of ₹530.20 on March 29 and currently hovering around ₹550. The loss would be higher for institutional investors, as the IPO price for them was fixed at ₹949.

However, in a percentage terms, retail investors rose to 2.04 per cent at the end of March quarter from 1.94 per cent in the preceding quarter. Currently, 33.01 lakh small investors hold about 12.89 crore shares, as against 12.11 crore shares held by them at the end of the December quarter. In the IPO, 39.86 lakh investors garnered 1.66 per cent stake or 10.51 crore shares. That means, since IPO, over 2.38 crore shares were added by existing retail investors.

“Market share has been declining over the years as private players are more aggressive in their approach but we expect to see a bounce back from LIC of India due to change in product mix and further penetration in rural region,” Religare Broking said. It initiated a Buy rating on LIC stock with at price target of ₹646, far from its IPO price.

On the other hand, foreign portfolio investors seemed to have lost faith in LIC, as they shed 54.43 lakh shares, reducing their stake to 0.08 per cent from 0.17 per cent. Mutual funds too reduced their holding to 0.63 per cent (0.66 per cent).

Life Insurance Corporation of India (LIC) reported a net profit of ₹22,970 crore for the nine months period ending December 31, 2022, as compared to ₹1,672 crore in the year-ago period. It was mainly on account of transferring ₹19,942 crore (net of tax) pertaining to the accretions on the available solvency margin from non par to shareholders account, per the corporation’s statement.

ICICI Securities, which came out with a buy rating on February 13 report, said: “We have always believed that product mix driven possible increase in VNB margin (management’s aim is to close in on private peer levels within next 3-4 years) is achievable and is underappreciated by the market.” Concerns on high sensitivity of EV to equity movement is also overdone, it added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.