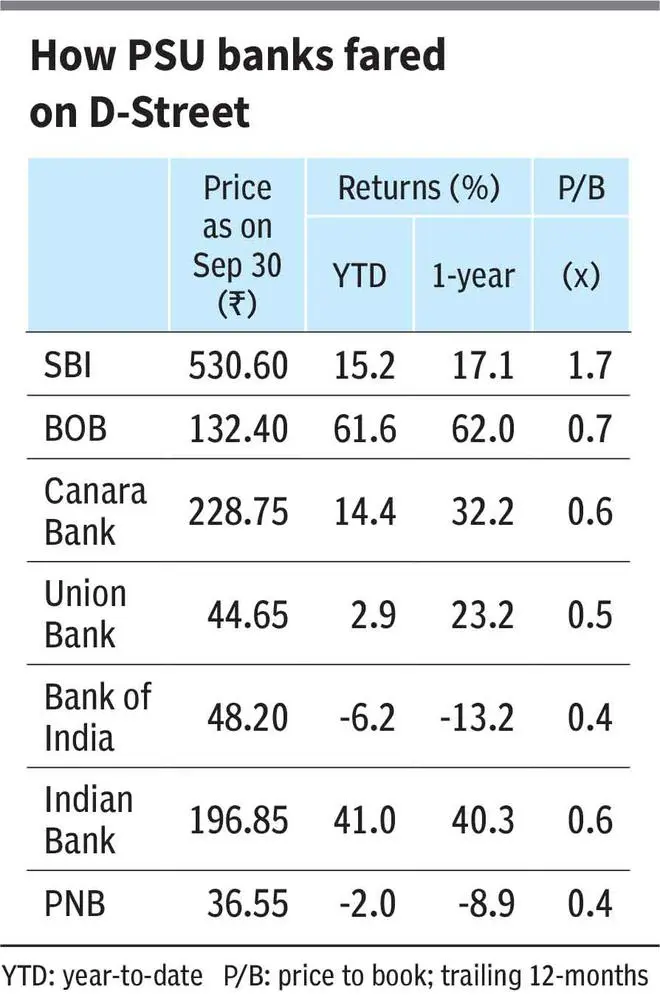

Smaller private banks or public sector bank (PSB) stocks? That’s the new debate around investing in banking stocks. Valuations-wise, both are attractive; but with the issue of bad loans gradually becoming a thing of the past and PSBs posting aggressive growth and profit numbers, public sector banks are beginning to catch investors’ attention. More importantly, they’ve weathered the Covid pandemic as efficiently as their private peers. Banks such as Canara Bank, Bank of Baroda and Punjab National Bank finding success raising money from the market, and not dipping into the government’s kitty for capital, puts them in favourable light. Why not opt for stocks of public sector banks or PSBs, especially given that they continue to trade below their book values, is the question on investor minds.

Historically, PSU stocks, whether in the defence, engineering or power sectors, have traded below book values and to that extent PSBs are no exception. But do they make for value traps or value picks? Which ones should you add to your shopping cart?

Why PSBs are a draw

PSBs were in the ‘avoid’ zone for several years.

State Bank of India (SBI) was the first to (re)capture investor attention in 2018, when it demonstrated that it could successfully absorb its subsidiaries and yet show signs of turnaround in its asset quality. Vijaya and Dena Bank were folded into Bank of Baroda (BOB) that year and this was followed by the mega-merger that saw 10 banks folding into four. For BOB, the advantages of the merger started reflecting only by mid-FY20 while for Punjab National Bank (PNB), Union Bank, Canara Bank and Indian Bank, results became visible in FY21.

