Rate hikes, Russia-Ukraine conflict, inflation worries and fear of slowdown in economic growth have affected the sentiment for both global markets and Indian markets. However, thanks to strong support by domestic investors, the domestic market withstood the global onslaught.

From the equity investors’ perspective, 2022 has been one of the best years. Though in absolute terms, the major benchmarks gave a flat return of 4-6 per cent, the secondary market continued their record-breaking spree with Nifty, Sensex and Bank Nifty hitting new all-time highs during this calendar year.

But, the buoyant mood failed to percolate to primary market on fund mobilisation and the number of issues. The number of companies raised capital through main market (BSE and NSE) stood at 40 as against over 55 in 2021. The fund mobilised stood at nearly ₹64,000 crore as against over ₹1-lakh crore in 2021, despite LIC’s mega issue of ₹21,000 crore.

Analysts said the IPO pipeline will remain robust in 2023, with several high-profile and new-age companies such as Jio Platforms, Tata Technologies, TVS Logistics, JSW Infra, Navi Technologies, Bharat FIH, HDB Financial, Sterlite Power and Aadhar Housing Finance likely to hit the market. Besides, SEBI’s recent initiatives to boost transparency for IPO market.

LIC – key dragger

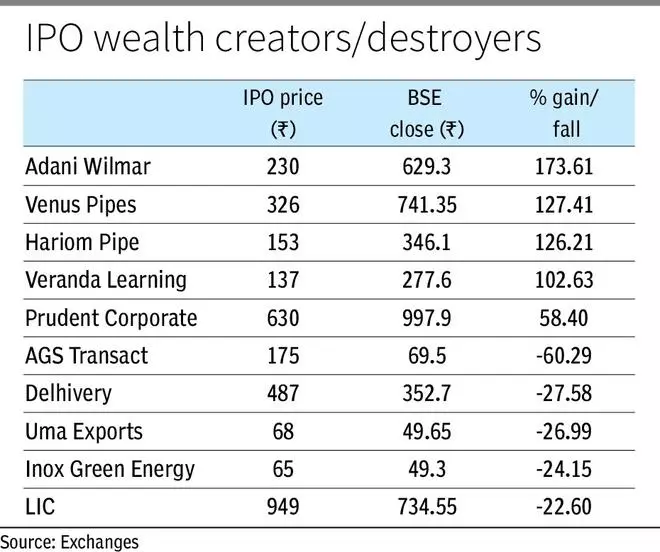

Despite the turn of events in 2022, investors can derive satisfaction over the performance scorecard of IPOs as just eight of 34 IPOs are in the red. One of the worst performers was LIC, which had attracted a strong response of over 75 lakh applications from retail investors for its IPO, but has tumbled 26 per cent so far.

The stock of LIC, after hitting a low of ₹588, is currently hovering at around ₹735 against the IPO price of ₹949. (Retail investors were allotted at a discount of ₹45 and policyholders at ₹60). In fact, the stock’s highest price of ₹949 was hit on the listing day. But Monday’s sharp rally narrowed the loss to about 16 per cent. Another major IPO stock Delhivery crashed over 34 per cent in 2022.

The average IPO size was ₹1,650 crore in 2022, thanks to LIC’s offer. Harsha Engineers International witnessed the biggest attraction from investors with the issue being subscribed by 74.8 times, followed by Electronics Mart India (71.9 times) and DCX Systems (69.8 times).

Because of LIC’s higher weightage, the performance of BSEIPO index tumbled 26 per cent year-to-date.

However, the star performer was Adani Wilmar, as the stock has returned a healthy return 174 per cent to investors who still hold the stock from IPO. This despite the stock witnessed a sharp correction after hitting a high of ₹878 post listing. The company came out with a IPO price of ₹230.

Adarsh Ranka, Financial Accounting Advisory Services Leader, Partner with an Indian member firm of EY Global, said the IPO market has witnessed a bearish phase recently. The backlog of companies that have received SEBI approval and are yet to float an IPO is set to give market direction in the upcoming quarters.

SME-IPOs sizzle

Though the main-board performance was rather lacklustre, IPOs at SME platform gave a sharp return. Apart from main-board IPOs, 108 small and medium enterprises (BSE and NSE SME platforms) collected nearly ₹2,000 crore, as compared with nearly ₹800 crore raised by SME IPOs in 2021.

The BSESME index doubled in 2022, thanks to a stellar performance from stocks such as Cool Caps (nearly 565 per cent), Empyrean Cashews (620 per cent), Rachana Infrastructure (720 per cent), Rhetan TMT (540 per cent), Jay Jalaram Technologies (530 per cent), Varanium Cloud (710 per cent) and Containe Technologies (540 per cent).

Healthy pipeline

In 2023, the focus will also be on new-age companies such as Ixigo, Snapdeal and Mobikwik. There are also hopes that India’s premier exchange, the National STock Exchange will hit the markets, with new chief at the helm.

“While volatility in the overall global markets and other macro factors will continue to affect investor sentiments, the pipeline of IPOs and momentum created by successful IPOs towards the end of Q3-2022 could lead to a recovery in the market,” said Adarsh Ranka.

According to global major EY, there have been several recent amendments such as disclosures in terms of Key Performance Indicators and price per share based on historical transactions, confidential pre-filing of offer document as an alternative mechanism, exemption for the requirement of a minimum 10 per cent shareholding for the non-promoter shareholders for offering shares through the OFS mechanism are amongst many other updates and the detailed regulations have now been rolled out by SEBI.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.