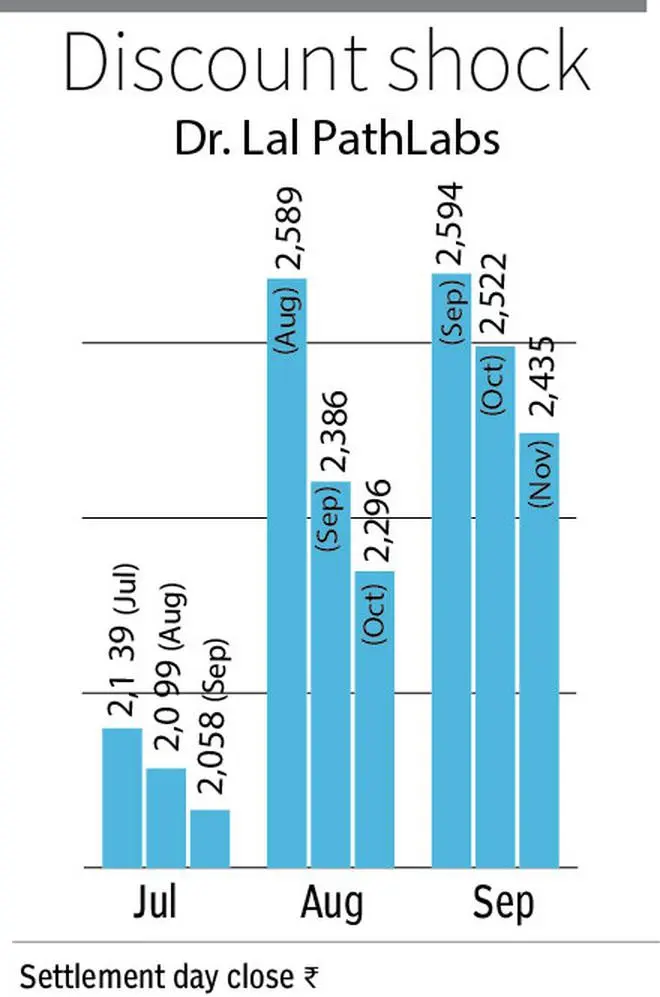

Traders are puzzled over discount of 15 per cent that Dr Lal PathLabs November contract is trading with respect to current month. For the third successive month, the company’s farther month contracts are trading at deep discount, analysts tracking F&O market closely said.

The price behaviour of Dr Lal PathLabs futures in derivative segment puts traders off-guard with farther month contract (November) is ruling in backwardation.

When the spot price is ruling higher than the future price, it is called backwardation.

Related Stories

‘Margins in diagnostics business set to return to pre-Covid levels’

According to Om Manchanda of Dr Lal Pathlabs, disruptive pricing is not sustainable in the diagnostics businessHowever, the gap between the November futures and spot has considerably narrowed down in the last couple of days ahead of F&O monthly expiry on Thursday.

Till a couple of days back, the gap between the spot price and the November futures was as high as ₹350, said analysts tracking F&O market. Even the middle month contracts (October) was ruling in a discount between ₹200-250 while the current month (Sept) contract is quoting in premium. "This behaviour defies any logic," said a Chennai-based market veteran, who tracks F&O since introduction in Indian markets.

An analyst from the Mumbai-based brokerage firm said, this phenonmenon is being witnessed since June. "The middle month contracts will turn into premium when it turns near-month while the new farther month contracts (third-month) come at a discount of 10-15 per cent," he added.

Generally, futures prices (FP) will quote in premium over spot price, as FP captures the risk-free interest rate (for number of days the contracts expire) over the spot price. However, when the stock trades in cum dividend, FP will be in discount, as the dividend will paid only to equity shareholders.

But in this case, there are no dividend or corporate events that warrant such a discount, he added.

Even, SEBI recently came out with a framework, where derivative contracts should be adjusted for dividends if the payout is at or above 2 per cent of the market value of underlying stock,

Generally, backwardation happens due to demand and supply of a contract, said Chennai-based veteran.

Dr Lal PathLabs’ November series is now ruling at ₹2,415 (10 am IST) against spot price of ₹2,617 and September contacts value of ₹2,620. At ₹2,515 October contract, which was in a discount of over 7 per cent with spot price a couple of days back, is ruling just 3 per cent lower.

One has to see how December month contracts would be when introduced on Friday, he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.