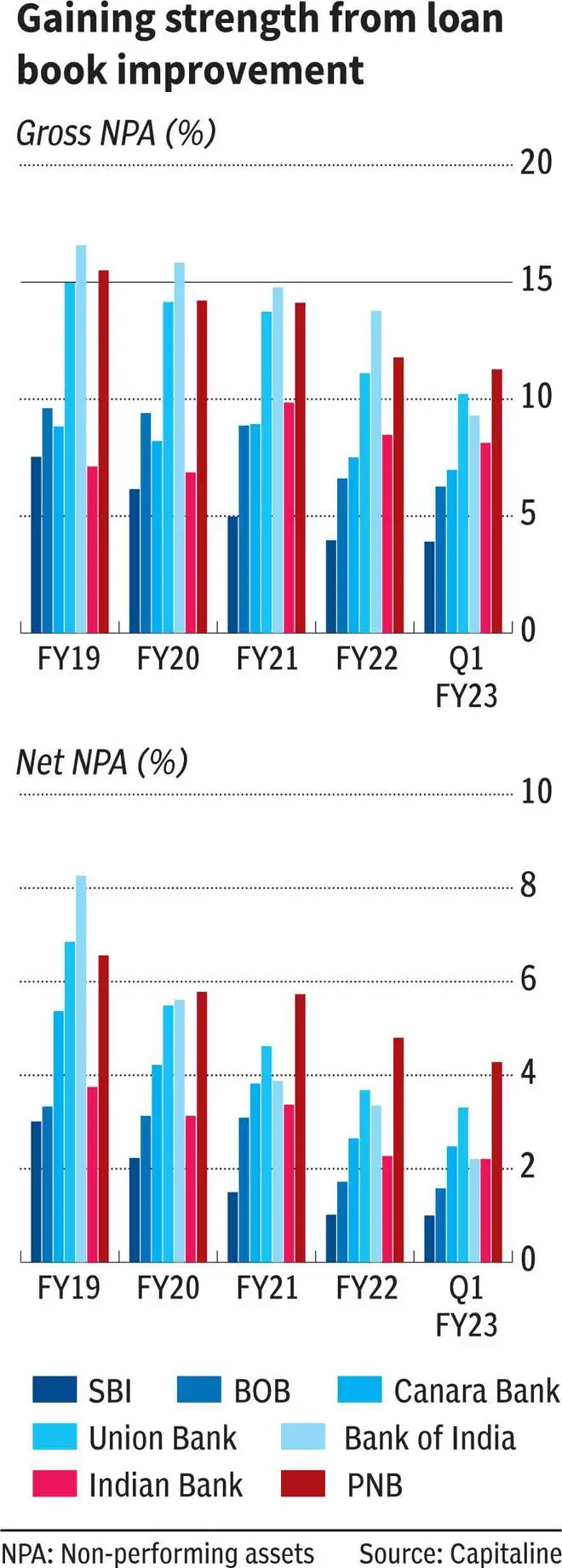

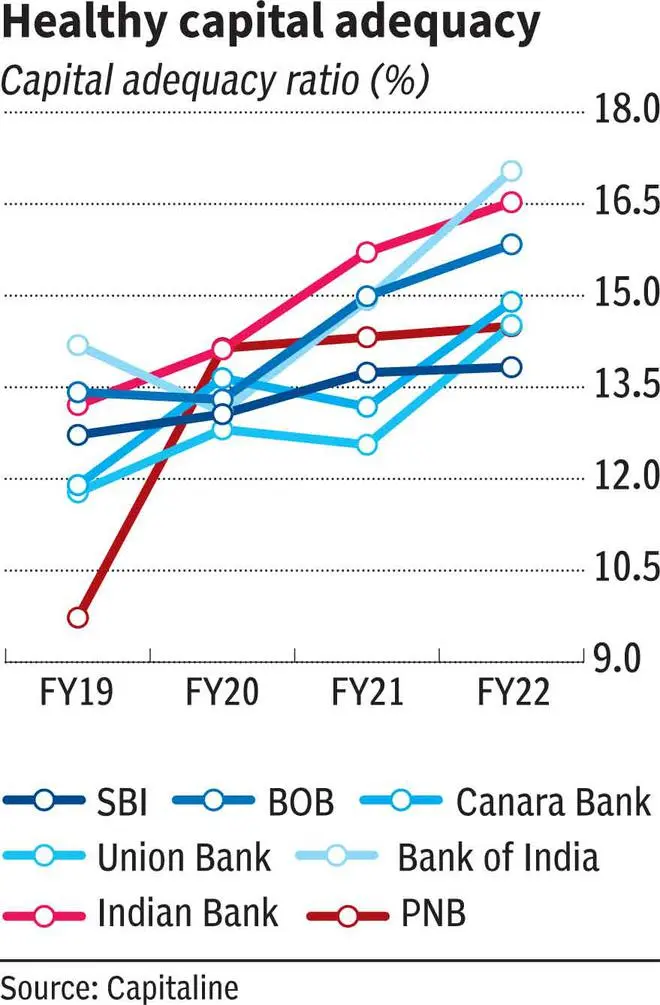

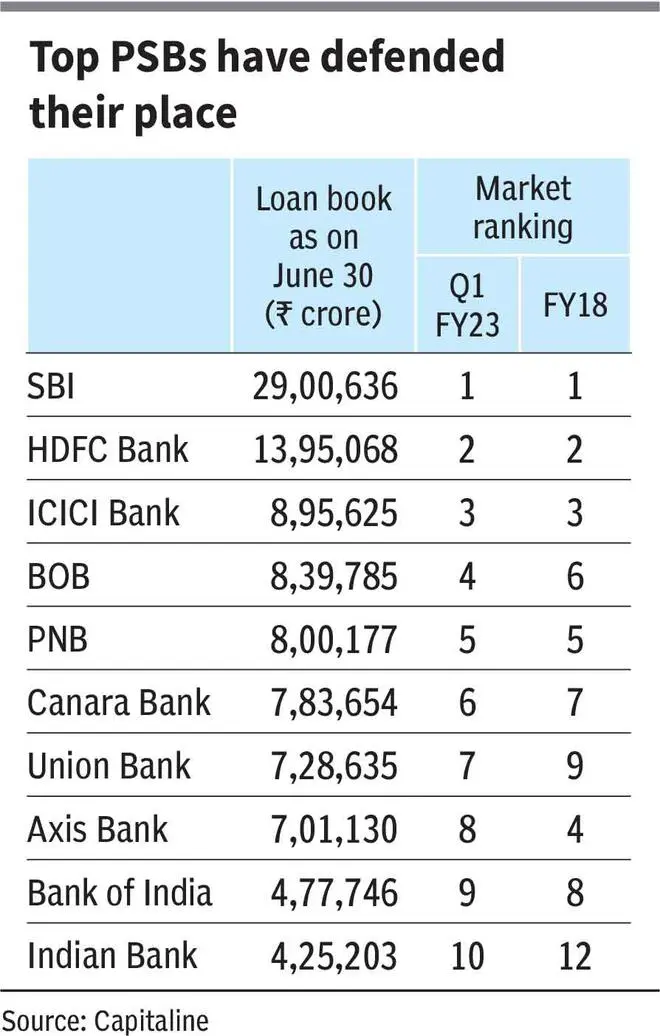

The merger has helped these banks in three ways. First, with the issue of fragmentation addressed, banks that led the merger moved up the league table significantly. Second, the size acquired through the consolidation helped them weather the pandemic even as they were redoing their processes and operations. Finally, it boosted their capital adequacy, and contrary to the popular perception, their asset quality is at an 8-year best, in tandem with the overall trends (see table).

But don’t get enticed just yet.

When analysed through the three broad parameters — profitability, underwriting strengths and market share — today, not all may pass the litmus test.

