CRISIL Research said the private sector will have to script economic turnaround by reviving investments and raising its contribution to overall growth.

This is because the private sector accounts for three fourths of the GDP, it said.

The government can enable this by pushing through the next level of economic reforms and removing policy bottlenecks. Unlike during the 2008 global financial crisis, the public sector was not in a position to provide an impetus to growth due to the government’s fiscal constraints, it said.

In the two decades since 1990, public sector GDP growth remained stagnant at six per cent, whereas private sector GDP growth went up to 7.7 per cent in the 2000 from 5.7 per cent in the previous decade.

The private sector’s performance during the high growth phase of the economy from 2004-05 to 2007-08 logged 9.7 per cent GDP growth a year.

Private corporate investments too had surged to 17.3 per cent of GDP from 10.3 per cent during this period.

Crisil said investments by the private corporate sector slumped to 11.3 per cent of GDP in the crisis year 2008-09 from 17.3 per cent in the preceding year. If India came through largely unscathed from the effects of the financial crisis, it was mainly due to the impetus from the public sector.

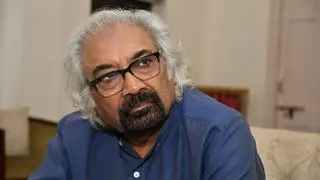

“The public sector cushioned India’s growth during the global financial crisis. During 2008-09 to 2009-10, private sector GDP growth had slipped sharply to six per cent from its pre-crisis levels of 9.7 per cent per year. Without a robust 12.3 per cent growth in public sector GDP on the back of increased government spending, India’s overall GDP growth would have averaged 6.2 per cent and not 7.6 per cent during these two years,” said Mr Dharmakirti Joshi, Chief Economist, Crisil.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.