Assets under management of NBFCs under the co-lending model are nearing the ₹1-lakh crore mark, five years since the model came into existence.

“Over the medium term, growth momentum is seen healthy at 35-40 per cent annually, amidst rising interests of partners – NBFCs and banks,” Crisil said in a note, adding that these partners are likely to increase their focus on other asset classes such as MSME and home loans, given the higher risk weights for personal loans.

Share of loans

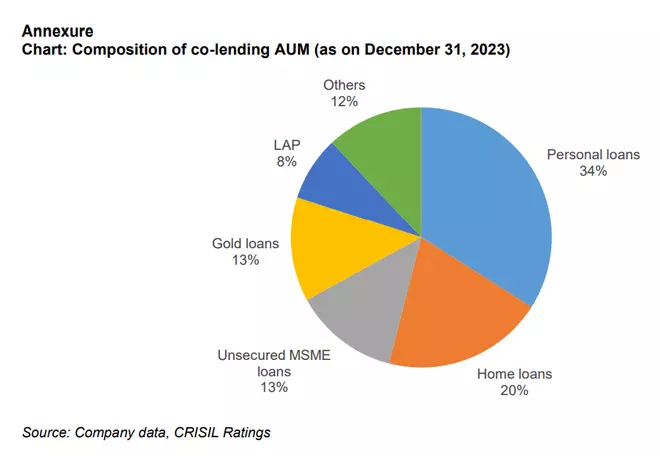

Personal loans account for a third of overall co-lending AUM across the industry, followed by housing loans at around 20 per cent and unsecured MSME loans and gold loans at 13 per cent each. Secured MSME (including loans against property) and vehicle loans comprise the remaining 20 per cent.

Growth in unsecured loans, including consumer loans (personal and consumer durable) and SME loans, is seen slowing down to 25-35 per cent in FY25 compared with the estimated growth of 35 per cent in FY24.

Co-lending AUM of NBFCs’ is estimated to be around ₹75,000 crore as of September 2023, up from ₹55,000 crore in March 2023, Crisil said, adding that it expects this AUM to cross ₹1-lakh crore by March 2024 or latest by Q1 FY25.

“The share of personal loan in the co-lending book could decline in FY25, and that of MSME and home loans should go up. This will be supported by government’s focus on increasing share of MSME sector contribution in India’s GDP and ‘Housing for All’ initiatives,” said Malvika Bhotika, Director, Crisil Ratings, adding that co-lending will continue to see increased traction as NBFCs look for alternative funding sources to cater to the healthy demand for retail loans.

The estimates are based on a study of around 100 NBFCs, accounting for over 90 per cent of the sector’s AUM. However, only about a third of these have active co-lending books at present.

‘Win-win’ for NBFCs

Crisil said co-lending is a “win-win” for NBFCs and banks alike as it allows sharing of risk and rewards. For NBFCs, particularly for mid-sized and smaller ones, it enables access to bank funding and diversification in funding avenues.

Growth is seen supported by controlled asset quality seen so far in the co-lending portfolio of banks and NBFCs. The increase in risk weights for bank lending to NBFCs has also worked in favour of the co-lending model as it allows NBFCs to grow in a capital-efficient manner whereas banks have optimal access to niche customers and geographies and help in meeting their priority sector lending targets.

“While sustenance of asset quality will be the key to long-term success of the co-lending business model, the manner in which regulations governing co-lending evolve will also bear watching,” it said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.