Profitability

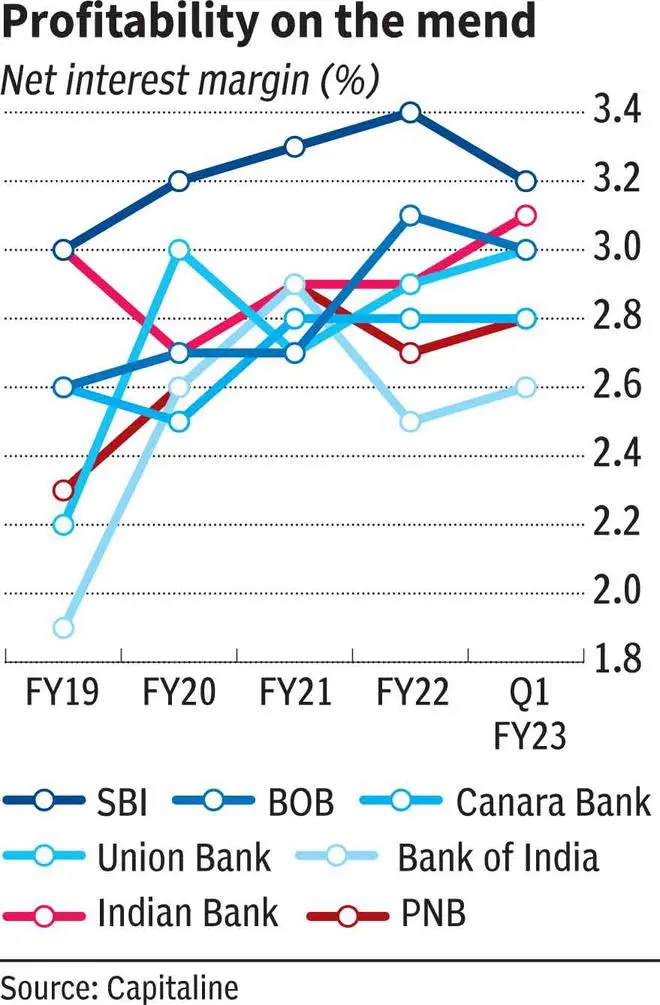

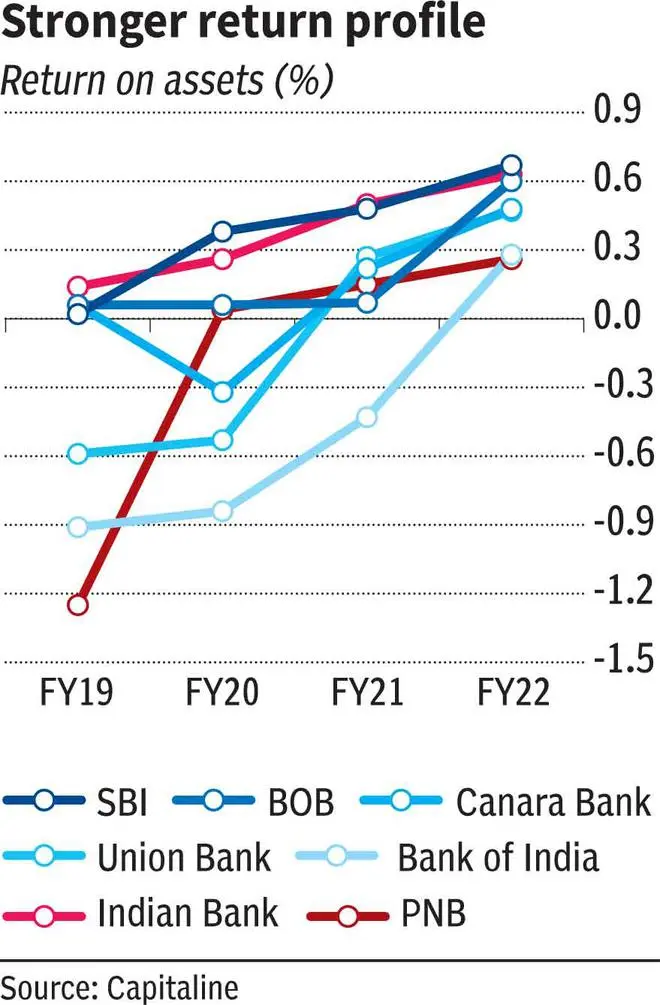

There is a wide gap between private banks and PSBs in terms of net interest margin, which is a measure of profitability. While private banks average at four per cent plus NIM, the average of PSBs was three per cent in June quarter of FY23 (Q1). SBI is a clear outlier, followed by BOB, Union Bank and Indian Bank. Given PSBs’ loan book construct, cost structures and their overall yields being at a disadvantage to their private peers, bridging the gap is almost unlikely.

What needs to be seen in an increasing interest rate scenario is whether they can maintain the NIMs at current levels. Despite cost of deposits not moving up significantly so far, yield on advances came under pressure by 10–40 basis points for PSBs in Q1 FY23. Consequently, compared to FY22’s NIM, profitability was under stress in Q1 itself. Therefore, while the overall trend of earnings improvement may well continue, as PSBs have the buffer to absorb asset quality issues, a qualitative improvement in earnings is unlikely.

What’s more, hardening bond yields impacted banks and more so the PSBs in Q1. While some of the large players such as SBI have adopted a new strategy for their investment book to minimise the impact of marked to market losses, with repo rates getting repriced upwards, this headwind, and drag on overall profits, cannot be avoided.

