The rising interest rates in the global market could not deter Indian companies from borrowing abroad. Overseas borrowing of India Inc has touched a historic high in the first quarter led by large ticket borrowings by Arcelormittal Nippon Steel India, Reliance Industries Ltd, and Reliance Jio Infocomm.

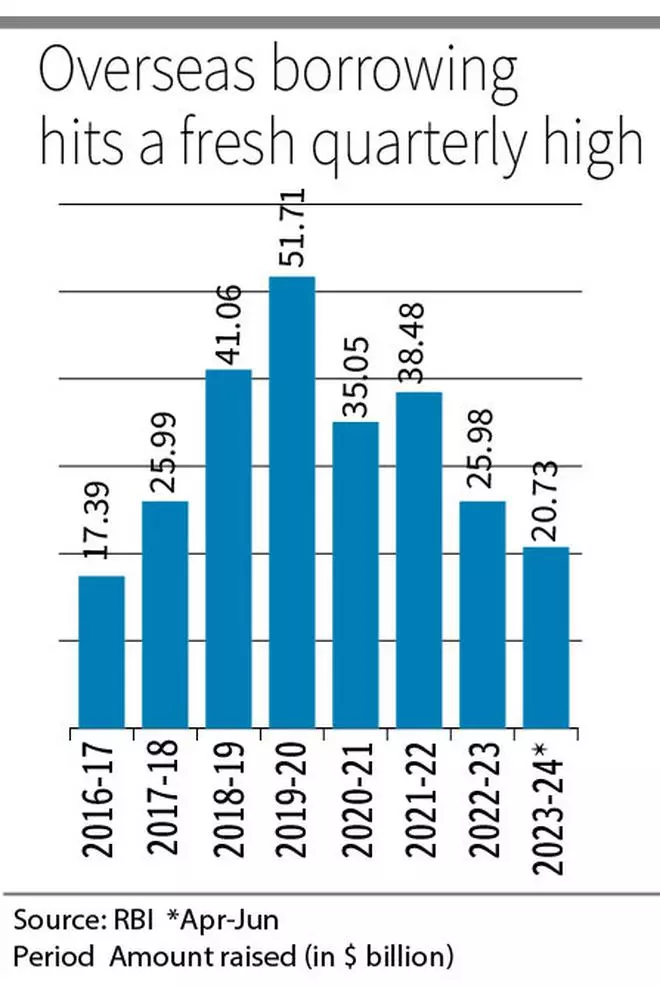

As per RBI data, Indian corporates raised $20.73 billion in external commercial borrowings (ECBs) in the first quarter of FY24.

To give a sense, India Inc’s overseas borrowing for the full year stood at $25.99 billion in FY23. Prior to this, the highest quarterly fundraising was seen in Q4FY20, when domestic entities raised $18.97 billion in external borrowings.

ECBs refers to the borrowing of funds by Indian companies from foreign sources in the form of loans, bonds, and other financial instruments. These are used for a variety of purposes including the expansion of business, acquisition of assets, and refinancing of old debt.

The record fundraising in Q1 comes despite US Federal Reserve’s frequent interest rate hikes which took the federal fund rate from a near zero level in March 2022 to a 22-year high in July 2023. In its latest Federal Open Market Committee (FOMC) meeting on July 26, the US central bank raised the interest rate by a quarter percentage to a range of 5.25-5.5 per cent.

Vivek Iyer, Partner, Grant Thornton Bharat, said, “External commercial borrowings have been on a rise despite the rising interest rates, especially in the infrastructure and services area, given the high amount of focus by the government around the larger Amrit Kaal goals.”

Introduced in the budget 2023-24, Amrit Kaal is a blue-print for India’s economic growth driven by seven priorities including inclusive development, infrastructure and investment, green growth and robust financial sector.

Iyer added that the high expected internal rate of return on the projects justifies high interest rates and hence the ecosystem is seeing a large appetite for external commercial borrowings.

“Expectations around a stronger domestic currency in the future, given expected weaknesses in the dollar, makes a strong case for borrowing dollar given the reduction in the equivalent rupee payout,” he added.

Top borrowers

Nearly 60 percent of the borrowing in Q1 was led by three companies. Arcelormittal Nippon Steel India topped the borrowing with $5 billion, followed by Reliance Jio Infocomm ($3.76 billion) and Reliance Industries Ltd ($3.46 billion).

Capacity expansion

Modernisation was the major purpose of borrowing at $5.88 billion, followed by capital goods purchase ($4.68 billion) and refinancing of earlier ECBs ($3.06 billion).

It is to be noted that steel major ArcelorMittal is betting big on India expansion. The company expects to achieve a production capacity of 8.6 million tonnes per annum (mtpa) by end of 2024 and subsequently increase it to 15 mtpa by first half of 2026 in Hazira in Gujarat.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.