Although there are no imminent signs of stress in the retail credit segment, its rapid growth amidst the disinflationary monetary policy stance raises concerns in terms of procyclicality of lending and higher debt servicing costs, RBI said in its latest Financial Stability Report (FSR).

Between September 2021 and September 2023, banks’ retail loans grew at a compound annual growth rate (CAGR) of 25.5 per cent, which exceeded the headline credit growth of 18.6 per cent.

Retail loans include housing loans, vehicle loans, loans against property, education loans, loans against FD, loans against shares, personal loans, credit cards, consumer durables and other retail loans. Procylicality refers to the tendency to overestimate future risk in times of crisis, while underestimating it in normal times.

Asset quality improves

Despite the sharp growth in retail lending, underlying asset quality has improved, per the FSR.

The GNPA (gross non-performing assets) ratio of total retail advances improved to 1.6 per cent in September 2023 from 2 per cent in September 2022, whereas the special mention account/SMA (1+2) ratio rose marginally from 2.7 per cent to 2.8 per cent.

The GNPA ratio of unsecured retail advances improved to 2 per cent in September 2023 from 2.5 per cent a year ago.

If principal or interest payment or any other amount wholly or partly overdue remains outstanding up to 30 days, a loan account is classified as SMA-0; 31-60 days - SMA-1; 61-90 days - SMA-2.

Co-lending: interconnectedness risks

The RBI said that as banks and NBFCs (non-banking finance companies) have entered into various co-lending models with divergent underwriting practices and banks have been the major lender to NBFCs, rising interconnectedness raises risks emanating from cross-sectional dimensions.

Furthermore, there are few outlier banks that have substantial SMA (1+2) ratios even as retail portfolios are witnessing rapid growth.

Accordingly, the RBI took proactive regulatory measures such as increase in risk weights on certain segments of consumer credit by banks and NBFCs as well as bank credit to NBFCs.

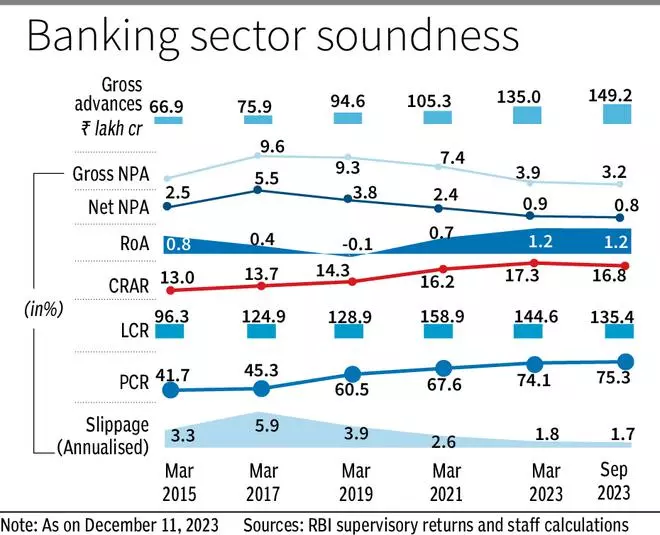

Adjusting for increase in risk weights, the CRAR (capital to risk-weighted assets ratio) of the banking system (PSBs/public sector banks + PVBs/private sector banks) is estimated to decline by 71 basis points (bps) to 16 per cent and CET (common equity tier) 1 may fall by 58 bps to 13.2 per cent, per RBI’s assessment. The impact, however, varies among banks.

“Our recent macroprudential measures to curb lenders’ exuberance towards certain segments of retail loans underline our commitment to preserve financial stability without compromising availability of funds for productive requirements of the economy,” RBI Governor Shaktikanta Das said in the FSR.

The central bank assessed that further gains in earnings for scheduled commercial banks (SCBs) could be moderated by rising cost of funds – the average cost of funds of SCBs have risen by 80 bps – from 4.4 per cent during Q4 (January-March): FY23 to 5.2 per cent in Q2 (July-September):FY24.

Stress test

The central bank said the stress test results reveal that SCBs are well-capitalised and capable of absorbing macroeconomic shocks even in the absence of any further capital infusion by stakeholders.

Under the baseline scenario, the aggregate CRAR of 46 major banks is projected to slip from 16.6 per cent in September 2023 to 14.8 per cent by September 2024.

CRAR may go down to 13.5 per cent in the medium stress scenario and to 12.2 per cent under the severe stress scenario by September 2024, which would also remain above the minimum capital requirements.

It said no SCB would breach the minimum capital requirement of 9 per cent in the next one year.

Under the baseline scenario, the GNPA ratio of all SCBs may improve to 3.1 per cent by September 2024 from the current level of 3.2 per cent. However, if the macroeconomic environment worsens to a medium or a severe stress scenario, the ratio may rise to 3.6 per cent and 4.4 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.