Risk management practices

One of the key reasons why PSBs trade at a wide discount to their private peers is the inherent weakness in their risk management or underwriting standards. Quality of the board, governance standards, risk assessment tools and, more importantly, the visibility and continuance of leadership teams have historically been notches below their private peers. Empirically, we do not have much evidence to demonstrate that PSBs have seen an improvement on these parameters.

For instance, the Financial Stability Report of the RBI dated June 2022 points out that PSBs have a higher exposure to below-prime customers (56.2 per cent as of March 2022) compared to private banks’ average at 32.9 per cent. Likewise, their exposure to super-prime and prime-plus customers stood at 16.2 per cent as against private banks’ average of 31.5 per cent during this period. Clearly, if retail delinquencies witness a surge — which has been the trend, extrapolating past experiences — in an increasing interest rate scenario, PSBs are more vulnerable to asset quality shocks.

But what needs monitoring is the fresh lending to corporates, which is set to pick up in the coming months. PSBs have been reducing the share of corporate loans in their balance sheets. The present stock of these loans is fully provided for and is nearabout clean in terms of asset quality. In the next 12–18 months, the industry expects demand from corporate India, including State-owned infrastructure companies, to pick up. But does that insulate the system from another situation like FY10–FY13 when loans were sanctioned without adequate cover? The doubt lingers.

What offers solace is the tightening of regulatory requirements, such as capping the group exposure, NPA recognition norms, and so on. Likewise, the government, particularly on road and other infra projects, has finetuned the right of way norms which, to some extent, would ensure that project loans cannot be sanctioned without the basic requirements, unlike in the previous decade.

Yet, the proof of the pudding is in the eating and if the next leg of growth is expected to come from India Inc, investors need to be extra cautious with PSBs. It would be appropriate to quiz the managements on how they have improved their risk management practices in the quarterly earnings call before taking the plunge on PSB stocks, especially the layer after SBI and BOB.

Market share

There could be some good news for PSBs on this aspect. While PSBs collectively have been losing ground to their private counterparts for over a decade, the stronger banks or the banks that have witnessed a wave of mergers such as BOB, Canara Bank, Union Bank and Indian Bank, have moved up the ranking (see table).

Having touched ₹29-lakh crore of loan book in Q1, SBI has undisputedly retained its No 1 position in the banking system for several decades. The only exception is PNB, which has maintained its No 5 position in the league table despite the merger. Likewise, the only PSB among the top 10 that has moved a notch down since FY18 is Bank of India. But Bank of India hasn’t participated in the consolidation process so far.

Therefore, while the loss of market share for PSBs is real, it may be more to do with the market base itself expanding significantly in the last decade and not really their ability to keep pace with growth, especially after 2019’s mega merger.

This is a positive takeaway for investors, the fear of placing a bet on a shrinking pie is dispelled.

Nonetheless, considering that PSB stocks have witnessed a massive rally in the last one year, largely reacting to an improvement in headline earnings numbers, it is important for investors to pay attention to the first two aspects mentioned earlier — qualitative improvement in profits and profitability, and gauging the risk management practices. At present, the conviction on these factors isn’t high.

Pecking order

With SBI representing a fourth of India’s loan outstanding, it’s logical that investors betting on the economy take a positive stance on SBI. For the first time in over decades the stock is trading well above its book value, indicating the premium that investors are willing to pay for a behemoth posting just about a percentage of net NPAs.

BOB is the next preferred PSB. Its ability to demonstrate leadership, grow a well-dispersed retail book and reduce its NPAs over the years is working in its favour.

Lately there is increased interest in Indian Bank, Canara Bank and UnionBank. While the financial performance of these banks has significantly improved in the last three years, Union Bank has a relatively longer rope to climb in terms of asset quality. It may still be early to take a long-term view on these stocks.

Interestingly, constantly battling scams and fraud, despite its No. 5 position in terms of loan book size, PNB hasn’t managed to come out of the ‘no-go’ zone for investors.

For the names below this league, such as Central Bank of India, Bank of Maharashtra, Indian Overseas Bank and UCO Bank, the buzz is largely around further consolidation and privatisation resulting in stock price movement. Therefore, barring SBI and BOB, the rest of the pack don’t qualify as high conviction bets.

They may end up being value bets or value traps — and only time will tell.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.