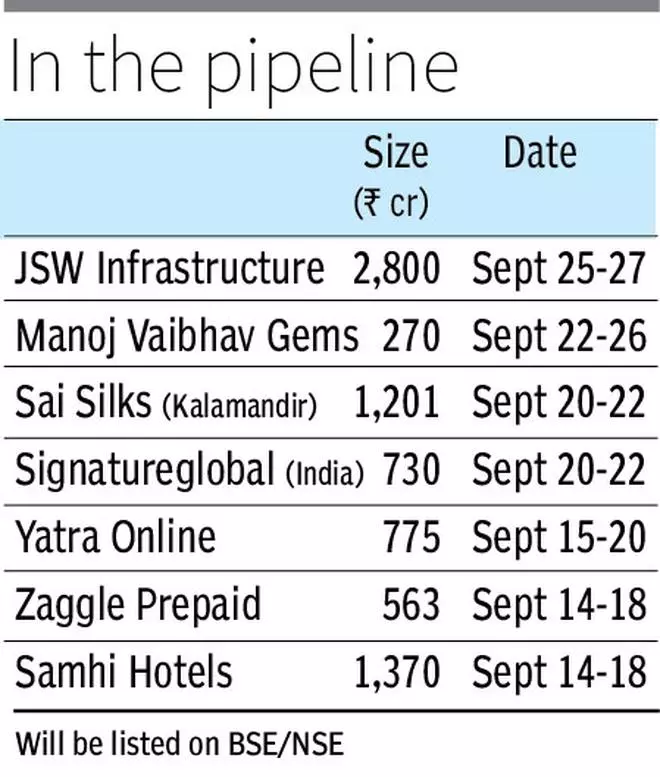

Seven companies, including Sajjan Jindal Family Trust-backed JSW Infrastructure and Yatra Online, will raise ₹9,600 crore in the next 15 days.

JSW Infrastructure will be the biggest to open this month with plans to raise over ₹2,800 crore through the issue of fresh equity shares. In fact, it is one of the few IPOs where the promoters are not diluting their stake.

Mahavir Lunawat, Managing Director, Pantomath Advisory Services, said next week looks promising as far as primary offerings are concerned with RR Kabel, Samhi Hotels, Zaggle Prepaid Ocean Services, and Michael Kaufman-backed Yatra Online together targeting to raise ₹4,673 crore.

The initial public offering of Haryana-based Online Travel Agency Yatra Online kicked off for subscription on Friday and the issue will conclude on Wednesday. Ahead of the issue opening, the company mopped up ₹349 crore from 33 anchor investors on September 14.

Sai Silks Kalamandir IPO, which opens on Wednesday, eyes ₹1,200 crore at the upper end of the price band of ₹222 a share.

The IPO comprises a fresh issuance of shares worth ₹600 crore by the company and an offer-for-sale of 2.71 crore equity shares by the promoter group.

Vaibhav Jewellers on Friday said it has fixed the price band at ₹204-215 a share for its ₹270-crore IPO, which will open for subscription on September 22.

Secondary market support

With booming secondary market, the subscription in the recent IPOs has been encouraging. Unlike in the previous instances, the market rally behind the Nifty crossing 20,000 mark has been supported by bullish trend in the broader market.

Though the Nifty-50 is at an all-time high, Mid and Small-caps have outperformed it by a big margin. In the year to date, the Nifty-50 is up 11 per cent, while the Nifty Midcap 100 and the Nifty Smallcap 100 are up 28 per cent and 29 per cent, respectively, said Motilal Oswal research.

The large caps remained clear outperformers during the Nifty-50’s journey from 18k to 19k. However, the mid- and small-caps hit new highs when the Nifty-50 moved up from 19,000 to 20,000.

As the rate-hike cycle approaches its end and positive retail sentiment persists, mid- and small-cap stocks continue to be favoured. This was evident in the recent widespread market rally, where both mid- and small-cap indices significantly outperformed the Nifty-50, with gains of 7.80 per cent and 11.50 per cent, respectively, from July to September, as the Nifty moved from the 19,000 to the 20,000 level.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.